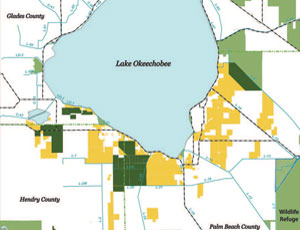

Bowing to the realities of a severely weakened economy and a ballooning budget deficit, the state of Florida has drastically revised its proposed purchase of agricultural land in the Everglades Agricultural Area south of Lake Okeechobee.

The state’s goal continues to be “to connect Lake Okeechobee with Florida Bay and restore the natural flow” of water that created and sustained the vast Everglades ecosystem for thousands of years, said Gov. Charlie Crist (R) on April 1 in announcing the revised approach. In pursuit of that goal, Crist last June had announced that the state had reached an agreement with United States Sugar Corp., Clewiston, Fla., for Florida to buy the agribusiness’ assets and 187,000 acres of land for $1.75 billion.

That plan subsequently was scaled down to acquire 180,000 acres of real estate only, at a cost of $1.34 billion. The boards of the South Florida Water Management District and U.S. Sugar both approved the deal in December. Under the plan announced April 1, the state still intends to acquire the entire 180,000 acres, but in two phases over as much as 10 years.

In the first phase, U.S. Sugar will sell 72,500 acres to the state for $533 million. “This represents the largest single purchase of land in Florida history by Florida,” Crist said, emphasizing that, even in its reduced scope, the purchase is twice the size of Orlando, but at a cost 60% less than the original proposal. The revised agreement gives the state a 10-year option, with right of first refusal, to purchase the remaining 107,500 acres of the U.S. Sugar land. Ten years will be “more than enough time for the economy to turn around” and allow the state “to complete the plan,” Crist said.

The revised plan meets the objections of critics who said the original purchase would overwhelm the South Florida Water Management District financially and severely disrupt the economy while throwing more than 1,000 U.S. Sugar employees out of work. “I am very confident that this is a deal the Water Management District can afford,” said Carol Wehle, the district’s executive director.

The extended time for concluding the purchase will give regional planners time to mitigate the economic effects of the purchase, said other state officials. Furthermore, plummeting property values, which have helped to create a $2.3-billion state budget deficit, could also make future acquisition of the land less costly.

The purchase also will not distract the state from its commitment to the Comprehensive Everglades Restoration Plan, the $10.9-billion program of joint federal and state projects to restore the region’s unique ecosystem, said Michael Sole, secretary of the Florida Dept. of Environmental Protection. “I think what were doing is we’re expanding on CERP, and we’re adding to it,” he said.

The revised deal could lead to resumption of construction on the Everglades Agricultural Area Reservoir A-1. SFWMD suspended construction of the $300-million, 22-mile embankment around the 25-sq-mile reservoir in May 2008, pending mediation of a lawsuit related to the project. Wehle has said that the reservoir might be repurposed to become a stormwater treatment area if the state’s purchase succeeded. On April 1, she said the SFWMD governing board would take up the reservoir issue in its next meeting. A joint venture of Bozeman, Mont.-based Barnard Construction Co. and Pasadena, Calif.-based Parsons Corp. have a master contract with SFWMD for construction of the reservoir.

Post a comment to this article

Report Abusive Comment