Construction employment in March remained below March 2020 levels in 35 states despite a robust homebuilding market and a strong recovery from severe winter weather, according to an analysis of U.S. Bureau of Labor Statistics Employment data by the Associated General Contractors of America.

AGC and data collection partner, Procore Technologies Inc., said the industry still faces significant hurdles in bouncing back from the COVID-19 pandemic more than a year after some states shut all jobsites as the threat of the deadly virus became more apparent.

"We've aggregated data from Procore customers and the projects that they're running around the globe," said Kris Lengieza, vice president of global partnerships and alliances at Procore on an April 20 AGC online media conference. "This has presented us insights into what is actually happening on projects throughout the pandemic. We are able to track—in real time on a week-by-week basis—the number of workers that are present on a jobsite throughout our daily logs, and that's reported not only by our customers, but all of their collaborators (such as subcontractors)."

Using March 1 as a benchmark and tracking worker-hours throughout 2020 and into 2021, the study shows a pattern of sharp employment dropoffs in states where there were work stoppages, such as New York and Michigan, and smaller ups and downs in states such as Florida and Iowa, where there were no COVID-19 construction shutdowns.

As of last month, "we are back at where we were at the beginning of COVID-19 in March 2020," Lengieza said. "Keep in mind, this is a constant customer base that we are looking at here. We are not including any new customers that came online and bought Procore. We kept that data set centralized as to who was on board at the beginning of COVID."

Construction businesses that Procore tracked were defined as large if they had revenue of more than $200 million, medium with $20 million to $200 million in revenue and small with less than $20 million. The medium and large businesses tended to react more quickly to changing safety conditions because they had strong plans in place with individuals able to address safety, said Lengieza, adding that financially, they were more stable and able to invest in whatever was needed to keep projects going. Smaller construction companies reopened job sites and retrofitted their workplaces more slowly than their larger counterparts, resulting in some sites not reopening until the latter half of 2020.

"The positive outlook here as we are seeing ... most of these areas and the nation as a whole returned back to pre-COVID levels," he said.

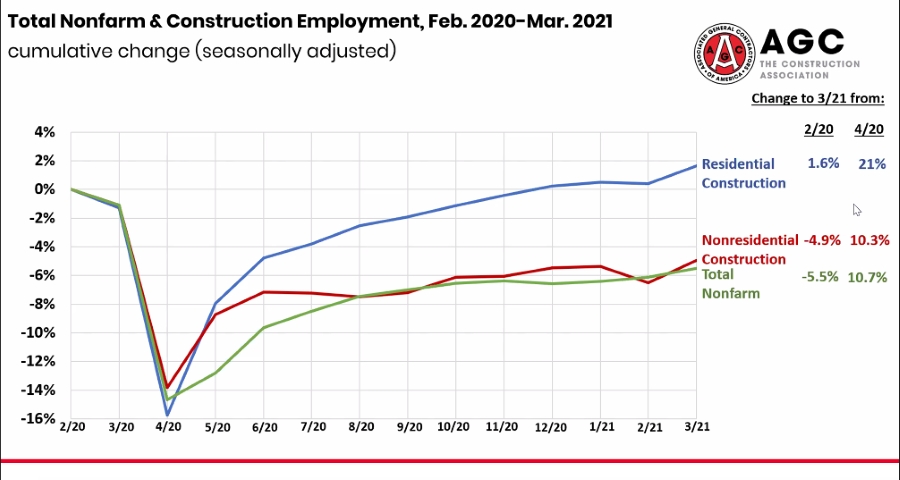

AGC Chief Economist Ken Simonson said that, according to the BLS numbers he analyzed, non-residential construction still has not caught up to its pre-pandemic levels of employment while residential construction, spurred by pandemic buying, increased for most of 2020 and is now 10% ahead of its March 2020 high.

"Non-residential construction employment—while it has increased 10% from the low point in April of last year—still only two thirds of the jobs that were lost have been recovered," Simonson said.

While stressing that public health concerns were tantamount, he said that states that either never shut down or had a much more limited shutdown also had other sectors of their economy that were reopened and adding to demand for construction services, so it's not surprising that they are rebounding faster.

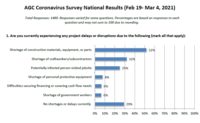

Simonson said that supply-chain problems involving lumber and steel mills that were shut down during the pandemic and the ongoing shipping container and truck driver shortage are also hindering the on-time delivery of construction projects.

"Once the floodgates opened and people rushed out to buy homes and remodeled their homes, or to add decks and railings to restaurants, both residential and non-residential demand for lumber surged," he said. "The mills weren't necessarily able to get all of their workers back for the same reason that other businesses weren't."

Post a comment to this article

Report Abusive Comment