Three-quarters of 1,077 contractors surveyed by the Associated General Contractors of America said they have experienced a project cancellation or postponement due to the ongoing COVID-19 pandemic, in survey data of members the trade group released on Oct. 28.

That figure, based on data obtained in late September and early October, is up from 60% reported by AGC in August.

"These results make it clear that the months-long pandemic is undermining the demand for projects, disrupting vital supply chains and clouding the industry's outlook without new federal relief measures," AGC Chief Economist Ken Simonson said. "These challenges pose a significant threat to current construction employment levels."

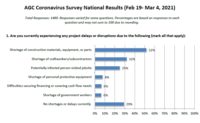

The number of contractors reporting a shortage of materials, equipment or parts increased to 42%, with firms citing disruptions in trucking, rail and ocean shipment and delays in domestic production and transportation. But only 7% reported a need for personal protective equipment such as masks and cleaning supplies, down from the previous survey.

Simonson said 35% of respondents experienced a shortage of craft workers over the last year, but only 86 contractors reported adding jobs in the last year and 42% said they do not plan to increase the size of their labor force in the next year.

Half of respondents said they want a larger federal investment in all forms of construction.

Regionally, more contractors in the Northeast—nearly 85%—reported that a project was canceled or postponed. Elsewhere, that situation was noted by 80% of contractors in the Midwest, 72% in the West and 71% in the South. About 88% of contractors with more than $500 million in revenue experienced a lost or postponed project, compared to 80% of firms with $50 to $100 million in revenue and 73% of firms with $50 million or less.

The rate of contractors experiencing cash flow delays remained at 10% in October, although the figure rose from 8% reporting them in June.

However, almost a quarter of respondents reported gaining business because of the pandemic.

Of those contractors, 7% said they won new medical projects, 5% reported work on other buildings such as data centers or distribution facilities required by more people working at home, and 2% reported additional highway work.

Simonson said that 46% of respondents called for a larger federal investment in all forms of public infrastructure and facilities, with 30% noting need for a new multi-year surface transportation bill enacted and 20% wanting "safe harbor" liability reforms to protect responsible firms from coronavirus lawsuits.

The survey did not seek information on candidate choice in the presidential election, but Simonson pointed out that President Donald Trump "never came forth with a detailed infrastructure package and never convinced Senate Republicans to bring something forward."

Simonson added that "if Joe Biden becomes president, he’s very interested in a broad package of infrastructure, including rail—he's a noted fan of Amtrak—and energy storage. We may see a big push for infrastructure, broadly defined, but the makeup of the Congress is key. Congress can act quickly if it wants to. President Obama got the 2009 stimulus through in about four weeks."

But, the economist warned: "If Congress is controlled by the opposition party, that can make it go from weeks to years."

Post a comment to this article

Report Abusive Comment