We tend to picture the software and information technology tools in the industry as coming from the superfarms–big software companies that sell planning and design programs, estimating, scheduling and project management tools, and back-office systems.

But there is a lot of kitchen-garden IT development going on which yields a crop of software and services that bears fruit continuously. Typically, these goods are nurtured and raised by firms in-house, or are developed by consultants or academics working to the specifications of construction and design firms, or in some cases, professional associations that represent them.

|

| (Illustration by Guy Lawrence for ENR) |

Some of the produce is in software and systems developed for project use, which may be conveyed at the end of a job as a deliverable. But sometimes creations are sold through IT divisions or spin-off companies as products in their own right.

"In any engineering company, there aren’t 100 but more like 1,000 bits of software that people develop," says Dave Harrison, manager of the IT services group for Montgomery Watson Harza, Broomfield, Colo. "Very few are professionally developed; maybe none are commercially viable, but it speaks to a company’s ability to innovate and think outside the box. We harness power for clients by creating decision-making tools."

Bechtel Group Inc., San Francisco, Calif., is a company that quietly does it all. "We develop lots of our own software. We have tailored application software, proprietary software, and we also have software that we sell," says George Belonogoff, general manager of Bechtel Software Inc., San Francisco, a Bechtel division started in 1987. It is not just a big-firm phenomenon. Scores of midsize and smaller firms create software and tools to meet construction industry needs, and many of them show up in the marketplace, too. Examples also include professional associations, such as the American Iron and Steel Institute, Washington, D.C., and the American Concrete Pavement Association, Skokie, Ill. The steel group commissioned development of programs to design short-span steel bridges, and other software of certain usefulness in the design of steel. The concrete crowd promotes similarly developed software to encourage designing for concrete. Distribution is handled through their respective Websites, at www.steel.org and www.pavement.com.

In each case the specifications were developed by practitioners in the industry. The creators are usually motivated by a desire to improve efficiency, gain competitive advantage, capitalize on strengths or meet unique needs. They justify the risks they run in developing products because their needs are not being met in the marketplace, and they reassure themselves with the prospect of recovering development costs through sales. But the risks can be substantial, Belonogoff cautions.

"Try to find it outside before you build your own," he says. "Especially for smaller firms, the cost of maintenance and support is very high. Technology is changing rapidly, standards and platforms are evolving, and unless you have a critical mass I don't think you can keep up with it. Competition is keen and it is coming from everywhere.

"The thing is the staying power: Can you maintain that software on different platforms under different standards as time marches on?" he asks.

|

| EARLY ADOPTER Bechtel developed its 3-D tool in the 70s. (Photo courtesy of Bechtel Software Inc.) |

Bechtel has been creating software since the 1960s when the tools it needed to design nuclear powerplants simply didn't exist. Belonogoff says it developed a 3-D modeling program for the work in the 1970s called 3DM. He says Bechtel's mechanical engineering program, ME101, which it began licensing in the 1980s, is one of the success stories of the industry. "A lot of analysis programs don't change much. What changes is the front-end interface and the connectivity with other programs," he adds.

Bechtel's products are for the petrochemical and power industry, civil infrastructure, pipelines and mining and telecommunications, and although many of its tools are only licensed to clients, it still has products for every sector it works in for sale. "Bechtel Software really does not advertise. Our clients just talk to other clients," Belonogoff says.

An example is SETROUTE, which keeps track of cables and electrical circuits in power, chemical and industrial plants. "We've licensed it to shipyards in Louisiana and they're using it to manage the cables and systems on ships. You may have 20,000 cables in a powerplant, but there are an amazing number of cables in a ship–maybe even more than powerplants." Another force driving outside sales of Bechtel's technology is the need to collaborate on international joint ventures. "We make sure it has been successfully used on Bechtel projects first. It's not the newest, it's just bulletproof," Belonogoff says.

A listing is at www.bechtelsoftware.com, but don't expect a fancy Website. "Customers complained the site was slow to load. They said 'just tell us what it does,' so we got rid of all the graphics," says Belonogoff.

Also commercializing an in-house product is Walt Disney Imagineering, Anaheim, Calif. The product, a 4-D Visualization tool that has been in development for about 5 years, has been developed in association with researchers at Stanford University's Center for Integrated Facility Engineering (ENR 1/1-8/96 p. 32). The purpose of the tool is to apply the element of time–a construction schedule–to 3-D models and fine-tune sequencing. It has been tested on several major projects and is planned for release in September.

The software is focused on the point of product delivery, says Chris Holm, a senior technical staff member with WDI. "It has to be on the point where the contractor is committing resources, as well as something that would leverage the data that we were already very good at creating. Disney has lots of CAD geometry and lots of schedules, and we always require a lot of detail from the contractor about his construction processes," Holm says.

