Congress has allocated billions of dollars to address contamination caused by the ubiquitous class of “forever” chemicals known as PFAS—with billions more also earmarked in recent legal settlements with manufacturers—but drinking water managers, construction sector experts and other stakeholders say the true cost of cleanup could be much higher.

The prevalence of PFAS, short for per- and polyfluoroalkyl substances, is a real and growing concern. Thousands of different chemicals have been used in everything from firefighting foam and construction materials to clothing and household products, and have been detected in food sources, water supply, wildlife and human tissue—with new ones still being discovered. Some are identified as a threat to human health, even in small amounts.

PFAS-tainted site is seen near the North Carolina factory of chemical maker Chemours.

Photo courtesy Cape Fear River Watch

Methods to treat or remediate PFAS to nearly non-detectable levels currently exist, but each has drawbacks. Engineering and construction firms, and others, are racing to evaluate, validate and scale up promising technologies to not just treat, but also to destroy the chemicals. It is daunting, they note, because the substances were created to be non-degradable. Despite ongoing studies to support use of destructive technologies, most have not yet advanced enough as scalable and affordable options for utilities.

“Remediation of PFAS in soil and groundwater is complex due to the persistent and mobile nature of compounds,” says Elliot Cooper, vice president of remediation firm Cascade Environmental. “The biggest challenge is working with the low part per trillion concentrations. The potential for cross-contamination is high and can invalidate results.” Traditional groundwater characterization “is great for pollutants like solvents or benzene,” he says. “It’s a whole new ball game with PFAS.”

The firm has developed a patented “profiling system” that can add high resolution data to PFAS conceptual models and better identify flux zones, Cooper says. But he also notes risks in “introducing technologies where federal standards, compliance deadlines or enforcement priorities have not been finalized.”

Said Alan LeBlanc, CDM Smith senior vice president and drinking water discipline leader in a 2022 ENR viewpoint: "The lack of specific regulatory guidance has forced utilities to take a 'hurry up and solve the best they can' approach to deliver PFAS removal solutions. With treatment technologies available, there is no need to wait."

But he added that "in some cases, such an approach can set aside the proven course of more thoughtful process planning, which can result in treatments that underestimate turbidity, corrosion control or other impacts."

Stuart, Fla., installed what is said to be the largest system in the U.S. so far to treat PFAS contaminants in a drinking water system

Photo courtesy Kimley Horn

With a number of states taking steps in recent years to regulate PFAS—and significant federal actions now looming—water and wastewater utilities, site owners, chemical firms and remediation experts are gearing up for the heavy lift of reducing contaminants to minute levels at a total cost much higher than thus far allocated.

“There’s been this long-running concern in the regulated community about the extent to which [federal regulations] align with both risk and resources,” says Steve Hall, executive vice president of the American Council of Engineering Cos. “The federal government does a good job of mandating, but it [doesn’t] always do a good job of providing resources necessary for compliance.”

Clean Harbors Inc. incinerator in Arkansas is one of six it operates that are stack-tested for PFAS destruction capability, but alternative elimination approaches are being sought.

Photo courtesy Clean Harbors Inc.

Chemical manufacturers developed PFAS substances in the 1930s for a wide range of products to withstand high temperatures and repel oil and water. Their chains of carbon and fluorine atoms form bonds that are extremely difficult to break. “The carbon-fluorine bond is very, very strong, and it takes an incredible amount of energy to break it apart,” says Chance Lauderdale, HDR global drinking water sector director.

