Driven by rising construction activity, an opinion survey of contractors, fleet managers, equipment dealers and rental shops is showing a generally positive outlook for the U.S. construction equipment market in the next year.

“Optimism is at a twenty-year high,” says John Crum, head of the construction group at Wells Fargo, which conducts an annual forecast of equipment industry attitudes. The forecast’s Optimism Quotient [OQ] is its most prominent metric, tabulating how members of the equipment industry feel about the near-future of the business in their region.

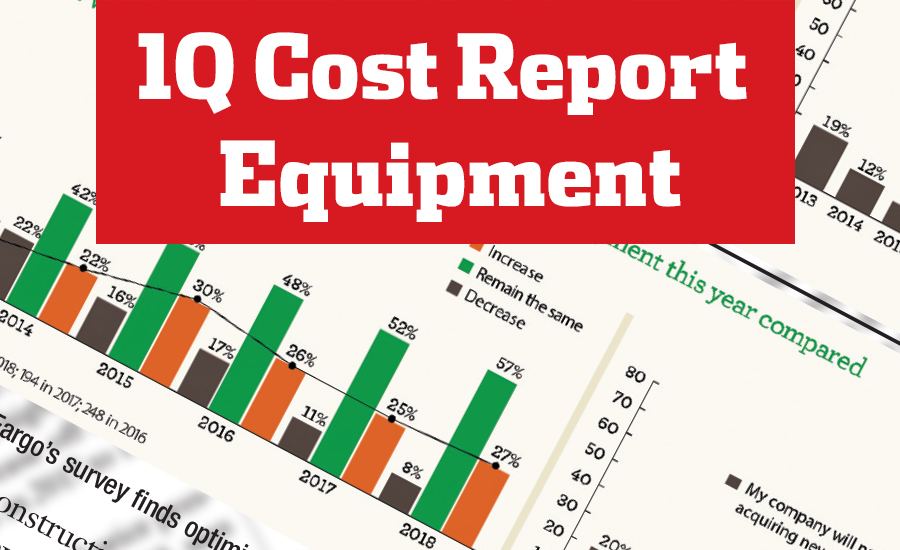

The survey asks respondents whether they think the next year of their local non-residential construction will be better or worse than the previous year. A reading over 100 is considered highly optimistic, and 2018 jumped to 133. It’s a far cry from the depths of the recession in 2009, when the Wells Fargo OQ was only 42.

“It’s been on an upward trend since bottoming out in 2009 during the recession,” explains Crum. “We saw a slight dip in 2016, but when looking at a normalized trend line, the number has been rising consistently since 2009.”

The positive outlook is driven not only by real growth in construction volume but by a few policy and regulatory changes. “From a contractor’s perspective, there was a sense when the survey was taken [at the end of 2017] that there was progress on tax reform, and a more favorable regulatory environment would get projects greenlit faster.” But the annual OQ only asks about the next year, and Crum says respondents did express long-term concerns about labor costs and finding enough skilled equipment operators.

But how does a positive outlook translate into pricing for heavy equipment? Sales of new construction equipment have been on an upward trend in recent years, but the rapid growth of rental has been eroding some of that acceleration.

“We ask contractors if [they] rent equipment, ask if rental is priced right and if the equipment is meeting their needs,” explains Crum. “One thing they tell us is that if rental prices were to move up 5% to 15%, a large number of contractors would just consider buying that equipment outright.”

Equipment distributors and rental companies reported growth in rental volume in the Wells Fargo survey, with a confidence rise from a slight dip in 2017. But despite the recent jump, half of respondents reported that they expected their overall fleet sizes to remain unchanged in the coming year, with the rest planning to augment their fleets through rentals.

But despite signs that firms are looking to rentals to keep up with construction activity, Crum says that the survey found contractors are still keeping a close eye on rental prices. “Right now rental prices are in line with what they expect, sitting at that equilibrium point where price is right,” he says.

While there is room for a slight increase in rental prices, competition among rental yards and worries about contractors deciding it would be cheaper to buy will likely keep a lid on prices for the near future at least, Crum concludes. “What we expect from the rental industry is they will increase the size of rental fleets, as they’re saying demand for rental will continue to grow. But as a result, there probably won’t be a significant ability to put higher prices out there.”

Post a comment to this article

Report Abusive Comment