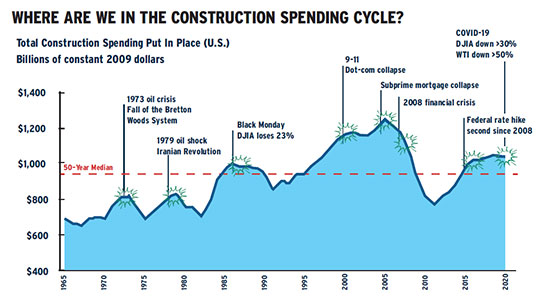

Until a few months ago, most contractors would have considered the Great Recession the biggest business challenge they have faced. The protracted downturn that started in 2008 put the leadership and strategic planning skills of industry executives to the test, forcing difficult decisions aimed at keeping their firms afloat until a recovery took hold.

The COVID-19 outbreak has changed that sentiment. Within a matter of days, contractors found themselves scrambling to figure out how to perform work while complying with social distancing and other new safety measures, or wondering if they could work at all under state and local shelter-in-place restrictions. Compounding the day-to-day challenges has been uncertainty about what the post-pandemic economy will hold, and what strategic adjustments may be needed to survive.

Although many economic forecasts prior to the outbreak had already suggested the likelihood of a recession, “we had 10 years of hindsight to prepare for it,” observes Scott Peterson, CEO of Interstates, Sioux Center, Iowa. To tackle the current challenge, he adds, “we have only a few weeks of hindsight.”

Peterson believes that while a virus-driven recession presents contractors with some unprecedented challenges, it should be framed in the context of previous downturns. “The things we’ve done in the past can work again or be adapted,” he says. “Mindset is the biggest thing—making sure we’re dealing with today while thinking about tomorrow.”

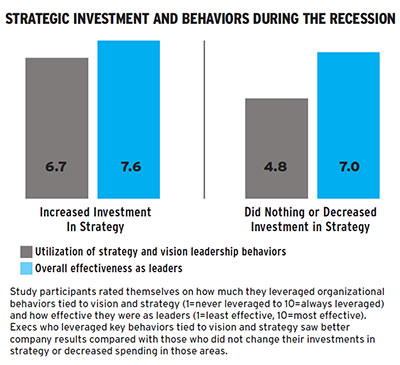

The results of an FMI Corp. study released this spring just as the pandemic took hold suggest that the experiences of the Great Recession offer contractors valuable lessons about strategic planning. Though the virus outbreak may have caught many firms off guard, FMI principal and study co-author Rick Tison says it’s not too late to apply those lessons in formulating business strategies for the coming months and, perhaps, years.

“The biggest risk is sitting back and hoping things will turn out better than we all collectively expect,” Tison says. “This is the time to take stock of what the organization is up against and increase focus on strategy, as hard as that may be given the immediacy of the current challenges.”

Acting quickly is also important. John Cannito, president of PENTA Building Group, Las Vegas, says a willingness to immediately confront hard facts as the virus began to spread has helped his firm adjust to its impact. “We made some decisions during the Great Recession that we should’ve addressed earlier,” he admits. “This time, responding to the virus and keeping the business on track has been easier to deal with because we’d already put leadership and planning mechanisms into place.”

While most geographic areas still are seeing full or partial construction activity and others are preparing to reopen jobsites that have been shuttered for weeks, Tison says contractors need to consider questions such as how much of current backlogs will be realized or how fast to move forward with collections should owners decide to hold on to cash to preserve liquidity.

Study co-author Emily Livorsi adds that the Great Recession also demonstrated the need for firms to have a clear understanding of their purpose, vision and values to guide decision-making. “Losing your way and not being true to who you are was a critical lesson learned for some businesses that really struggled,” says Livorsi, a consultant for FMI’s Leadership & Organizational Development practice.

SOURCE: 2020 FMI LEADERSHIP & STRATEGY SURVEY

Continue Developing Leaders

During the Great Recession, for example, many contractors attempted quick entries into then-active markets without being fully prepared to execute projects successfully. Other firms implemented severe austerity measures that left them poorly positioned for growth. “As firms started to grow again and tackle bigger projects, they struggled to get enough hands on board to tackle the problems of the future,” Livorsi says. “Those who continued developing leaders when times were tough were able to fare better in the war for talent.”