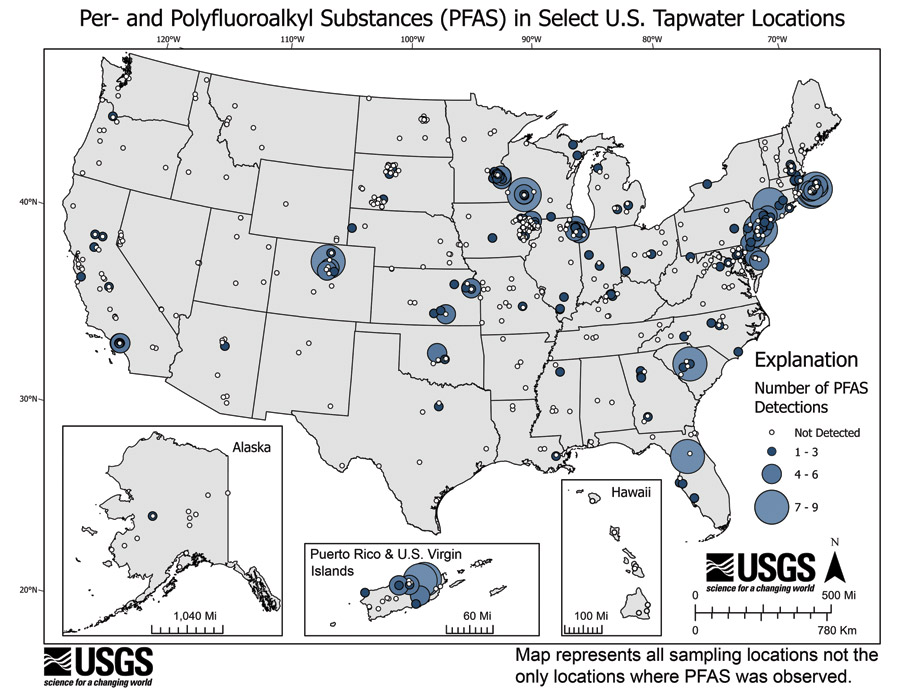

A new U.S. Geological Survey study concludes that up to 45% of households have some level of PFAS in tap water (see map below). The U.S. Environmental Protection Agency said in August that hundreds of drinking water systems contain PFAS, with about 8% having the most common types—PFOA and PFOS—at concentrations above the level it has said poses health risks. The Natural Resource Defense Council, a leading environmental group, suggests that EPA numbers underreport the actual level of contamination because only a fraction of PFAS that could be present in drinking water is actually monitored.

Identifying contaminants is key, but daunting. The Environmental Working Group, which tracks chemicals like PFAS in consumer products and in the environment, identified more than 40,000 U.S. manufacturing or industrial sites that may have used PFAS at one time.

“Current estimates of the total number of PFAS compounds are nearly 15,000, according to an EPA database, but commercial laboratories are only reporting up to 75 PFAS target analytes,” says John LaChance, vice president of Cascade Environmental’s TerraTherm unit, which uses thermal technology to destroy PFAS in soils. He notes a need for more specialized training and operating procedures “related to eliminating cross-contamination during drilling and site characterization.”

With costs up, funding has emerged on multiple fronts—from annual federal appropriations and $10 billion earmarked for PFAS in the 2021 infrastructure law to recent big settlements by some key manufacturers with public water systems in long-running litigation.

An initial 3M settlement with many water utilities, estimated at up to $12.5 billion, was reached in June in a South Carolina federal court. A judge also okayed a separate final $1.2-billion deal between them and Dupont and its spinoff companies Chemours and Corteva Inc.

Attorneys general from 23 states challenged the 3M settlement July 26, stating the amount agreed to is too low, but a the federal judge approved it initially on Aug. 29, "with funds to be distributed to any public water system that has detected PFAS in one or more of its water sources," and to those "that have not yet detected PFAS but must test for contamination."

Fund allocation information for the estimated 300 municipal plaintiffs was also noted, with 19 that sued initially designated to represent the class. They include Camden, N.J.; Delray Beach, Fla.; the Coraopolis, Pa., Water and Sewer Authority; the Dutchess County, N.Y. Water and Wastewater Authority; and the California Water Service Co.

The pacts exclude state and federally-owned water systems, private well owners and other individual complainants. More litigation is expected, since the chemical companies have challenged suspected links between their products and specific health conditions.

Attorneys for the municipal systems say the five-year litigation has involved 160 depositions.

Paul Napoli, a lead attorney for plaintiffs, told ENR that final court approval of the settlement is expected after "fairness hearings" set for December and January.

