As the U.S. power industry evolves toward cleaner energy sources, the construction industry is following the trend by diversifying into new markets and, in some cases, getting out of traditional ones.

San Francisco-based Swinerton Builders started looking for opportunities in the solar EPC business after the 2008 recession, when its traditional construction business declined. What started as a business to build distributed solar generation projects at client-owned locations has become, starting in 2010, a business that builds large-scale solar projects for utilities—and the market continues to grow.

|

|

“In January 2016, we reached our first gigawatt of solar construction. By January 2017, we will reach our second gigawatt,” says George Hershman, senior vice president and general manager at Swinerton Renewable Energy.

Swinerton is bullish on the solar market based on the passage of a long-term federal investment tax credit for renewable projects and the expectation that solar prices will continue to fall. Prices are expected to drop to $1 per watt in 2017 from approximately $1.20 per watt in 2016, two years earlier than expected.

“Ultimately, renewables are a low-cost form of energy generation and a path forward to a changing power grid. This is the traditional power market my kids will know,” Hershman said.

Babcock & Wilcox Enterprises Inc. has seen its traditional coal construction business in the U.S. come to a halt. There are projects internationally, but none in the U.S., says Jimmy Morgan, senior vice president of operations and construction. Gas-fired generation is the fastest-growing market due to its low fuel cost. While B&W will diversify, it will not build gas-fired units, Morgan says. However, it will be a player in the gas-fired market through a company it bought earlier this year: SPIG, based in Arona, Italy.

Coal-fired units are being retired, with a few being converted to gas-fired units or dual-fuel units. “But coal generation is not totally going away tomorrow,” Morgan notes. While retirements will continue, a big part of B&W’s business will be to maintain the plants that are still operating.

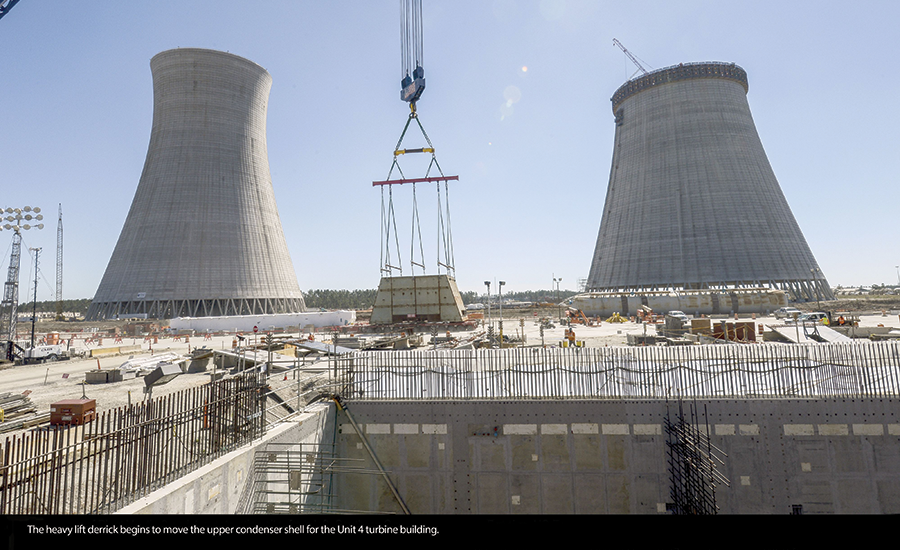

Fluor Corp. is completing the only large-scale nuclear-power projects in the U.S.: Southern Co.’s two AP1000 units at Plant Vogtle in Georgia and SCANA-Santee Cooper’s expansion of its V.C. Summer nuclear plant in South Carolina. While the industry is watching the cost and schedule of each unit, construction of more traditional nuclear plants, especially in unregulated markets, remains questionable as long as natural-gas prices stay low. “It’s all driven by economics,” says David Williams, vice president of sales.

Fluor is moving into the small modular nuclear reactor (SMR) business and will file an application by the end of the year with the Nuclear Regulatory Commission for the construction of up to 12 of the 50-MW units for Utah Associated Municipal Power. “We are focused on the SMR. It’s a matter of when the market takes off, not if,” Williams says. Natural-gas technology is evolving, he notes. Units are larger, more efficient and have faster ramp-up times, Williams says.

“I don’t think we will see a major change in the use of natural gas through 2025 to 2030,” he says.

Post a comment to this article

Report Abusive Comment