Related Links:

ENR 2023 Top 600 Rankings

View Complete List with Revenue and Market Data

(Requires Subscription)

In comments about the market’s most pressing challenges, Top 600 Specialty Contractors are widely optimistic that the worst of pandemic-induced delays are done—buttressed by another year of double-digit revenue growth for listed firms. But the market still suffers from major challenges as firms look to cultivate limited labor resources and manage rising project costs.

The transition from COVID-19-era construction demand to a post-pandemic marketplace with high inflation has been a “tale of two cities” for many subcontractors, says Joel Phelps, chief operating officer at subcontractor Reflection Window + Wall.

“Work was plentiful when interest rates were low,” he says. “Coming out of the pandemic, there was a lot of pent-up demand; consequently, we experienced massive growth, which presents its own challenges and perils.”

During rapid growth stages, contractors are forced to “spread knowledge and competencies across more projects,” Phelps adds. “You’re hiring more people, trying to train them and get them up to speed.”

Yet as quickly as business ramped up for the subcontractors after the pandemic’s pause, higher loan interest rates have firms preparing for an economic slowdown.

It’s a balance between conserving resources and staying competitive, according to Phelps. “We’re busy executing on the biggest backlogs in our history but the next 12 months aren’t going to be like that,” he says. “The challenge is to effectively manage the rapid ascent and descent simultaneously.”