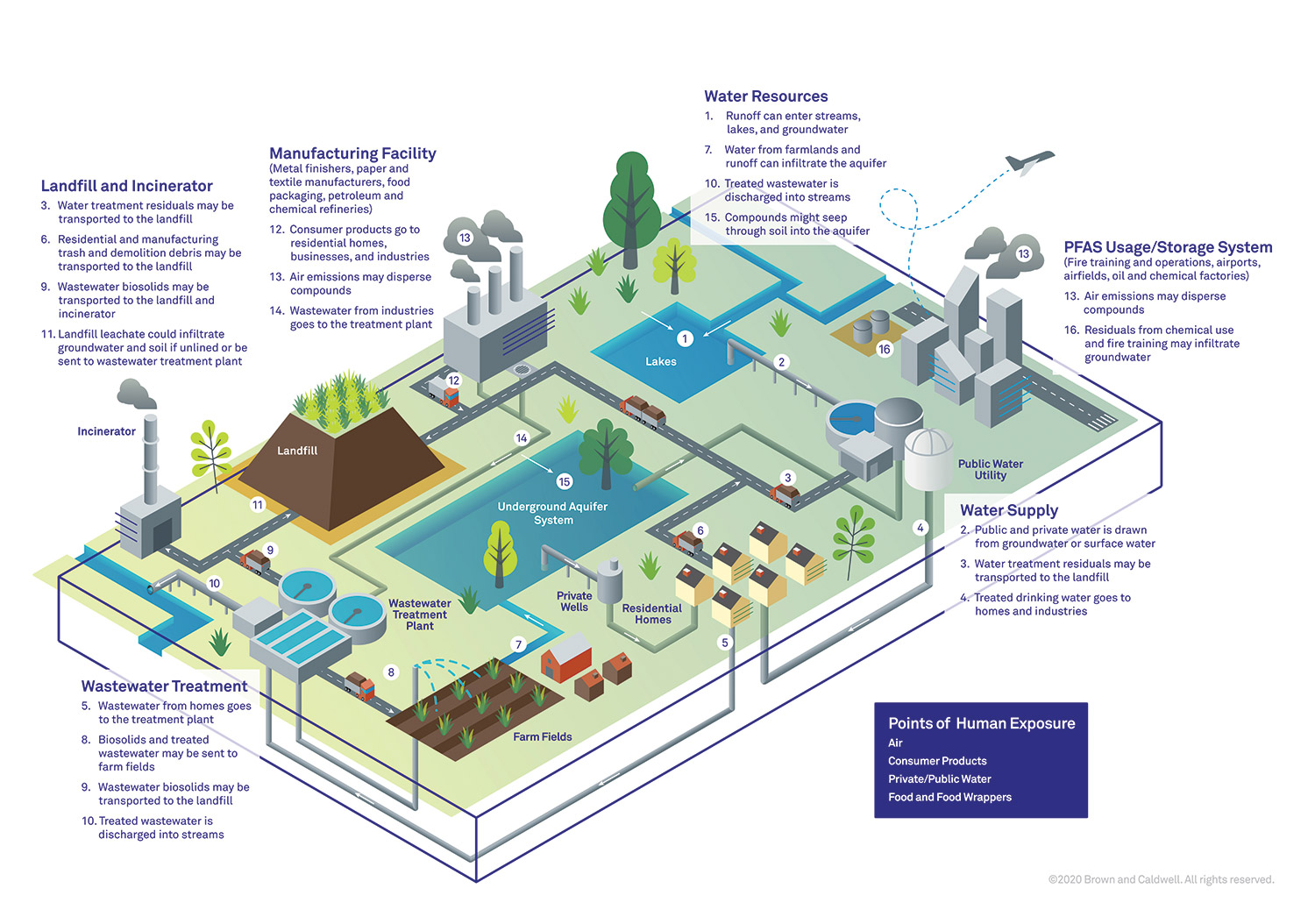

PFAS Life Cycle: Where Toxics Come From and Where They Go

Image: Brown & Caldwell

One major challenge in addressing the family of PFAS chemicals is their sheer ubiquity. Because they don’t degrade, substances used to manufacture numerous industrial and consumer products migrate into water and affect aquatic wildlife. Consuming contaminated fish and water causes PFAS to pass through to wastewater facilities, and contaminant-laden biosolids sent to landfills or used as fertilizer seep into groundwater and soil. When chemicals are incinerated, they can be released into the air without emissions capture.

