Hurricane Harvey’s immediate impact on the construction sector will be a disruption in the supply chain for key materials, along with scheduling problems for projects that were under construction. As the cleanup and eventual rebuilding proceed, increased demand for materials and labor will push costs upward and contractors will be scrambling to secure supplies and workers.

“Based on our experience with Katrina and Sandy, we know that rebuilding requires several years to gear up, so we expect Harvey to start to influence construction starts in the region during 2018-19 time frame after the immediate damage is dealt with,” says Robert Murray, chief economist for Dodge Data & Analytics.

Before the storm hit, Texas had already generated $83 billion in new construction starts through July, slightly above last year’s pace, according to Dodge. Houston was a particular hot-spot with Dodge reporting 26 projects, valued at over $25 million, starting since last January. Some of these projects are quite large, including: a $3-billion liquefied natural gas export facility; an $850-million tollway; a $390-million refinery; and a $385-million polyethylene plant, says Dodge.

“Harvey will further tighten an already tight labor market, which had a 4.9% unemployment rate in July,” says Emily Crowley, labor economist with Global Insight, Washington, D.C. The initial push will come in trades such as flooring and drywall, followed by demand for higher skilled trades, such as electricians and ironworkers, she says. “Look for a strong boost in overtime,” Crowley adds.

However, these higher wages may take several years to unfold, Crowley says. “Using Katrina as a benchmark, the storm hit in 2005 but it was not until 2007 that we started to measure a 10% increase in wages for carpenters in the storm area,” she says.

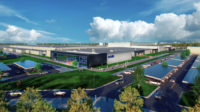

Most Steel Passes Through Port of Houston

While the general media is focusing on petrochemical and gasoline prices, contractors may have an additional concern. The port of Houston is the largest importer of steel products into the country and the combination of a disruption of imports, lost inventory, and increased demand from rebuilding could check steel prices, which were weakening before the storm, says John Anton, steel analyst for Global Insight. “Steel prices had been sliding, but after Harvey we expect prices to flatten out. Any risk to this forecast is now on the upside,” Anton says.

Harvey did hit petrochemicals hard but most of those have an indirect impact on construction costs, the exceptions being diesel fuel, gasoline, PVC feedstock and natural gas, which is a major energy input for materials such as cement.

“At least 70% of total U.S. capacity for PVC feedstock is either confirmed offline or has the potential to be impacted as a result of Harvey,” says Ted Semesnyei, a Global Insight economist. That number runs as high as 90% for resins used in other plastic products, he adds.

Natural gas prices did spike after Harvey but is expected to fall off, since the reliance on Gulf Coast natural gas has fallen in recent years. The same holds for gasoline prices. So, the two Harvey-related cost items people feared most may be the least of contractors worries.

Post a comment to this article

Report Abusive Comment