Tison agrees. “Many people left the industry during that slowdown and didn’t return,” he says. “Because the industry is already challenged by an aging workforce, a similar trend will stretch the industry’s abilities even further.”

Herb Sargent, president and CEO of Sargent Corp., Stillwater, Maine, says curbing talent development was one of the bitterest lessons for his firm during the Great Recession. “It was a mistake that we’re not going to make again,” he says.

One aspect of strategic thinking that’s likely been altered permanently by COVID-19 is the cyclical nature of the planning process itself. Rather than laying out a plan for the next five to 10 years, Tison says strategy should be “a perpetual part” of a firm’s leadership focus. “There are countless examples of times when something like this comes up and a strategic plan goes out the window,” he explains. “As a result, firms get into reactionary mode and make decisions that might not be best for the future.”

SOURCE: CHART COURTESY OF 2020 FMI LEADERSHIP & STRATEGY SURVEY

Tracking Transformation

A fall 2019 leadership change at Bellevue, Wash.-based GLY Construction spurred updates to the firm’s strategic plan and vision guideposts that have proven valuable during the COVID-19 outbreak, according to president and CEO Ted Herb. Mirroring a common strategic practice of high-tech firms, GLY’s plan incorporates separate tracks for short- and long-term transformation.

As the virus began to spread, GLY’s leadership quickly established a task force to focus on safety, human resources and other day-to-day issues, allowing Herb and other executives to concentrate on short- and long-term questions.

Herb says that along with making GLY’s strategic planning more immediately relevant, the approach also makes the firm more nimble, “particularly since we don’t know what the industry will look like as it heals. We need to be prepared to deal with whatever happens.”

Flexibility will be especially critical in a dynamic business environment that, according to the FMI survey, had already led many businesses to adopt increasingly shorter planning windows. The need for rapid response to virus-related changes will likely shorten those timelines even more.

“COVID-19 has demonstrated that the life span from thought to implementation goes from months and years to days,” observes Steve Levy, senior vice president of construction operations for McCownGordon Construction, Kansas City, Mo.

Transparency, another lesson learned about strategic planning from the Great Recession, also will take on greater importance as employees worry about their own futures. “If you don’t have a good internal communication strategy, now is the time to do it,” Livorsi says. Rather than waiting until all the facts are available, “communicate what you know and what you don’t know, and do it consistently. Employees will appreciate it.”

“You can’t overcommunicate in a crisis,” agrees Penta’s Cannito, “but it only works if the person hears the message.”

That’s especially true for field employees who may be working in far-flung locations. Sargent discovered that corporate emails to employees, working on projects from Maine to Virginia, often went unopened. He substituted them with a weekly podcast to provide updates and thoughts about the current situation and the future. “We found that 80% of our employees download the podcast, compared with 20% who read emails,” he says.

And while current uncertainties may force contractors to change course quickly, Levy believes that proactive plan development—and having good people to carry it out—should be the norm. “We’ve gotten through the COVID-19 crisis so far because we had a plan,” he says. “Now, if we see something that we want to change, we can strategize and plan that change and implement it much quicker than we once thought possible.”

Top FMI Strategy Report Takeaways

FMI’s report, “Leading Through Business Cycles,” is based on the survey responses of more than 150 engineering and construction executives who shared their experiences and strategies from the last downturn. Among the key findings:

> On average, engineering and construction executives who reported higher effectiveness and better post-recession profit margins spent at least 15% of their time in executive meetings discussing strategy.

> Nurturing client relationships allows firms to be successful during a tough economy.

> Only 40% of respondents say strategy is based on an objective view of context, suggesting that too many firms opt for risky, short-term solutions in pursuing new projects, clients or markets, rather than building a stronger equity base that establishes success for the future.

> Successful diversification into new markets requires an investment mindset, with a full understanding of what it takes to compete in unfamiliar environments.

> While decisive action is critical in an economic crisis, decentralizing information and sharing it downstream may have even more significant impacts in tough circumstances than in a robust market.

FMI reached out to company leaders from ENR’s Top 400 Contractors ranking to explore what makes leaders effective. From May 2019 to August 2019, FMI surveyed more than 150 leaders and completed 30 interviews with company executives from a wide range of firms: specialty contractors (37%), building contractors (30%), highway/civil contractors (13%), architecture and engineering firms (10%) and construction managers (9%).