Destructive Technologies

Current water treatment technologies work primarily by separating PFAS compounds from drinking water supply. By far the most common treatment methods to reduce them are granular activated carbon (GAC), ion exchange resins and high-pressure membranes in reverse osmosis or nanofiltration. Although effective, all three come with their own challenges, says Sean Lammerts, director of strategic growth at Black & Veatch. GAC and ion exchange treatment require periodic regeneration or replacement of the media. With reverse osmosis, the volume of the PFAS-contaminated waste stream can be so large that it’s difficult to break down further and must be disposed of.

AECOM crew at a PFAS site uses a destructive technology called DE-FLUORO that the firm says is commercially available and can be scaled up.

Photo courtesy AECOM

Because these technologies separate the water from waste streams, the waste must be either treated again or disposed of, typically through incineration, landfilling or deep-well injection. PFAS chemicals can be emitted into the air when incinerated without capture, and landfill leachate also can be heavily contaminated with PFAS.

Waste management firm Clean Harbors Inc. has six U.S. incinerators that are stack-tested for PFAS destruction capability and validated by a third party, says Paul Bratti, senior vice president. It also has closed loop landfills that do not release leachate, “so there is no fear of us discharging any into a waterway,” he adds. A 2022 outside review of its Utah hazardous waste incinerator on “multiple forms” of PFAS showed that the process destroyed more than 99.99% of compounds, exceeding state and federal ambient air standards, says Bratti.

Cascade Environmental developed a high resolution site characterization tool to detect chemical traces.

Photo courtesy Cascade Environmental

But says Jeff Hale, a Kleinfelder principal, “waste management options such as incineration and landfilling are becoming more limited due to PFAS stigma and regulations.” With more community concern, many utilities and facilities are relying on deep-well injection, although it could be “potentially problematic” if PFOA and PFOS are deemed hazardous under the Superfund law as EPA has proposed, Lammerts adds.

Such challenges are driving interest in new destructive technologies. A handful being evaluated and validated include: supercritical water oxidation; pyrolysis; electrochemical oxidation; foam fractionation; and plasma reactors, among others. All focus on breaking the fluorine-carbon bond, but most are not fully mature or cost-effective for widespread use, firms say.

“Right now, we’re definitely still at the lab-scale phase for a lot of these technologies. It really is kind of like a chemistry problem,” says Kyle Hay, municipal PFAS lead at Brown and Caldwell. He says some technologies now being evaluated could take from five to 10 years to mature. “A lot of the challenge is around scaling from the lab setting and being economically viable,” he adds. Black & Veatch has been working for the past two years with an undisclosed northeast U.S. utility to evaluate 18 destructive technologies. By next year, they will select four to progress to the demonstration project phase, says Gary Hunter, the firm's global technology practice leader.

HDR's Lauderdale notes that one strategy for reducing costs is to concentrate the brine or waste stream from initial treatment through technologies like foam fractionation so that the volume of PFAS-tainted water requiring treatment is smaller. “It starts to become more economical to put all that energy into that really small volume to start to break it apart,” Lauderdale says.

In March, as part of its “strategic roadmap” to tackle contamination, EPA proposed its first primary drinking water standard for six PFAS chemicals, including three of the most common: perfluorooctanic acid (PFOA); perfluorooctane sulfonate (PFOS); and Gen-X, the shorter-chain successor to Teflon. It expects to finalize the legally enforceable rule by year end and has also proposed designating PFOA and PFOS as “hazardous substances” under the U.S. Superfund law, with that rule likely to be final in 2024.

National water and wastewater utility groups agree that some PFAS should be regulated. But they say current proposals miss the mark in being more focused on regulating drinking and wastewater systems—passive “receivers” of contaminants—than on their manufacturers and industrial facilities that use them.

