“The U.S. economy is now racing back,” said Anirban Basu, chief economist at Associated Builders and Contractors, adding that the second half of the year should be “spectacular for economic growth." He presented his analysis during a July 14 webinar titled “Construction Executive's 2021 Q2 Construction Economic Forecast."

While single-family construction has been strong throughout the past year, multifamily is now beginning to grow as well, according to the American Institute of Architects’ Architecture Billings Index. During the pandemic, many cities experienced a “mass exodus,” said Basu, but multifamily and apartment construction will be quite active going forward.

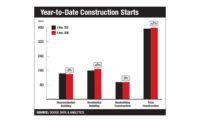

In its mid-year outlook, Dodge Data & Analytics also offered a positive forecast for multifamily construction but with a caveat: construction remains down in large metro areas such as New York, Houston and Los Angeles, bringing down overall numbers.

In the non-residential market, commercial starts are expected to increase 5% in 2021, according to Dodge, with the majority of the work in the warehouse sector.

Still, some non-residential sectors remain in decline. “I really believe the office construction segment will be among the last segments to recover,” said Basu, noting that many workers are likely to continue working from home.

According to the U.S. Census Bureau, spending on office construction is down 8.5% year-over-year as of May 2021, while spending on lodging construction is down 22.3% in the same time period.

ABC’s construction backlog indicator rose to 8.5 months in June, its highest rate in several months. High material prices and an ongoing labor shortage remain the largest obstacles to the recovery.

“We just do not have enough skilled workers in America,” said Basu. In addition to increased backlog, he points to workers that will be needed for the upcoming infrastructure package. “If anything, the demand for these workers is going to increase.”

Post a comment to this article

Report Abusive Comment