It is said that the trick to riding a tiger is finding a way to dismount. The U.S. construction market has provided contractors with a wild ride over the past eight years. For most of 2001, the industry was bracing for a major recession. But overall, the market did not meet those dismal expectations. Some segments are off significantly, but others are holding steady, or even showing modest growth. Many contractors now are guardedly optimistic that they will be able to manage a soft landing as the recession ends.

|

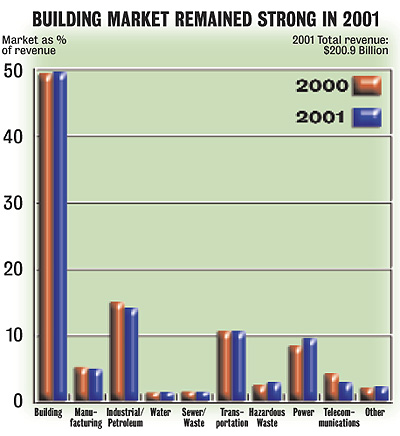

Overall, construction revenue for ENR's Top 400 Contractors rose 3.2% in 2001 to $200.93 billion from 2000's $194.63-billion mark. And like 2000, the U.S. market led the way, rising 5.7% in 2001 to $178.9 billion. On the international side, the Top 400 struggled again, suffering a double-digit decline in revenue for a second straight year. The total fell 13.4% in 2001 to $22.03 billion.

Many contractors believe that it will be a struggle to keep contracting revenue at 2001 levels. But few see the recession spiraling out of control. "Everyone is trying to read the tea leaves," says Kenneth A. Isaacs, president of Graycor. "The economic forecasting wizards make the point that the market hasn't changed much. Only that growth has slowed."

The consolidation in the industry is continuing apace, despite the unsettled market. "We are continuing the same strategy, looking for bolt-on acquisitions to supplement our existing businesses," says Stuart Graham, CEO of Skanska USA. He says that Skanska has nothing to announce in the immediate future, "but we are continuing to look for companies with specific geographic or market specialties."

Jacobs has worked hard to balance its markets through acquisitions. In a little over a year, it completed its acquisition of Netherlands-based Stork NV, U.K.-based GIBB from LawGIBB Group, Atlanta, and most recently, Canadian Delta Catalytic from J. Ray McDermott. But the most significant purchase was Sverdrup, says Tom Hammond, Jacobs' executive vice president. "It's now been three-and-a-half years since the Sverdrup acquisition and we are extremely pleased with how it turned out. It gave us an entry into government markets and a balance between the public and private markets," he says. "And through an exchange of best practices, it made us both better."

Many other firms have pushed to diversify their markets to guard against downturns, and Turner Corp. is no exception. "We fought our way into the healthcare market and we fought our way into the edu-cation market," says Robert E. Fee, Turner's president. The firm now plans to expand into the Carolinas, where its presence is weak, he says. Turner also is moving into the facilities services market and is looking to acquire a major rigging firm to supplement its existing in-house capacity. In addition, it is considering adding process piping capacity and even acquiring a design firm, Fee says.

But Fee says that Turner also is making internal changes. The firm had always treated markets geographically. "But we are breaking down our larger offices along market segments," he explains. Fee says that the firm now has created "matrix/market" segments for airports, sports and pharmaceuticals and is setting up segments for healthcare, justice facilities, education, high-tech and interiors. "We are beginning to look like a very different firm, but all these moves are in service of our core business," he says.

Some companies experienced more subtle changes. In April, Michael McCarthy stepped down as chairman of McCarthy Building Co., selling most of his shares in the company. "For 138 years, McCarthy had been a family-owned company," says President Mike Hurst. "Now it is an employee-owned company. It's the end of an era, but the beginning of a new one."

One firm that is anticipating a major change is J.A. Jones. With the bankruptcy of its corporate parent, German contractor Philipp Holzmann, Jones has been taking great pains to demonstrate that it is not involved in the parent's financial problems. "We are up for sale and are moving forward quite nicely," says Al Neffgen, Jones' CEO. "We have been very fortunate with our people. We have not lost a single officer or senior manager and clients seem to be comfortable about the situation."

