Caterpillar inc Starting Line. Recruiters hit drag races to look for aspiring mechanics.

|

Attracting young men and women into construction will keep getting tougher: Government estimates put at least 1.8 million new skilled-trade workers in the field through 2014, and 61% will be needed just to replace retirees. Desperate for warm bodies to fill the gap, employers are trying new tactics—some mundane, some flashy—to lure candidates with mechanical skills.

A microcosm of this far-reaching labor problem stands out among equipment mechanics and diesel technicians, a hands-on field with 400,000 workers, yet contractors and dealers complain every year that they still need more. This shortage is having a profound impact on the bottom line, especially as the machines needing repair become more complex.

|

“With the shortage of technicians, it forces you to buy newer equipment,” says Thad Pirtle, vice president of equipment for Evansville, Ind.-based Traylor Bros. Inc. “Instead of running a machine for 10 years, we may have to run it for five years if we don’t have the technical capability in-house to maintain that machine. So you are reliant more on the manufacturer warranty and dealer technicians.” Operator shortages are also forcing manufacturers to make machines easier, safer and more comfortable to run.

Contractors have to compete against dealers for the same pool. Dealers are at a slight advantage, contractors say, because those jobs are more local. But the mechanic shortage has forced everyone to slim down. For example, small tasks like oil changes are left more to project superintendents, while technicians focus on broader issues like oil analysis and long-term maintenance issues.

The cost on the top line is becoming more evident, too. For dealers, an unfilled mechanic’s position can cost $150,000 a year in lost revenue, according to Oak Brook, Ill.-based Associated Equipment Distributors. Today, dealers need at least 4,875 of those positions filled. Another factor is the constant churn of labor. AED surveyed 116 heavy-equipment dealers last year and found that nearly 35% of their new employees came from competitors.

Employers are attacking the problem from multiple angles. Traditional efforts continue full-bore and more union locals are starting to offer college credits for training in conjunction with community colleges. The Association of Equipment Management Professionals this year started up a new scholarship fund to place aspiring mechanics in two-year colleges. A Caterpillar dealer in Wisconsin teamed up with a tech school to build its own training center for entry-level recruits, who are guaranteed a job near home and a set of tools when they exit the program.

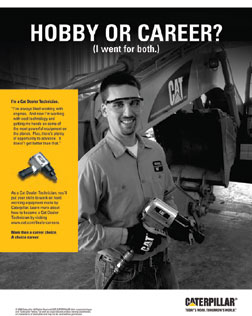

There also are flashier routes. Caterpillar Inc. just launched a national image campaign to help infuse dealers with young blood. The Peoria-Ill.-based company is advertising on Websites like YouTube to lure young adults that normally pass over jobs in heavy equipment. The barriers are tall, says Edward E. Gordon, a labor author and president of Chicago-based Imperial Consulting Corp.: “You have to overcome the cultural bias…where everyone needs an MBA.”

Cat is also sponsoring a car at National Hot Rod Association drag races. So far, those events have proven to be “a technician-rich environment,” says Todd Goins, senior marketing manager. Over Labor Day weekend in Indianapolis, recruiters talked to 1,513 potential mechanics. Of them, 738 panned out to be positive leads for an interview.

Related Links:

Related Links:

Post a comment to this article

Report Abusive Comment