EPA has taken steps to rein in polluters in some places, notably in Cape Fear, N.C., (see box below). The agency issued two guidance memos to state agencies in 2022 that outlined how to incorporate PFAS reductions into federal pollutant discharge permits for industrial facilities under existing authorities. In January, EPA said it would develop technology-based pollution limits and more studies on wastewater discharges from industrial sources under the federal effluent limitation guidelines program.

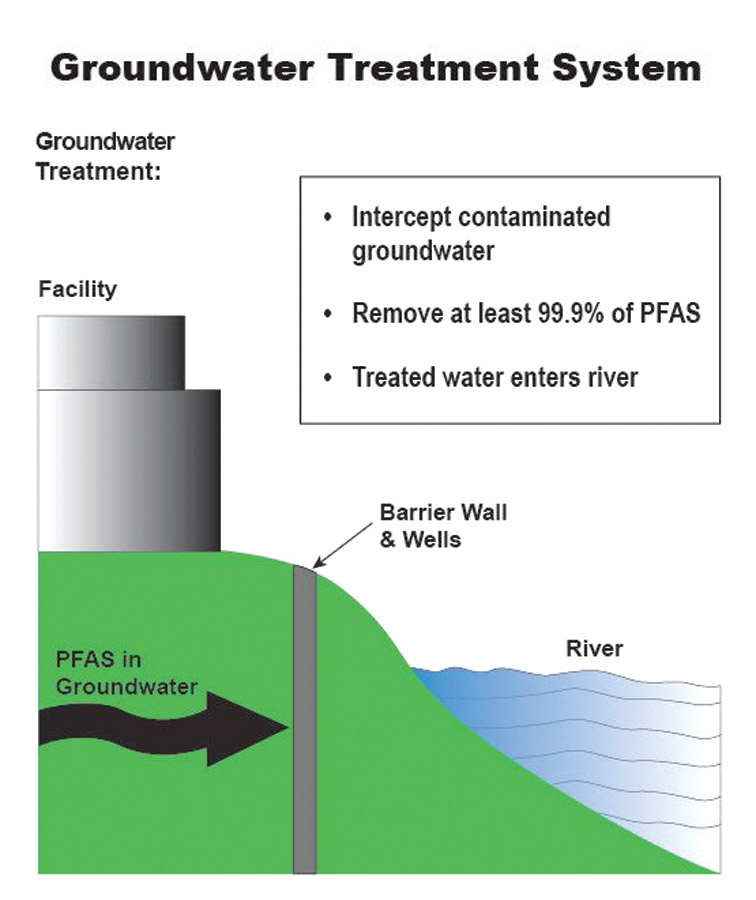

Manufacturer Chemours just finished building a mandated barrier—2.5-ft-thick, 60 to 80 ft deep and 1.5 miles long—in North Carolina, to prevent added Cape Fear River contamination

Image courtesy North Carolina DEQ

Water Group Concerns

Steve Via, American Water Works Association director of federal relations, says EPA could be doing more and moving faster to impose limits and new requirements on PFAS producers. The group supports a drinking water standard for certain types of PFAS that utilities can comply with in the timetable required under the Safe Drinking Water Act, which is three years, with the potential for a two-year extension in some cases.

With supply chain and workforce shortages, requiring all water utilities to install PFAS treatment systems in the same timeframe could be a logistical nightmare, he says. Adding systems to remove or destroy PFAS where there’s little risk takes funds and resources away from problems that might be more pressing, ACEC’s Hall notes.

One solution could be to raise the maximum contaminant level so utilities with the highest PFAS levels would have to install treatment systems first, Via says. His group recommends MCL be raised to 10 parts per trillion from the 4 parts per trillion EPA proposed.

Cost estimates and studies EPA relied on to develop the drinking water standard are flawed, according to the water utility group. A Black & Veatch analysis the agency included in comments predicts PFAS compliance costs at $2.5 billion to $3.2 billion annually, much higher than EPA estimates. “This rule will be one of the most costly ever under the Safe Drinking Water Act … and a burden carried by less than 10% of water systems,” the association said, emphasizing that its impact analysis “be accurate so that water systems and communities are assured that investments in infrastructure being made represent [those] with the greatest societal benefit.”