DIMMER SWITCH. The power market has been on a roll recently, but there has been a noticeable cooling. TIC Holdings Inc. had a strong year in the power market "but we anticipate a leveling off," says Paul Compton, senior manager of business development. Much of that is from a pull-back by independent power producers. "The banks are taking a much harder look at IPPs now," but projects for regulated utilities and for IPPs with firm power agreements still are providing opportunities, he says.

There has been a lot of building in the past two years, but Graycor's Isaacs says overbuilding is not the problem. "We've had a couple years of mild weather, and that has taken some of the pressure off," he says. Isaacs attributes much of the slowdown to Enron's financial problems, which have made financing new power capacity difficult. "And a lot of companies are looking over their shoulders to make sure their books look right," he says.

One firm that now is making its mark in the power sector is AEP Pro Serv. A subsidiary of energy giant American Electric Power, Pro Serv is the result of a reorganization in 2000 that consolidated AEP's engineering, construction, operations and maintenance groups. "We are the successor to the group that built most of AEP's capacity," says John Jones, Pro Serv's president. "But we have kept a low profile for the past couple years because we had to ensure we were competitive in both the internal and external markets."

Pro Serv has ridden the wave in building generating plants for independent power producers. "There was a big rush to build, but reserve margins have risen to 20% in many areas of the country," Jones notes. However, that doesn't mean that the market has dried up. "Not much has really been spent on transmission, so there are areas of the country where new capacity will be needed," he says.

Generation isn't the only power market for contractors. Emission controls "seemed to be deferred while the power companies tried to read the tea leaves of regulatory developments," says Isaacs. "Now the companies feel they are under the gun to limit emissions." AEP Pro Serv also is finding potential in the emissions reduction market. "We have a backlog on [nitrogen oxide] emissions reductions of about $1 billion, and are winning about $500 million a year in new work," says Jones.

In the oil and gas market, change is bubbling to the surface. For years, oil prices have been so low that producers were discouraged from making capital investments. But much of this glut has dissipated, resulting in a major increase in upstream petroleum work, says Khalid Farid, executive vice president of ABB Lummus Global.

Further, the consolidation among the major oil companies, which caused the deferral of many major projects, is finished for now, releasing some of the deferred capital for new projects. Farid is fairly confident of an upturn in the petroleum market. "The economies in the U.S. and Asia seem to be improving, and as they do, so do the prospects of our customers," he says.

The U.S. oil market is not robust, but it is active. "The market is driven primarily by clean fuels compliance," says Jacobs' Hammond. He has seen a major increase in contracts over the last year and a half. "Most of the work is for low-sulphur gasoline," says Hammond, but he hasn't seen much low-sulphur diesel work yet. "That may be a couple years away," Hammond speculates.

One firm that has done well in a hot fuels niche is Tellepsen. The U.S. Dept. of Transportation's pipeline integrity program has provided a big boost to the firm's gas pipeline maintenance and repair operations. "There's enough work in our niche to keep us busy for the next five years," says Howard Tellepsen, CEO. The firm also has enjoyed a bounty from the boom in new gas-fired powerplants, installing lateral lines off the main gas lines to supply the new plants, Tellepsen notes.

|

THE 2002 TOP 400 AT A GLANCE

|

||||||

|

VOLUME

|

||||||

|

DOMESTIC

|

INTL

|

TOTAL

|

||||

|

$BIL.

|

%CHG.

|

$BIL.

|

%CHG.

|

$BIL.

|

%CHG..

|

|

| REVENUE |

178.9

|

+5.7

|

22.0

|

-13.4

|

200.9

|

+3.2

|

| NEW CONTRACTS |

191.6

|

+0.1

|

22.8

|

-16.5

|

214.4

|

-2.0

|

|

PROFITABILITY

|

||||||

|

|

NUMBER OF FIRMS REPORTING

|

AVERAGE % OF

|

||||

|

PROFIT

|

LOSS

|

PROFIT

|

LOSS

|

|||

| DOMESTIC |

361

|

13

|

3.3

|

NA

|

||

| INTL |

61

|

18

|

5.4

|

NA

|

||

|

PROFESSIONAL STAFF

|

||||||

|

NUMBER OF FIRMS REPORTING

|

AVERAGE % OF

|

|||||

|

DOMESTIC

|

INTL.

|

DOMESTIC

|

INTL.

