Construction’s employment growth slowed in October as the industry added just 1,000 jobs during the month, the Bureau of Labor Statistics has reported.

Construction averaged increases of 19,400 jobs for the previous five months.

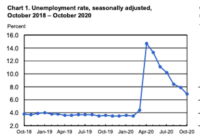

In its latest monthly employment report, released on Nov. 4, BLS also said that construction’s jobless rate rose to 4.1% last month, from September’s 3.4%. It also was slightly higher than the year-earlier level of 4.0%.

The BLS unemployment rates are not adjusted for seasonal differences, which can be significant in construction.

But the bureau’s figures for jobs gained or lost are seasonally adjusted.

The industry’s October jobs gains were concentrated in buildings construction, which added 5,600 positions. They slightly outpaced losses in the specialty trade contractors sector, which shed 4,000 jobs, and heavy and civil engineering construction, which lost 400.

Architectural and engineering services, which BLS lists separately from construction, recording a gain of 6,800 jobs in October.

Stephen E. Sandherr, Associated General Contractors of America chief executive officer, said in a statement, “The construction sector would likely have added more jobs in October if only firms could find people to bring on board.”

Sandherr added, “Labor market conditions are so tight, however, that the sector barely increased in size even as demand remains strong for many types of construction projects.”

AGC also pointed out that on a year-over-year basis, total construction employment climbed by 266,000, or 3.6%.

For October, construction’s average hourly wages were $35.27, an increase of $1.86, or 5.6%, from the year-earlier level. AGC observed that the construction wage increase was higher than the 4.7% for the private sector overall, according to BLS figures.

Looking at the overall U.S. economy, the bureau reported that jobs climbed by 261,000 in October, and the unemployment rate moved up to 3.7%, from September’s 3.5%.

Anirban Basu, Associated Builders and Contractors chief economist, referring to the interplay of labor market numbers and interest rate activity, said that “in this economic environment, good news is bad news and vice versa.”

Basu said in a statement, “For inflation to return to its 2% target, the demand for labor needs to weaken.”

He added. “We’re not there yet, which means that the current cycle of [the Federal Reserve] raising interest rates will continue.”

High interest rates are likely to dampen demand for construction, at a time when contractors continue to face worker shortages and high materials costs, Basu said.

Post a comment to this article

Report Abusive Comment