Seeking to optimize its power manufacturing strength as energy construction markets shift, and to boost its top and bottom lines against growing global competition, Boston-based GE is combining its fossil fuel, renewable energy and digital software units into one new company to be spun off in early 2024.

The spinoff, announced Nov. 9, will be made up of GE Power, GE Renewable Energy and GE Digital businesses. “This business possesses a unique offering, with some of the world’s most powerful wind turbines and most efficient gas turbines as well as technology to modernize and digitize the grid,” GE CEO Larry Culp said in announcing the split. He said the new company will be well positioned to be an energy transition leader.

The company has all the components for high growth in the sector, Andrew Dillon, a Dallas-based market strategist at consultant West Monroe Partners, told ENR. In addition to being a major manufacturer of onshore and offshore wind power turbines, it is pivoting to enable use of hydrogen in its huge fleet of power combustion equipment and is integrating grid modernization technology into its digital business, he says.

The current energy business reported about $33 billion in 2020 revenue, making up about 15 to 20% of GE’s total, with the digital unit contributing about $1 billion. While the company also said in financial filings that its traditional power business had an operating profit of $416 million for the first nine months of 2021, the renewables unit lost $484 million.

Analysts told the Wall Street Journal that the GE energy business will face more market headwinds than the firm’s health care and aviation units that also are spinning off in two years.

Consistent and Reliable

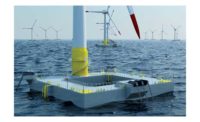

Dillon says GE’s three-pronged approach for the transitioning energy market will help boost its position—citing its clean energy innovations such as launch of the record-setting Haliade offshore wind turbine in 2020, advanced software to modernize the U.S. electric grid now set for major infrastructure bill investment, and hydrogen-fired turbines that will make renewable sources more consistent and reliable by smoothing out intermittency and unpredictability.

GE supplied turbines that will blend hydrogen and natural gas, for the first time in the U.S., in a purpose built 485-MW Ohio power plant that opened this year in Ohio.

GE is well positioned to take advantage of the potential $1-trillion hydrogen fuel market, even if its development potential is unclear, Dillon says. He emphasizes that energy sector companies seeking to succeed in the new market have to make bets today on its five to 20-year horizon.

“GE is making that bet,” Dillon says. The offshore wind market will continue to grow, and more electrified transportation could require doubling the size of the grid, says Dillon. “The key story is the market is moving fast and the amount of change is consistently higher than in the past. Energy also is ever growing in importance to the economy.”

Sector businesses also will have more access to investment that now emphasizes environmental, social and governance (ESG) factors, as well as being able to attract new talent, Dillon says. “So a company focused on clean energy and renewables could benefit,” he says.

Deane Dray, an RBC Capital analyst, said the GE breakup has been expected for years, and its corporate ratings are positive. “The company is embarking on the three-way separation from a position of strength,” she said in an investor note.

The new energy business will include equipment and services for natural gas, coal and wind turbines and services for hydropower and nuclear energy generation, the company said.

Post a comment to this article

Report Abusive Comment