The recession may have been a mild one for the U.S. economy as a whole, but certain parts of the construction industry have taken a beating. Equipment makers are consolidating, rental firms are reorganizing or conserving cash and some contractors think that now might be the best time to get good equipment deals. There seems to be more than enough to go around.

With about 75% of the firm's costs "fixed or semi-fixed...we get creamed in a recession," says Brad Jacobs, chairman of Greenwich, Conn.-based United Rentals Inc., the nation's largest rental shop, with about 471 outlets. But the bright side is that it can ramp up quickly after a recession just by increasing rental equipment utilization, he adds.

Although United Rentals took steps in 2001 to conserve cash by curtailing used equipment sales and new equipment purchases, it remained profitable and increased its rental sales by 5.6%, Jacobs says. Rental revenue was $2.9 billion in 2001 and the firm managed to pay down debt by $250 million, to $2.4 billion. Net income was $150 million. But Jacobs says that all is not rosy with stock trading at about $20 a share, less than half of the $48 high of several years ago.

United Rentals "curtailed used equipment sales" in 2001 because of depressed used equipment prices, says Jacobs. "Used equipment prices have stabilized" and sales will now pick up, he adds. Sales were only $150 million last year, compared to $350 million in 2000. They will be almost $400 million this year.

"We are the world's largest manufacturer of used equipment," quips Wayland Hicks, vice chairman. "We buy it right, rent it [as much as possible] and then sell it right." He says the turnover varies by type of equipment and that the $3.6-billion fleet is an average of 31 months old. "We start moving it out in the fourth or fifth year," he says.

"There was excess used equipment in the market and it did affect prices," says equipment consultant Frank Manfredi, president of Manfredi & Associates, Mundelein, Ill. He notes that prices for hydraulic excavators, for example, were down 15% last year, a combination of weaker demand and oversupply. "My sense is that prices have firmed up," Manfredi says.

|

How Rental Rates Vary by City

|

|||||

| Equipment Type | Atlanta | Chicago | Dallas | N.Y.C. | Seattle |

| Generator | |||||

|

1,170 | 1,600 | 1,240 | 1,210 | 944 |

| Scissor lift | |||||

|

624 | 703 | 595 | 799 | 720 |

| Light tower | |||||

|

673 | 965 | 1,020 | 690 | 1,090 |

| Backhoe/loader | |||||

|

2,115 | 2,650 | 1,785 | 2,100 | 2,600 |

| Skid-steer loader | |||||

|

1,332 | 1,908 | 1,365 | 2,111 | 1,700 |

| Excavator | |||||

|

5,160 | 4,625 | 4,866 | 6,833 | 5,138 |

| Dozer | |||||

|

3,222 | 2,600 | 2,920 | 3,500 | 3,000 |

|

Source: United Rentals. List prices for average monthly rental rates.

|

|||||

But the aging of rental fleets puts manufacturers in a bind. Manfredi notes that United Rentals in 2000 purchased almost $900 million in new equipment, less than $500 million last year and expects $365 million this year. But Deere & Co., Moline, Ill., reported a 60% drop in North American sales in the fiscal year ending October 2001 and expects another 70% drop this year, Manfredi says. Other firms also are similarly affected. "It is a direct reflection of buying [by rental firms] in North America," he says. Jacobs says United Rental purchases will be up to $900 million in 2003.

Size apparently does matter when it comes to buying. "We negotiate directly with manufacturers and get better pricing," which can be 15 to 30% lower than normal outlets, says Hicks. But this also can cause problems with companies that want to protect their dealership network, such as industry leader Caterpillar Inc., Peoria, Ill. "We stay away from Cat because they force us to go through their dealership channel," Hicks explains.

"Our costs have gone down considerably as we went from a small company to a large one," says Hicks. The firm's rental rates vary by city and region (see table). A backhoe may be cheaper to rent in Florida than in New York, but "we can rent it 12 months of the year," says Hicks.

NationsRent is not faring as well. The Fort Lauderdale, Fla.-based firm reportedly is selling off larger dirt-moving machines as it adjusts its fleet to market conditions in its bankruptcy reorganization. The firm filed for Chapter 11 protection Dec. 17 when it failed to make a debt payment. On March 7, the bankruptcy court in Delaware approved $55 million in new financing, and the firm announced that Phillip V. Petrocelli has been appointed interim president. He was executive vice president. Chairman James L. Kirk resigned Feb. 11.

Some firms, like Appleton, Wis.-based Boldt Co., believe the "overfleeting" of the industry makes it a good time to buy. "Now is a good time for us to be in the market" and we bought a couple of cranes last year, says Executive Vice President James M. Rossmeissl. "We felt like we were treated very fairly in the market."

The company buys mostly rough-terrain cranes and track-type lattice-boom cranes and has a fleet of 80 worth about $65 million. "We have traditionally owned our own equipment, but it is not a philosophy but rather a business decision," Rossmeissl says. "We can provide equipment more economically to customers than by leasing." It makes economic sense if you can buy equipment without having to borrow money, he says.

"Some of the best pricing was available just prior to the calendar year's end," because most of the equipment manufacturers are on a calendar year for financial reporting and they wanted to clear the equipment off the books, says Scott Hansen, Boldt's vice president of operations support. The company purchased a Manitowoc 100-ton lattice-boom track crane and a 65-ton Link Belt rough-terrain crane. "We are trying to cycle the older rigs out," of the fleet, such as the Model 5299 American 50-ton lattice-boom cranes from the 1970s, he says.

The firm has its sights on larger iron for its power work. "That requires lots of large crane picks," says Hansen. The company leased a new Manitowoc 500-ton model 2250 for a project in Michigan and has an option to buy. "We have until fall to decide," says Hansen.

|

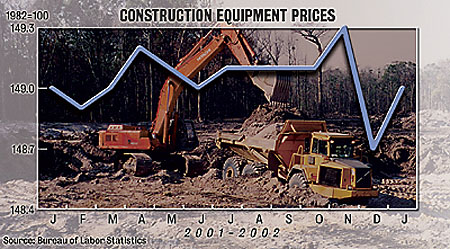

| (Source: Bureau of Labor Statistics) |

Post a comment to this article

Report Abusive Comment