Responding to PFAS In Your Water Supply

With identification of PFAS contamination in its drinking water dating to 2016, Stuart, Fla.’s $100-million lawsuit against manufacturer 3M was considered a test case for multidistrict litigation—as officials aim to recover funds spent to treat city water, cover future water-filtration investment and seek damages.

Since discovering high PFAS levels in its system from firefighting foam stored nearby, officials replaced three of 24 drinking water wells and installed an ion-exchange treatment system. When completed in 2019, it was the first project of its kind built in Florida and the largest U.S. operating system—with treatment capacity of up to 8 million gallons per day, according to design firm Kimley-Horn. The system removes PFAS and other contaminants to less than 10 parts per trillion, which the firm says is non-detect level.

Annual operating costs, estimated at $2 million, are set to rise as the city aims to reduce contamination to zero, officials said in court depositions noted in a June Grist report. Stuart also is set to finish in November an estimated $18.3-million reverse-osmosis treatment facility at its water plant. City officials and Kimley-Horn managers would not comment to ENR on financial or technical details of Stuart’s response, citing the litigation.

Stuart, Fla., which spent millions since 2016 to cut PFAS from its drinking water system, (above), has sued manufacturers; granular activated carbon treatment was added in 2022 to the main Cape Fear, N.C., water plant (below).

Photo: Cape Fear Public Utility Authority

Leaking pipes from a Chemours plant near Fayetteville, N.C., tainted about 9,000 wells near the plant with PFAS chemicals, says Dana Sargent, executive director of advocacy group Cape Fear River Watch.

Under a 2019 state order, Chemours is remediating toxics in the Cape Fear River, including construction of a parallel 1.5-mile-long subsurface wall that is 2.5 ft thick and 60-80 ft deep, along with a groundwater extraction system to remove at least 99% of PFAS. Although recently completed, the project was several months behind its targeted schedule, she notes.

Chemours says the Gen-X chemical product now produced there “is safe for its intended use” in producing fluoropolymers for materials needed for U.S. energy transition. Sargent says such claims are an example of greenwashing.

Meanwhile, the the Cape Fear Public Utilities Authority in North Carolina has filed separate litigation with Chemours, and finished work in 2022 on a granular activated carbon treatment system to cut PFAS at its 44-mgd Sweeney water treatment plant.

By Debra K. Rubin and Pam McFarland

Superfund Specter

Similarly, water and wastewater groups are worried about possible Superfund liability if EPA moves forward to designate PFOA and PFOS as hazardous substances. Environmental groups say those concerns are overblown. “Water utilities are accustomed to receiving and treating hazardous substances and disposing of contaminated waste properly and safely,” the Environmental Working group wrote in May. “Adding PFAS to the hazardous substance list will merely add to the list of hazardous substances that drinking and wastewater utilities already routinely handle.”

Many communities are not waiting for federal regulation to deal with what’s coming. “It’s on everybody’s mind,” says Jay Surti, GHD east region biosolids leader. New Jersey has had an enforceable PFAS drinking water standard in effect since 2018, the first state to develop one. Others in the northeast, as well as Minnesota, California, and West Virginia have done the same.

Map: U.S. Geological Survey

Rosa Gwinn, AECOM global PFAS technical lead, says the firm is working with municipalities that are already planning for different scenarios, including different MCL limits for PFAS in a final drinking water standard.

“What does it mean, if the number of compounds change? Let’s face it: a city as large as Los Angeles, with the amount of water it provides, is not going to be able to flip a switch on a treatment system,” she says. “These things are going to be large construction efforts to design, build and operate.”

AECOM has also worked for more than a decade with the U.S. Defense Dept.—a one-time major user of PFAS-containing aqueous film forming foam for firefighting—on remediation, Gwinn notes. Current work with the U.S. Army Corps of Engineers includes investigations, feasibility studies, removal actions and other activity at 189 national guard facilities nationwide.

On the wastewater side, firms such as GHD are encouraging clients to focus on risk assessment and adaptive planning. Utilities need to anticipate regulatory requirements in their capital planning “to avoid any risk of stranded assets, given that regulations may change in the future,” Surti says. “You have to plan for it now.”

Post a comment to this article

Report Abusive Comment