Dave Markey likes to approach jobsite security the same way he negotiates a big equipment purchase. In every sale, both sides play tug-of-war to shift the risk and they attempt to meet somewhere in the middle. Likewise, theft is a kind of cruel game between property owners and pilferers. "If we make it easy for thieves, then we are taking all the risk," Markey says.

The 59-year-old vice president of American Infrastructure, Worcester, Pa., is in charge of a $130-million fleet of trucks, trailers, off-road machines, portable equipment and small tools. Markey doesnt like to talk too much about the perennial problem of jobsite theft, for fear that unfriendly souls are listening. But he says the firms strategies are getting tougher all the time.

Poor physical security of construction machinery, trailered equipment and small tools on the jobsite and in the yard is one of the leading reasons for loss. According to law enforcement and crime experts, the exact cost of theft in construction is unknown because not all incidents are reported. Also, the Federal Bureau of Investigation, which compiles annual crime reports, does not distinguish construction machines from other types of commercial vehicles.

But varied analysis of what little data is available shows that construction equipment theft costs at least $1 billion each year in the U.S., translating into higher costs for insurers, builders and project owners. "Contractors are going to lose a lot of equipment unless they have good inventory control," says Earl Gunnerson, executive director of the Crime Prevention Program of Southern California, Cerritos.

|

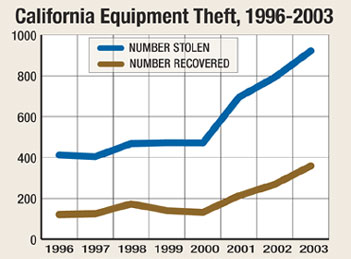

| Source: Crime Prevention Program of Southern California, California Highway Patrol |

Increasing reports of jobsite theft, particularly in the Southwest, and more awareness of the problem nationwide is forcing large and small fleet owners to crack down on losses (see chart). Gunnerson, a retired sheriff, helps equipment owners label their machines with $90 die stamps and police stickers that discourage would-be thieves from driving backhoes off a jobsite or hitching up trailer-mounted generators to pickup trucks and speeding away.

Similar nonprofit programs exist in a few other states and in Canada, but these efforts largely are unorganized in the rest of North America. "Theft does seem to be getting worse," says David Shillingford, president of National Equipment Register, a recovery-database service in New York City. "It is easy for thieves to steal equipment," he adds.

In many cases, equipment theft is a factor of time and property owners have only 15 seconds to guard themselves. According to security experts, that is how long it takes an experienced thief to make a score.

Theft deterrents come with no guarantees, but widening that brief window of time can greatly reduce the risk of loss. Security guards, chains and ignition cutoff switches are still common methods. "If you start to think like a thief make them work for it," says Markey. Doing so can lower insurance premiums for policies that offer crime-prevention rebates.

Shared Risk

It is no secret that most off-road construction machines share a common key. The convenience is a blessing and a curse for the construction industry. Operators can "only have so many keys" before they manage to lose them, says Pete Spear, fleet administrator for James McHugh Construction Co., Chicago. Trades working side by side can share rented machines without the hassle of keeping tabs on keys.

|  |

| Vulnerable. Equipment operators like the convenience of universal keys, such as $50 sets available from dealers (left). New control lockouts eliminate the obvious security loophole (right). (Photo left by Tudor Hampton for enr; right by Guy Lawrence for ENR) | |

In order to illustrate just how easy it is for anyone to gain access to construction machinery, ENR searched an Internet auction site for "equipment keys." Approximately one dozen hits came up, and we were the winning bidder on a set of 14 keys advertised as fitting "most popular types of heavy equipment." The auction closed at $50 plus shipping and the keys arrived a week later with detailed labels.

|

| (Photo by Nancy Soulliard for ENR) |

The dealer that auctioned the keys, CLM Equipment Co. Inc., Lafayette, La., sells 30 to 50 sets a month online and over the counter, according to Jason Jarrett, parts manager. "If you tell us what machine you have, we pretty much have [the keys] already made," he says.

Contractors acknowledge the problem of universal keys, but they tend to dismiss it with an air of futility: "A key only keeps an honest person at bay," says Markey.

Technology is helping some contractors overcome the security loophole. Equipment manufacturers, such as Caterpillar Inc., Peoria, Ill., now are offering optional electronic keys. The cut still is universal, but a tiny transponder inside the key triggers a receiver mounted on the vehicle. If the key is not programmed for use on that machine, the ignition will not start. Many passenger car manufacturers are using similar keys, which typically cost $100 or more to replace.

Theft in Europe is even more problematic than in the U.S., according to security experts. Technology firms have sold electronic keys in the European aftermarket...

Post a comment to this article

Report Abusive Comment