The compensation paid in 2021 to WSP Global Inc. CEO Alexandre L’Heureux easily topped that fiscal's year's total pay to AECOM CEO W. Troy Rudd, according to proxy statements and other documents—even though the latter outranks the former on revenue-based ENR design firm surveys.

The two publicly traded companies are both infrastructure leaders that have grown through acquisition with chief executives who once sat at the chief financial officer's desk.

But comparisons of pay are complicated by the fact that both CEOs also took partial Covid-19-related pay cuts in 2020 and Rudd received special compensation on becoming CEO. That anomaly is largely why the two CEO pay packages moved in opposite directions.

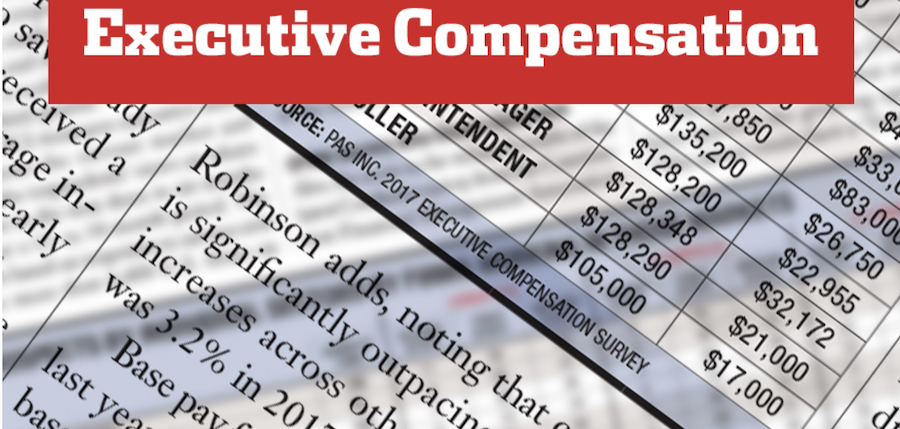

For perspective, pay packages for some publicly traded construction and contracting CEOs were far higher than those paid by AECOM and WSP, companies with revenue mostly from design and consulting. Ronald N. Tutor's 2021 total compensation from Tutor Perini Corp was $14.8 million and Jose R. Mas's pay from Mastec Inc. was $9.1 million, most of it in cash bonus, incentive pay, stock and stock options.

As WSP (TSX: WSP) continued its ambitious growth-by-acquisition strategy, L’Heureux’s total compensation increased by nearly $2.3 million to $9.2 million, according to WSP’s notice to shareholders released in the spring. In addition to a 2021 base salary of $1.3 million, he received $5.67 million in long-term incentive plan awards, plus various shares, options and other kinds of compensation.

In addition to a base salary of $1.3 million, Alexandre L'Heureux received $5.67 million in long-term incentive plan awards, plus various shares, options and other kinds of compensation.

—WSP Global notice to shareholders

After joining the Montreal-based company as CFO in 2010, L’Heureux became chief executive in 2016. His compensation has grown in each of the last three years.

In fiscal 2020 AECOM (NYSE: ACM) recorded a net loss of $186.4 million but was solidly profitable a year later, posting net income of $173.2 million for the year ended Sept. 30.

But Rudd’s total compensation from AECOM slid from $9.3 million to $6.52 million in 2021, according to the Los Angeles-based company’s proxy statement. He had won a significant pay increase—his base salary was set at 682,000 in 2019, and $1 million in 2020—coinciding with his promotion to CEO.

But in 2020 Rudd only collected $701,000 of his base salary due to his Covid-19-related pay cut.

The biggest difference in Rudd's overall 2021 compensation came from the absence of anything like the $3 million stock option granted him in 2020.

—AECOM proxy statement

The biggest difference in his overall 2021 compensation came from the absence of anything like the $3 million stock option granted him in 2020—a one-time option provided to him on his promotion to CEO.

Both companies compensation for executive officers is based on a system of incentives and rewards. Tweaks are common.

For example, WSP for 2021 added a metric for its short-term incentive pay program related to all regions of the company improving operational efficiency and financial performance and sharing best practices.

Also, the company board stated that it had upped CEO and CFO total compensation for 2021, "taking into consideration their experience and sustained strong performance in their roles and to better position their compensation versus the median of the peer group."

At its annual meeting March 1, AECOM's board asked stockholders to approve a "say-on-pay" resolution that would allow them to hold an advisory vote each year on executive compensation. The vote was approved but is not binding on the board or the board compensation committee, which have the final say.

AECOM's executive pay approach is performance and stock-based and sets targets that named executive officers, who are occupants of the C-suite, aim for to receive the maximum amounts. The compensation is divided, as it is at other similar companies, into base salary, incentive cash pay and incentive stock awards and options.

Post a comment to this article

Report Abusive Comment