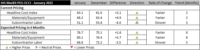

Lumber prices continued to rise through the first quarter of 2018, coming off last year’s strong finish. The ENR 20-city average price for the most common varieties of 2x4 lumber is up 10.4% over the year-ago period, while IHS Markit’s most recent forecast predicts a 4.5% increase for softwood lumber in 2018. That price hike is a marked shift from the industry forecaster’s outlook released in the fourth quarter of 2017, which called for a 1.8% decrease in lumber after a double-digit spike last year.

“Lumber continues to surprise me [with] the continued price climb,” says IHS Markit economist Thomas McCartin, who attributes this largely to the downturn in the Canadian lumber supply coming into the U.S. At the end of last year, the U.S. Commerce Dept. put in place a new tariff on Canadian lumber coming into the U.S., at a rate of 20.83% for the majority of importing companies.

“Supply constraints in British Columbia such as wildfires have held back the Canadian logging industry,” he says, adding that “countervailing and antidumping duties have increased the price of imports from Canada, which, as a result, reduced the quantity of imports.” McCartin also cites increased residential construction for the boost in lumber costs. Single-family housing starts increased nearly 9% in 2017.

Cement “continues to be unsurprising,” McCartin says. “It is following a rather steady path of price increases, and producers have been able to maintain healthy margins.” According to ENR’s 20-city average, cement prices showed a modest 1.1% increase over the year-ago period. The IHS Markit forecast shows slightly higher gains through 2021, beginning with a 4% increase in 2018.

Large Projects Drive Growth

The ENR 20-city average for steel increased 3.3% over the past year, but prices are expected to increase in 2018 due to new tariffs to be enacted later this month by the Trump administration on imported steel and aluminum. Canada and Mexico have temporary exemptions, and on March 22 it was announced that the European Union, Australia, Argentina, Brazil and South Korea have also been granted exemptions (see p. 49). IHS Markit forecasts spikes in several steel products in 2018, including a 23% increase in concrete rebar prices.

Construction starts in January and February are slightly below last year’s numbers overall, says Robert Murray, chief economist at Dodge Data & Analytics. Still, construction is expected to remain relatively robust in 2018 before a possible downturn next year. Murray cites several large upcoming projects, such as a $1.3-billion football stadium in Las Vegas for the soon-to-relocate Oakland Raiders and the $545-million Gateway Express highway project in Tampa, as construction growth catalysts in 2018.

“The Federal Reserve is tightening monetary policy, and concerns about inflation by the financial markets have contributed to rising long-term interest rates, with the 10-year Treasury note reaching 2.9% in March,” says Murray. “The prospect of an infrastructure program getting passed by Congress this year remains uncertain, against the backdrop of a growing federal budget deficit.” Still, Murray notes, a short-term lift from tax reform could “benefit commercial building and manufacturing construction projects, while funding from recent bond measures will support such institutional project types as school construction.”

On the labor side, the U.S. Bureau of Labor Statistics reports the addition of 40,000 construction workers in January and 61,000 workers in February. McCartin called the numbers “surprising,” in part due to the IHS Markit forecast calling “for a steady pickup in construction wages in line with a tightening labor market.”

ENR’s 20-city average posted 2.8% and 2.6% increases, respectively, in common wages, which applies to nonunion labor, and skilled wages, which is based on union workers, compared with the same time last year. The Construction Labor Research Council, which tracks North American organized labor collective-bargaining settlements, reported similar numbers last year. It predicted that union wages would rise 2.7% overall in 2018, following a 2.6% increase in 2017.

Post a comment to this article

Report Abusive Comment