Triumphs and Tribulations

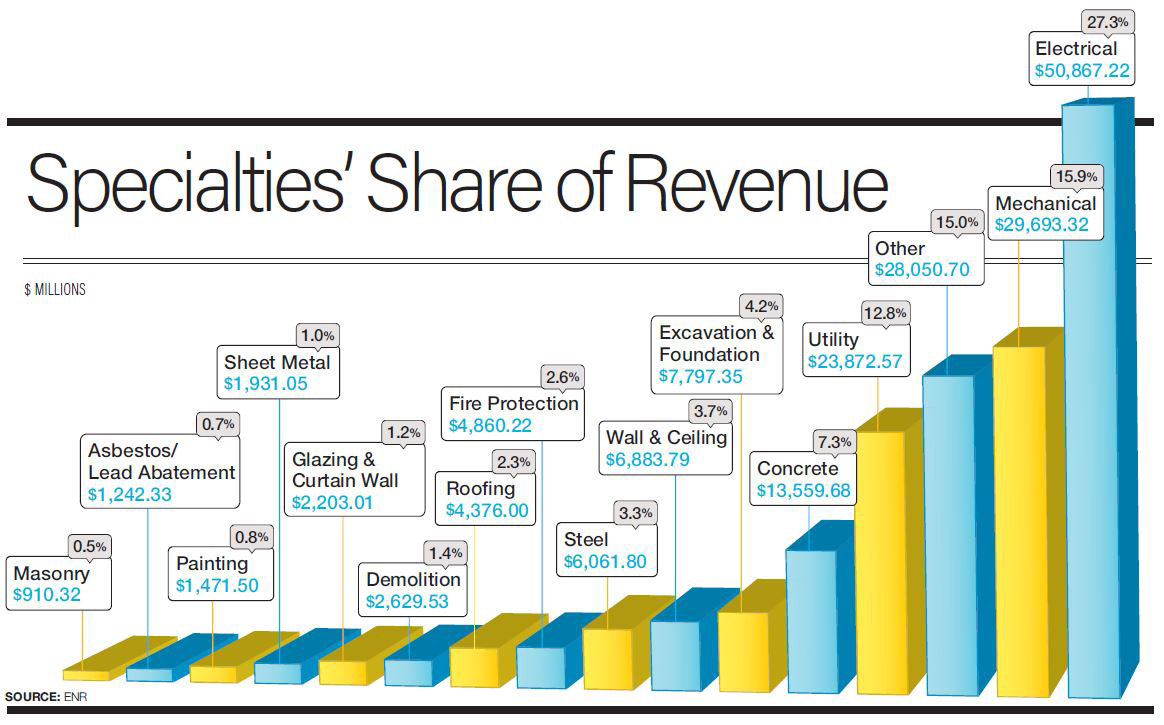

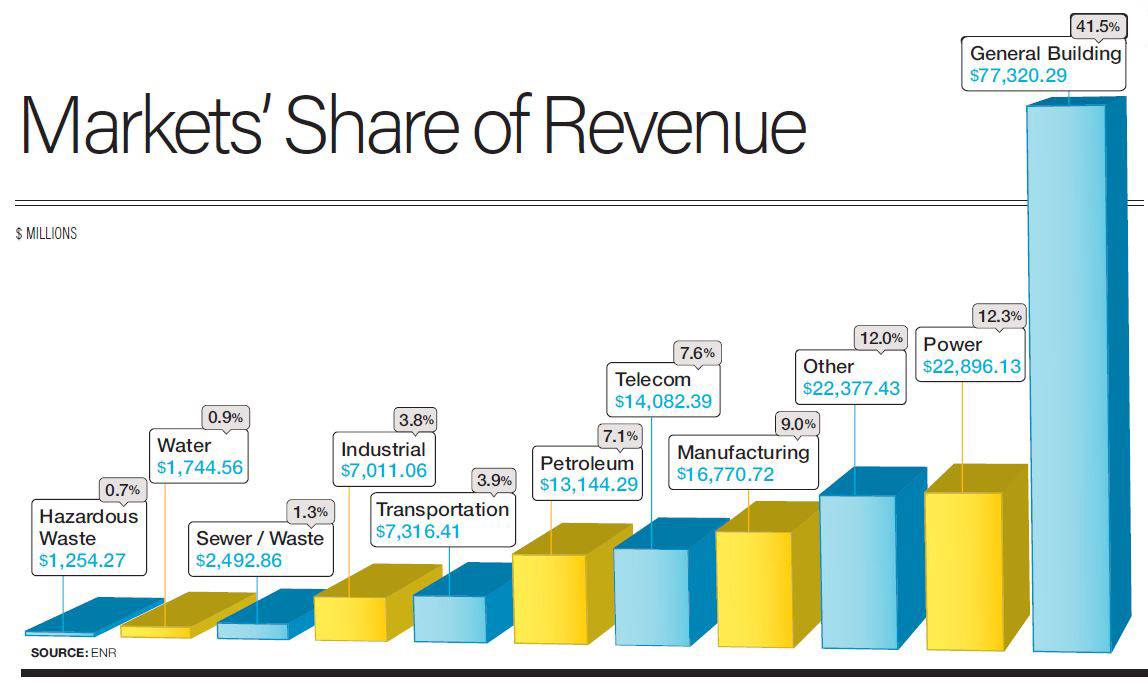

Overall, last year brought strong revenue growth for Top 600 contractors, with the 2022 total up 13.3% to $186.4 billion. Median firm revenue also rose, 11.2%, to $106.71 million. Of the 530 firms that filed a survey this year and last, 79.4% reported an increase in revenue on the 2023 ranking, up from 66.4% on the 2022 list.

The median new contract total on the 2023 list also rose, 14.8% to $101 million, from $88 million last year. New contract awards rose 22.5% to $173.31 billion, while 94.4% of the 522 firms that shared their profitability status reported a profit in 2022.

Among subcontracting firms reporting new contract awards is No. 28-ranked Power Design, with chief growth officer Lauren Permuy adding that the firm is on track to reach $1 billion in revenue for the first time in its history. She says it is expanding operations in Nevada and Utah to offer electrical, mechanical, plumbing, systems technologies, engineering and fixture project scopes.

“This has unlocked a variety of new projects and partners,” says Permuy, such as the firm’s recently awarded MEPS contract on the $70.5-million Pendry Tampa project. “It will not only be a cornerstone of our portfolio, but also it will be the crowning jewel of the Tampa Bay area,” she contends, explaining that the mixed-use project is the largest contract in Power Design’s history and “will challenge the status quo with electrical, mechanical, plumbing and systems technologies.”

Persons Services Corp. President and CEO Paul Persons says the firm’s priority in the last year has been to manage its growth and scalability of its processes and procedures.