CIFE's director, Martin Fischer, says that while other 4-D software is being sold, the Disney 4-D visualization tool is adept at accepting cad files in many formats and allowing adjustments to the model itself, without having to go back to the source cad files and regenerate every time you want to run a "what-if" scenario.

|

| (Illustration by Guy Lawrence for ENR) |

Another firm taking IT to market is J.A. Jones, Charlotte, N.C., which has launched a spin-off to capitalize on its construction expertise. Jones started Virtual ESI last June as a systems integrator capable of putting a construction face on general industry-standard management software from J.D. Edwards. Virtual ESI hosts company Websites and handles software implementation services. "Most of the companies that produce software don't really have the industry expertise," says Kevin Kochanski, assistant vice president for business development. As an application service provider, ESI integrates front-end estimating, scheduling and project management software with back-end enterprise software. The customer needs "minimal up-front capital," he says.

HNTB Architects, Engineers and Planners, Kansas City, Mo. has also found good reasons to develop in house tools. Agnes Otto, an HNTB associate vice president and director of technology initiatives, says her firm has two sets of products: tools it sells, and tools it holds for strategic advantage. "None of this stuff is that profitable. Our decision has been made on operating more competitively in an extremely competitive environment."

HNTB's construction information management system and the collaboration products are designed to help owners. "InterXchange is a Web collaboration and project communication tool. It connects all the players–HNTB, subs, clients, even key public figures who are particularly interested in the project. The other tool, CIMS, is a construction information management system designed to protect the owners' interests and assets. It is used by construction inspectors to log all action happening on a site on a daily basis, whether it's people, materials or activities. And it also has handheld capabilities, which has been a huge productivity tool. They do their inspections, go home, sync-up, maybe add a few bullet points, but it is basically done," Otto says.

However, other company-produced software, such as a bridge design program, is deemed part of the HNTB's competitive edge, and is not sold, Otto says. Liability concerns also come into play, she says, because complex design software "has to be used properly."

Development on the tools HNTB sells began about 1995. "We were looking for a way to use the Web. We were spending a lot of money on licenses, and a lot of money on customization," Otto says. "We said, 'This is a pretty simple tool, we can do that,' so we did."

Otto says the firm's construction package is unusual because "we saw some things in the marketplace, but they were targeted for contractors. HNTB is an owner's agent. We were looking on the inspection side, safeguarding the owner's interest."

Another area in which HNTB is taking its it expertise to market is in selling 3-D visualization and Web design services for government clients putting together large projects. It has eight massive bridge sites and is getting ready to launch its first live Webcam on a bridge in Greenville, Miss. "Multimedia is somewhere we have had huge success in the public involvement arena. As the public has more access to the Internet, it may be more valid than the town hall forum," says Otto, "so we've developed tools for content management on public involvement sites."

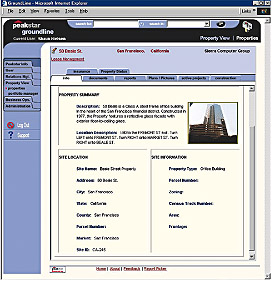

But the pace of information technology development is rapid, and meeting under-served needs is a moving target. Other tools for owners born out of the industry are proliferating. An example is PeakStar, from a Mill Valley, Calif., company of the same name. The product began as an in-house design-firm project that was dropped as being too expensive. The consultant on the work, Tom Clark, a former contractor and engineer, found outside financing to go it alone and is gradually rolling it out now.

|

| OWNERS' SERVICE PeakStar is a property-centric data management system. (Graphic courtesy of Peakstar) |

PeakStar takes a cue from customer relationship database systems, which use the premise that all commercial activity revolves around customers, so if you center your data there all activity will be reflected. PeakStar is property-centric and focuses on property records, investigation, construction, leases, capital improvement and budgeting. Clark says getting the center of data right is key.

Similarly, at Montgomery Watson Harza, Harrison says the company is combining its industry knowledge to create combination packages such as mWizard, a system for retrieving database information from the field, which has been in development for about 14 months. "This sprang out of an idea a couple of field guys had," he says. The technology transfers construction and inspection data to field crews for locating pipe and other tasks, using a GPS component to sync data to location.

Harrison says that while competing products are coming out, the firm is still offering mWizard to clients. "We wanted to prove we could develop and produce something," he says. "The value is so easy to pitch to a client. It can save field guys a lot of time rummaging around for drawings, material safety data sheets and other documents. If you can save 5% of that time, this thing pays for itself."

Pete R. Perciavalle, director of operations for InfoStructures, the MWH unit that offers its IT products, says the product is a differentiator for the firm and has applications for any utilities with distributed assets.

MHW is also offering electronic "manuals" for operations and maintenance. Perciavalle notes there are many competitors, "but we've found a way to put these together cost-effectively." He says the firm has sold about $5 million in electronic O&M manuals this year alone, primarily to water and wastewater utilities, but it is also marketing to other public owners such as school districts.

One of the biggest challenges for "intrapreneurs" like Harrison and Perciavalle is to convince their own colleagues to use or specify a homegrown technology, says Perciavalle. "In an entrepreneurial company there's always someone who thinks they can do it better."

Post a comment to this article

Report Abusive Comment