|

|||

| INCREASE |

175

|

21

|

11.9

|

17.5

|

||

| DECREASE |

48

|

11

|

13.4

|

29.5

|

||

| SAME |

158

|

56

|

NA

|

NA

|

||

|

BACKLOG

|

||||||

|

NUMBER OF FIRMS REPORTING

|

AVERAGE % OF

|

|||||

| HIGHER | 188 |

39.0

|

||||

| LOWER | 111 |

19.8

|

||||

| SAME | 80 |

NA

|

||||

PROCESSING IS SLOW. The industrial process market is a mixed bag. "On one side, you have pharmaceuticals and some chemicals holding up fairly well," says Hurst of McCarthy. "But on the heavy side, including automotive, steel and metals, the market has really slowed down." Hurst says that this means the projects have been getting smaller. "We used to chase $30-million projects, but now are taking $2- to $3-million jobs," he says.

|

MARKET ANALYSIS

|

||

| TYPE OF WORK | REVENUE $MIL. |

PERCENT OF TOTAL |

| BUILDING | 99,420.20 | 49.5 |

| MANUFACTURING | 10,091.00 | 5.0 |

| INDUSTRIAL | 10,969.80 | 5.5 |

| PETROLEUM | 17,444.70 | 8.7 |

| WATER | 2,807.70 | 1.4 |

| SEWER/WASTE | 3,047.20 | 1.5 |

| TRANSPORTATION | 21,356.80 | 10.6 |

| HAZARDOUS WASTE | 5,899.10 | 2.9 |

| POWER | 19,346.60 | 9.6 |

| TELECOMMUNICATIONS | 5,884.50 | 2.9 |

| OTHER | 4,663.20 | 2.3 |

On the chemical side, "bulk chemicals and petrochemicals are as slow as I've seen in a long time," says Hammond. The last up cycle was from 1995 to 1998, and he doesn't see another big upswing in the near future. "There is a tendency for these markets to follow consumer demand, and physical consumption has not been growing recently," he says.

"Steel is as close to dormant as I've ever seen," Graycor's Isaacs points out. Part of the problem relates to financial troubles among major steel producers. "Those in Chapter 11 can't build, those that have come out of Chapter 11 are focusing on production and those that are financially healthy are sticking to their knitting," he says. "I don't expect any recovery in the market in the next 6 to 12 months."

Emissions reduction work also is growing on the industrial side. "The industrial marketplace will be facing the same environmental constraints as power–that's the next big market," says Jones. He notes that the industrial side has been lagging behind the power industry in emissions controls, but that it is only a matter of time before regulations catch up. "We've been through so many technologies on the power side that it is only natural to transfer this expertise to the industrial side," he says.

|

INTERNATIONAL REGIONS

|

|||

|

NUMBER

OF FIRMS |

REVENUE

$MIL. |

PERCENT

OF TOTAL |

|

| CANADA | 38 | 5,267.40 | 23.9 |

| LATIN AMERICA | 44 | 2,889.00 | 13.1 |

| CARIBBEAN ISLANDS | 34 | 1,232.20 | 5.6 |

| EUROPE | 34 | 5,544.20 | 25.2 |

| MIDDLE EAST | 27 | 1,474.50 | 6.7 |

| ASIA/AUSTRALIA | 34 | 3,325.80 | 15.1 |

| AFRICA | 17 | 2,297.50 | 10.4 |

| ANTARCTIC/ARCTIC | 0 | 0.0 | 0.0 |

On the automotive side, the big three automakers are building less. "We are moving vertically in the industries we know best," says John Rikolta Jr., CEO of Walbridge Aldinger. The firm is moving into plant operations and maintenance and taking smaller jobs in the automotive industry, he says. On the bright side, some of the foreign auto makers are going ahead with projects, including Nissan, Toyota, DaimlerChrysler and Mercedes-Benz, he says. "We are chasing a couple new plants planned in the South," Rakolta says. He adds that one or two auto jobs can mean up to $150 million.

Isaacs agrees that the auto market is slow, "but even when it is slow, it still is big." One major win for Graycor was a recent job for Navistar in a joint venture with Ford in Escobedo, Nuevo León, Mexico. "It is a plant expansion to build trucks for Ford," he says. "They gave the job to us rather than a larger competitor because we were big enough to do the job but small enough to involve senior management in their project."