“We’re working on hiring personnel for key positions with the right skillsets and getting our existing personnel in the right seats,” he says. “Companies thrive on hiring, training and operating effectively, and that is one of our largest tasks and highest priorities.” According to Persons, revenue for the No. 294-ranked company has grown nearly 50%, as it broke into new markets across the Southeast and Caribbean.

“Skilled labor resources still remain the challenge; however, we have turned that into a success by being very aggressive in recruiting new talent. ”

Pino Mancina, CEO, Nat’l Construction Enterprises

Over the last year, Seretta Construction President Andrew S. McPherson says the company has also experienced large growth in its production, creating the challenge of “finding a balance” between project logistics and workforce.

“We have been able to overcome this challenge by increasing our recruitment efforts and hiring high-quality employees,” says McPherson. “Our goal for the year to come is to maintain similar production levels while continuing to offer a quality product.”

In the greenfield industrial project space, Systems Group director of engineering Kyle Morgan calls the construction market boom a “blessing and a curse” due to limited labor pools and longer lead times on supplies.

“Both of these problems have led to successes in new in-house training programs for welding and pipefitting,” he says, “along with new processes for Bill of Material takeoffs to start pre-buying material and equipment long before we set foot on a jobsite.”

Access to skilled labor continues to be an issue for Top 600 firms. But with years before skills catch up to demand, contractors are helping to develop the talent they need with distinct solutions. “Skilled labor resources still remain the challenge,” says Pino Mancina, CEO of National Construction Enterprises. “However, we have turned that into a success by being very aggressive in recruiting new talent. Our goal is to continue this attention to recruiting field labor force and working with local unions to help facilitate.”

Concrete/Foundation | By Jonathan Keller

Baker Stacks the Decks at Desert Resort Project in Utah

Photo Courtesy of Baker Construction Enterprises

Baker Construction Enterprises (No. 15) is providing foundation work and building elevated decks on the Black Desert Resort in Ivins, Utah. The firm will provide 1 million sq ft of structural slabs, along with 45,000 cu yd of concrete, 7.5 million lb of rebar and 500,000 lb of post-tension cables. The 600-acre resort is due to be completed in fall of 2024.

Tapping Into Talent

Although craftworker shortages continue to be an industry-wide challenge, the percentage of firms reporting them this year decreased to 69%, from 73.1% last year. The largest gains were made by firms in concrete and utility specialties. About 67.7% of utility subcontractors report shortages this year, down significantly from 82.4% last year. Among concrete subcontractors, 61.8% report shortages, down from 83.9%.

Michael Cannon, KHS&S Contractors CEO and Chairman, says the No. 105-ranked company has reached new workers by supporting local high school trade programs.

“Our hope is that we are also planting seeds for a strong construction industry in the future,” he says. “Young people can build successful careers and lives in commercial construction. They just need to be made aware of the opportunities.”

“Young people can build successful careers and lives in commercial construction. They just need to be made aware of the opportunities. ”

Michael Cannon, CEO and Chairman, KHS&S

Harris CEO Michel Michno says the company has had success sourcing skilled labor through local and international trade unions. He calls partnerships with such unions “essential” when working on high-level projects with lots of moving parts.

“Through our partnerships with the trade unions, we also work with Joint Apprenticeship and Training Committee programs that offer on-the-job training opportunities for workers and apprentices new to the construction trades,” he says. “We are consistently impressed with how the training initiatives and programs developed by these groups offer classroom-style and hands-on learning in a controlled environment prioritizing safety and stability.”

Harris also works with trade groups to plan and develop training programs to ensure the local workforce is well-equipped to meet a variety of jobs in the skilled trades, says Michno. “This empowers learners to enter the workforce with up-to-date information and familiarity with skills that are specific to the technically advanced work that Harris does,” he says.

Power Design chief growth officer Permuy adds that “trade apprenticeship programs are becoming more and more relevant for our industry.” She says more prospects “realize that the trades offer long-term career opportunities without the accruing debt that standard four-year colleges usually come with.”

The Top 600 Dialogue

What new development at your company do you consider to be a game changer?

