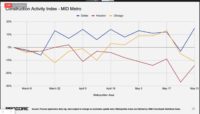

The American Institute of Architects/Deltek Architecture Billings Index score decreased from 50.4 in March to 48.5 in April, with any score below 50 indicating a decrease in billings in the on-the-boards survey of more than 100 AIA member firms. The index was negative in late 2022 and at 49.3 in January before reaching back into positive territory in March.

Design firms reported that inquiries into new projects accelerated slightly in April, even as most firms continued to report a decline in the value of their new design contracts. AIA said costs are also increasing while firms are finding the value of their own contracts go down.

"The ongoing weakness in design activity at architecture firms reflects clients’ concerns regarding the economic outlook,” said AIA Chief Economist Kermit Baker in a statement. “High construction costs, extended project schedules, elevated interest rates, and growing difficulty in obtaining financing are all weighing on the construction market."

The index reflects an approximately 9–12-month lead time as an economic indicator of actual construction activity.

Despite the recent softness in billings, many firms were cautiously optimistic about this year, according to the survey. As the construction market cools, costs and schedules are expected to ease, which may make some projects more feasible, AIA's statement said. Professional services firms will continue to be able to capitalize on opportunities related to green building and energy efficiency initiatives that have increased over the past few years, says the professional association.

Key ABI Highlights for April

- Regional averages: Midwest, 51.2; West, 49.3; South, 48.7; Northeast, 47.2

- Sector index breakdown: mixed practice (firms that do not have at least half of their billings in any one other category) 52.1; commercial/industrial, 51.8; institutional, 50.6; multi-family residential, 41.5

- Project inquiries index: 53.9

- Design contracts index: 49.8

Post a comment to this article

Report Abusive Comment