The U.S. electric-power industry is stuck in the middle of a messy transition to a competitive system and groping for clarity in business models and generation technologies, John Rowe told the Electric Power conference April 5 in Chicago.

"Were constantly experimenting in this country with mixed models of competition

and regulation," he said. "The big question now is, how will the next generation of powerplants be built?"

|

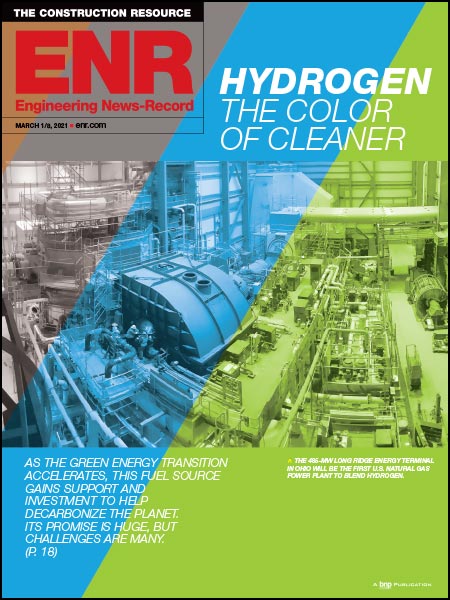

| Coals Cool But new technologies further improvements. (Photo courtesy of Bechtel Power Corp.) |

Chicago-based Exelon Corp.s chairman, president and CEO sees "three different models of how to do business, none of which seems to be working." In the Southeast, vertically integrated utilities operate with little retail competition and modest wholesale competition. Statewide integrated-resource systems such as Californias are another model, and systems elsewhere, with substantial wholesale competition and largely unused rights to retail competition, are a third. Questions remain about what kinds of generation must be built, when, who will build it, how it will be financed and under what kinds of regulation, he said.

Because of high natural-gas prices, the country needs "a large quantity of cleaner coal-fired plants and new nuclear plants .In both nuclear and coal, were experimenting with new technologies, but tentatively," Rowe said. Because of technological uncertainties, "We will continue to rely on gas peaking plants with some additional load management."

Advanced-coal technologies caught the attention of many attendees, who were told the systems need to be proven at large capacities. Malla Reddy, vice president of operations for Fluor Corp., Greenville, S.C., said 90 new coal-fired plants would be needed to replace aging ones if owners were to close them. Producing some 50,000 MW, they would cost $70 billion to $90 billion. Subcritical pulverized-coal is proven technology and supercritical and integrated-gasification combined-cycle may be options. But the last two are "basically unproven at the large size now contemplated," he said.

Hitachi Canada Ltd., Calgary, has just completed construction of Canadas first supercritical-pressure coal-fired boiler, the 495-MW Genessee Phase 3 project, Genessee, Alberta, for EPCOR Utilities Inc., Edmonton, and TransAlta Utilities Corp., Calgary. Supercritical technology has been employed in Japan since the 1960s, says Jody Acton, Hitachi senior manager, special projects. North American generators have been cautious about adopting it because of higher costs.

The 400-MW Springerville Unit 3 project, now under construction in Springerville, Ariz., is more typical of new coal-fired capacity, observers say. Bechtel Power Corp., Frederick, Md., is building the $939-million project as engineering, procurement and construction contractor for UniSource Energy Corp., Tucson, and Tri-State Generation and Transmission Association Inc., Denver. Its a subcritical PC plant that will use a full battery of best-available control technology for air emissions, including dry scrubbers, selective catalytic reduction, low-NOx burners and baghouses. Included are upgrades for scrubber systems and improved low-NOx burners at twin 380-MW Units 1 and 2.

Post a comment to this article

Report Abusive Comment