Steven Hamilton, COO

Donley's (#201 on the Top 600 List)

Valley View, Ohio

We recently restructured to an ESOP. We’ve always grown our business to provide more career advancement opportunities. The ESOP now connects business growth to employees by creating a long-term wealth building tool through company stock.

Peter Lauro Jr., President

JRCruz (#237 on the Top 600 List)

Holmdel, N.J.

The acquisition of a new asphalt plant, City Asphalt in Staten Island, N.Y., has given us the ability to be more competitive on milling and paving projects in New York City.

What have been your firm's challenges and successes over the last year?

Ben Johnston, Chief Technical Officer

Pittsburg Tank & Tower Group (#292 on the Top 600 List)

Henderson, Ky.

Understanding, challenging and growing our youth within the organization continues to be a top priority for us. They are our future. As for next year’s goals, holding the cost of goods sold and not seeing jobs fade is high on the list.

Michael Parkes, President and COO

O’Connell Electric Co. (#87 on the Top 600 List)

Victor, N.Y.

Our challenges continue to be material and equipment lead times and workforce. We have not seen improvement to lead times on major electrical equipment that carried a 1-2 week lead time prior to COVID, but are now 6+ weeks in many instances.

Addressing Shortages

To address skilled labor shortages BMWC is experiencing in the Midwest, the firm has more than doubled its prefabrication capabilities and added two new facilities, says President and CEO Chris Buckman.

“Our focus on safety, project selection and building internal capacity across our organization will continue the following year. ”

Chris Buckman, CEO, BMWC

“These facilities are strategically located in regions that draw from different labor pools,” he explains, allowing the company to leverage labor from one area to “provide fabrication and preserve labor capacity in the project region for installation.” Building such capacity has brought challenges and successes, he says.

“Ultimately, we aim to continue delivering safe, productive and reliable installations to our clients that continue their plans to make significant capital investments in new and existing facilities,” says Buckman. “Our focus on safety, project selection and building internal capacity across our entire organization will continue the following year.”

The gap between qualified labor and demand is only growing, says Baker Construction Enterprises CEO Karl Watson.

“Demand for construction, especially in the industrial sector, is going to lead to wage and price escalation in the coming years,” he predicts. “In response, we plan to double down on workforce development, recruitment and retention in the coming year.”

Watson says the firm’s goal “is to be the recognized leader in attracting, training, developing, incentivizing and retaining the most competent and motivated people in the industry.”

On the Rise

Top 600 total revenue has risen 27.8% since 2020 despite the absence this year of MasTec, which ranked No. 3 on last year’s Top 600 with $9.6 billion. With a key acquisition in 2022, the firm is ranked on the 2023 ENR Top 400 Contractors list, landing at No. 3 with $11.6 billion in reported revenue.

Overall, revenue is up across all markets that ENR tracks. Most prominent is the power market, which rose 46% in 2022 after falling 8.6% between 2020 and 2021. Other sectors showing hikes are manufacturing (33.8%), telecommunications (20.9%) and industrial process (19.8%). Telecommunications and manufacturing are both up around 80% over their 2020 totals.

“Rising interest rates have triggered a softening in the private commercial building market as well as light industrial markets.”

Seth L. Pearlman, CEO, Menard North America

For Menard North America, “Rising interest rates have triggered a softening in the private commercial building market as well as in light industrial sector construction such as large warehouses and distribution centers,” says Seth L. Pearlman, CEO of the company, which ranks at No. 150.

He explains that the subcontractor was “heavily reliant” on those type of large footprint projects in 2020 and 2021 but did not lose focus on small to medium-size jobs in its local markets.

“Our share of local projects has helped us weather the drop-off in the number of larger projects and has given us resiliency in the changing market,” says Pearlman. “Going forward, we are adding new offices in local markets and bolstering resources in our existing offices while also focusing on operational excellence and honing efficiencies to maintain momentum in these markets.”

With loan interest rates and construction costs generally on the rise, a slowdown in work is generating an increase in competition.

“One of our biggest challenges has been increasing margin pressure to successfully win work,” says Nevell Group President Chris Taylor. “With the shrinking of more private, vertical markets, some of the competitors are now beginning to chase more of the larger design-build, design-assist work that we specialize in.”

