The “shared global experience” of COVID-19 continues to be the primary factor shaping the U.S. economy, said economist Anirban Basu, CEO of Sage Policy Group, in a presentation to the Construction Users Roundtable National Conference on Feb. 8. While a second wave of the pandemic held back economic growth as the U.S. headed into 2021, Basu forecasts a surging economy and construction industry in the latter half of the year.

The U.S. and much of Europe saw big declines through 2020, with U.S. growth output down 3.4% and European nations such as Spain and Italy experiencing output decline of 11.1% and 9.2%, respectively.

“The year was really very uneven in terms of performance,” said Basu. There was “raging momentum” at the start of 2020, prior to the emergence of COVID-19. By March, the U.S. economy was shutting down, which resulted in a 5% decline in GDP in the first quarter of 2020.

“[Negative 5%] was merely the appetizer,” said Basu, as the second quarter of 2020 saw a GDP drop of 31.4%.

In the third quarter, however, the U.S. saw a V shaped recovery; the economy rebounded 33.4%. The fourth quarter brought a more modest 4% uptick.

“Through the early stages of recovery this U.S. economy proved how rapidly it can repair itself,” said Basu. Still, even with the growth of those two quarters, growth is smaller than at the end of 2019.

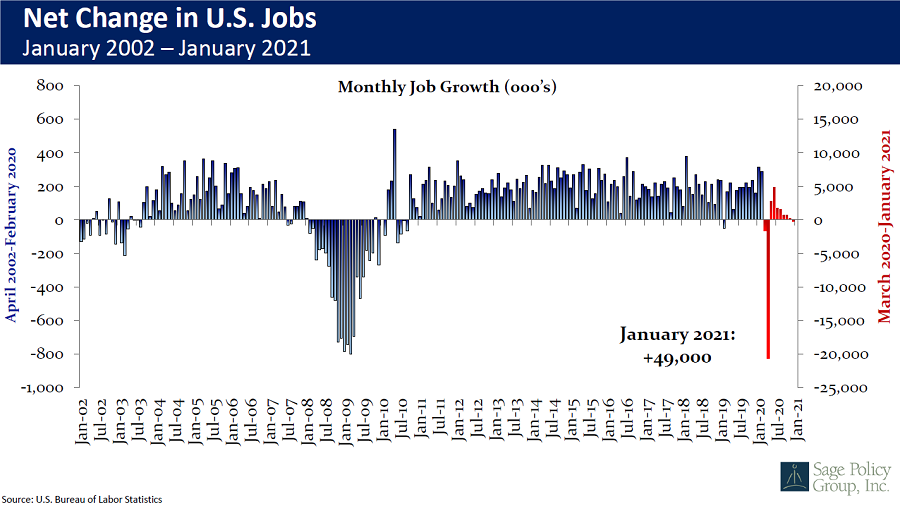

Overall employment numbers followed a similar trajectory. In early March, a loss of 1.4 million jobs was recorded; by April, an additional 20.8 million jobs were lost. The U.S. began to add jobs again in May, but at a much slower rate. Now “momentum is fading,” said Basu. “By December I’m sorry to say, we’re losing jobs again.” He points to the months-long stretch between federal stimulus packages as part of the reason for waning economic growth. As of January 2021, the U.S. is down 9.6 million jobs year over year.

Construction jobs in specific took a significant hit in early months of the pandemic, losing 14.6% of its jobs from February 2020 to April 2020. However, from February 2020 through January 2021, construction only lost 3.3% of jobs overall. Region matters, notes Basu. Metro areas in Texas, Arizona and Georgia saw fewer job losses as governors focused on keeping the economy open. States such as Michigan, New York and New Jersey experienced more job loss due to stricter health guidelines.

Looking forward, Basu expects trouble on the supply side in the first half of 2021. Consumer demand is high, he says, and while many lost their jobs during the pandemic, overall household savings rose as the economy shut down.

“Coming into this crisis, the savings rate was around 8%,” said Basu. “By April, it was 34%.” While spending increased as the economy partially reopened in the summer, the savings rate is still 13.7%.

On the supply side, lockdowns continue to hamper economic recovery for many businesses. Diminished capacity at restaurants and cancellation of other events for the foreseeable future puts the country into a recession even while demand is high, says Basu. The additional stimulus currently being discussed by congress will only further the demand, which could lead to a "spectacular" second half of the year.

As vaccines become widely available, "the second half of the year [will be] brilliant for the economy,” said Basu, “setting the stage for a much stronger 2022, and more demand for construction services.”

Post a comment to this article

Report Abusive Comment