INSURANCE GAME. Contractors are frustrated by litigiousness in some markets and its impact on insurance costs. "We did our first, and last, condominium project a few years ago," says Allen Rudolph, CEO of California-based Rudolph & Sletten. He says that just before the time limit for construction defect lawsuits was to run out, the firm was served with a defect complaint. "It was a canned complaint alleging, among other things, defects on the fifth floor. Too bad it was only a three-story building," he says.

Rudolph's experience is not unique. McCarthy was set to work on a $4-million condo project in Phoenix. "We went around to the insurers and got general liability quotes in the $1-million range," says Mike Hurst, also president of McCarthy Building. "It's just not practical to build like that."

McCarthy's experience points up one of the biggest problems facing contractors today: insurance. "This is the real day-to-day concern," says Isaacs. Many contractors believe that the high insurance premiums and the limits on the availability of surety bonds may help drive out the marginal contractors in the industry. "Some generals who aren't liquid may have trouble getting bonds," says Fred O'Neill, senior vice president of Suffolk Construction Co. "Clients that want bonding are going to have to deal only with the most stable contractors; the marginal contractors are going to have trouble."

Rikolta agrees. "It is the 80:20 rule. In insurance, you make 80% of your profit from 20% of your customers," he says. So insurance companies are going to concentrate on their top contractor clients, leaving some marginal players out. But Isaacs is skeptical about insurance costs driving marginal firms out of the market. "I don't know that this often happens as quickly or as thoroughly as you would expect," he says. What the high insurance and bonding rates may serve to do is give the top-flight contractors a competitive edge.

|

NO MOLDY OLDIES. While environmental firms may find a growing niche in mold cleanup, the fungus is growing into a nightmare for building contractors. "We've all seen horror stories about asbestos and worry about potential liability to the industry if mold creates an asbestos-like wave of litigation," Isaacs says. Adds Rudolph: "I recently saw a local legal journal with a story on the issue. The headline was ‘Mold Is Gold.' That should tell you where the legal community is coming from on the issue."

The threat of liability from mold-related problems has many firms analyzing the risk. "We've got an in-house task force looking at the issue," says Graham of Skanska. "We have academics, as well as building people, looking at the question of mold. It's our way of doing a preemptive strike on the issue," adds Mike Healy, CEO of Skanska Building USA.

"Mold is the sleeping giant in the industry," says Fee. Turner is working with outside testing firms to ensure against mold contamination. But some contractors say wallboard manufacturers need to do more to improve protective coatings on their products. They also are wondering if the issue, and the threat of liability, may alter construction methods. "We may have to change the scheduling and sequencing of jobs to guard against mold," says Hurst. "We have to be more sensitive to hanging rock before the structure is completely dried in," agrees Tellepsen.

But others don't believe that a radical approach to scheduling a job will work. "If you wait until everything is watertight before doing the interior work, the project will never get done," says Healy. Rudolph agrees. "Because of fast-track schedules, you have to hang the sheetrock while still open to the elements," he says.

Rudolph says that traditional ducting may help. "We urge clients to go with metal ducting rather than nonducted returns," he says. It is sometimes a tough sell, because of costs. But he says contractors have to be alert. "We are not in this to cause anyone harm," Rudolph says.

BRAVE NEW WORLD. But construction firms are changing their ways of doing business, as technology becomes less of a novelty and more of a requirement for contractors and owners. "For a while, everyone seemed to pat themselves on the back for having project Websites," says Isaacs. But it now "is the litmus test for a good contractor. It's a requirement, rather than a selling point."

"Owners were initially enthusiastic about project Websites, but now, they aren't as important, especially if they are an added cost," says Isaacs. He says the real advantage to project Websites now is the ability to link project principals.

Technology also allows firms to standardize processes. "Once processes are standardized, you can do real benchmarking across projects," says Rikolta. "And once you have benchmarks, you can objectively establish and share best practices."

Some firms are going a little farther out to experiment. "We saw the recent demonstrations of the ‘it' machine–the personal human transport," says Rikolta. Walbridge has decided to test two machines on a construction site. "We want to see if they can help safety engineers who have to move back and forth around a site. You normally walk about three miles per hour, but these machines can go 11 mph," he notes. "We'll see if they work."

Post a comment to this article

Report Abusive Comment