The Top 600 Dialogue

What changes have you made to improve the effectiveness of your firm's safety program?

Tom McCormick, President and CEO

Primoris Services Corp. (#5 on the Top 600 List)

Dallas, Texas

We have corporate and regional business safety teams that work together on new resources, implementations and systems. They also track and maintain key safety metrics. All of this goes into informing new policies and programs.

Joseph Lansdell, President

Poynter (#297 on the Top 600 List)

Greenwood, Ind.

Our safety program now includes a weekly check-in where our director of safety reviews the number of toolbox talks turned in and any safety incidents that week. These key performance indicators help track our safety program and gauge our safety culture.

How have your company's diversity, equity and inclusion policies improved operations?

Dane Evans, President

Skoda Contracting (#342 on the Top 600 List)

Flanders, N.J.

Our largest effort has been our partnerships and mentorships with MBE and WBE subcontractors. Our goal is to have 30% MBE and WBE spend annually and this is made possible by partnerships with new and diverse subcontractors.

Mike Doner, president, CEO

Flagger Force (#305 on the Top 600 List)

Hummelstown, Pa.

We offer rapid advancement opportunities with a merit-based path to internal growth. We also offer a free GED program, secondary educational scholarship grants, a training curriculum, a 24/7 employee assistance program and more.

Rising Risks and Rewards

Another challenge has been delayed award and startup of some projects, Taylor says. “There are several reasons for these delays, but they definitely hamper our ability to meet our annual operating plan targets.”

On the payment schedule front, firms report a slight improvement. The proportion of payments past due decreased to 26.7% last year, from 28.3% in 2021. On average, firms report payments are about 40 days late, virtually identical to last year.

On the other hand, material costs continue to be a point of friction between subcontractors and general contractors, explains BrightView Landscape Development President Tom Donnelly.

To offset those cost increases, the company is “building an across the business procurement group, comprised of subject matter experts focused on local, regional and national relationships with our vendor community,” he says. “Specialty contractors have an insatiable appetite for solid backlogs and predictable workloads. We need to keep our crews on the job, engaging in productive task level activities and maximizing hours.”

Rising costs not only affect fuel for jobsite equipment trucks but also for personal vehicles of employees who commute to work, explains Lang Butler, vice president of Ruston Paving Co. Inc.

“To fend off these rising costs, Ruston Paving uses several tools and incentives aimed at reducing our fuel consumption,” says Butler. These includes a system that provides video analysis, predictive analytics and performance programs to help our drivers improve vehicle efficiency and lower operating costs.

“We also use a fleet management system that allows us to push optimal driving routes to assist drivers in the reduction of fuel consumption,” he adds.

For many Top 600 contractors, contract structures are a way to redistribute project risks and add more flexibility to find solutions.

Sheet Metal | By Jonathan Keller

Poynter Handles Massive EV Job

Photo Courtesy of Poynter

Poynter (No. 297) is sheet metal contractor for a 10-million-sq-ft electric vehicle plant in Kentucky for an unnamed owner. It is tasked with setting up 128 building air handling units, 90 direct heating units and 384 fans.

Collaborative Approach

Persons of Persons Services says his company has seen more CMAR and design-build contracts. “These types of contract structures engage the contractor earlier and more often. They also provide more of a collaborative team approach, which we thrive in,” he says, explaining that the firm has also been moving toward negotiated contracts with an agreeable profit margin.

“The unit-based cost structure with allowances for premium time adders and material markups provides the most protection, certainty and flexibility,” says Michael Robirds, CEO of Charge and affiliate companies. “Owners get the assurance that any extra time or material is agreed to in real time so change orders are easier to process,” he notes. “Meanwhile, we are assured that any of our costs that typically negatively impact project budgets are reimbursed at a fair rate.”

Design’s special operations division is solely tasked with helping projects get back on track and contain risk when subcontractors have faltered. “By offering this service to our partners, even if we aren’t on the job as a trade or even lost the project in the bid process, this is a way to be flexible even amid market challenges,” says Permuy.

Cache Valley Electric Executive Vice President Eric Laub says integrated project delivery has enabled the firm to align the interests of the project team.

“During times of market volatility, material shortages, etc., the IPD method allows the project team to work together and come up with a solution that is best for the customer,” he adds.

Sun Valley Masonry Vice-President Todd Nessler says the biggest challenge for the No. 328-ranked company has been managing project schedules due to material supply shortages in trades preceding its work.

“There have been significant delays in getting our work started that have exposed Sun Valley to material escalation costs from our vendors and suppliers,” he explains. “We are negotiating with our vendors to lock in structured pricing for a predetermined period of time. These pricing dates are then stipulated in contracts with our clients to mitigate exposure.”

Workforce Development | By Emell Adolphus

Firms Sharpen Apprentice Skills

Photo Courtesy of Baker Construction Enterprises

Amid ongoing labor shortages, some Top 600 firms have developed in-house training programs to cultivate the skills they need from new hires.

Baker Construction Enterprises (No. 15) has expanded its apprenticeship programs in key markets, including its Field Leadership Academy, an eight-month course that provides foreperson-level employees with training to become certified crew chiefs.

“Since launching the program in 2020, dozens of our co-workers across the country have graduated or are currently participating in the program,” says CEO Karl Watson.

In 2020, Cleary Construction (No. 300) established the Cleary Academy to proactively recruit skilled workers. The training program centers on a threefold partnership among the firm, a local high school and a technology center.

“It is a 100 percent work-based learning venture that uses data from formal and skill-based assessments to guide students toward a career in our industry,” explains Carter Walden, company chief technical officer and director of workforce development. Students receive credit toward high school education and learn a skilled trade simultaneously.

“The results have been greatly successful,” he adds. “Through this partnership, students leave school early and come to Cleary to co-op where they have access to our facilities and cutting-edge technology and equipment.”

At Power Design (No. 28), a variety of future workforce development initiatives help the firm find the talent it needs internally and externally—including through its PowerU Apprenticeship and PowerYouth programs, Junior Achievement and 3DE partnership, the Power Design Career Learning Advancement program and Power Design internship.

“These programs provide an inside look into Power Design and the work we do throughout the country, with many of these providing continued education and skillset development to feed directly into company employment,” says Chief Growth Officer Lauren Permuy. PowerU is in its fifth year as a federally approved apprenticeship program. With on-the-job training, a customized curriculum and mentorships, it fast-tracks participants to become licensed electricians.

“We just recently celebrated our first graduating PowerU apprenticeship class in July and currently have 126 apprentices enrolled and active,” says Permuy.

Supply and Demand

KHS&S Chairman and CEO Cannon believes the market has mostly moved on from the supply chain bottlenecks of the early pandemic. “For the most part, supply chain issues have resolved themselves and material prices have stabilized, although at somewhat higher costs,” he says.

But at Ward Electric Co., CEO Mark Ward says the company is still seeing bottlenecks around big ticket items. “We are still able to deliver projects but timelines are being adjusted,” he says. “These supply chain issues require constant communication between contractors and clients.”

Staying on Track

Late design information and changes in project scope can create time crunches that supply chains simply cannot handle, Top 600 firm executives say. At Gaylor Electric, President and CEO Chuck Goodrich says the company relies on its relationships with vendors and manufacturers to procure early. “Gaylor Electric has risen to the occasion, harnessing innovative approaches and manufacturing to ensure our projects remain on schedule, even when the supply chain poses difficulties,” he says.

CentiMark’s long-term relationships with core manufacturers have helped the company to continue diversifying its supply chain portfolio. “Any product availability challenges that may arise within the industry would have minimal impact on our ability to perform the high level of service that our customers expect and deserve,” says President and CEO Timothy M. Dunlap.

The bottom line: preventing bottlenecks is about communication, according to Commonwealth Electric CEO T. Michael Price. “Effectively communicating within our project teams is extremely important to manage the project schedule and expectations,” he points out. “We cannot always control the delivery dates, but we can control how we plan and react to them.”

Post a comment to this article

Report Abusive Comment