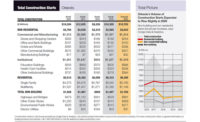

McGraw-Hill Construction, part of The McGraw-Hill Cos., recently released its annual construction forecast for 2102, which predicts that overall U.S. construction starts for next year will remain essentially flat. The level of construction starts in 2012 is expected to be $412 billion, following the 4% decline to $410 billion predicted for 2011.

The construction industry has struggled to see recovery take hold over the past couple of years. After plunging 24% in 2009, new construction starts leveled off in 2010 and have hovered within a set range during 2011, said Robert Murray, vice president of economic affairs, McGraw-Hill Construction.

“The backdrop for the construction industry is the fragile U.S. economy, which continues to see slow employment growth, diminished funding from federal and state governments and pervasive uncertainty,” Murray added. “In 2012, the top-line numbers are not expected to show much change but there will be variation within the major construction sectors, with some gains predicted for housing and commercial building—assuming the U.S. economy avoids recession.” Based on significant research and in-depth analysis of macro-trends, the 2012 Dodge Construction Outlook details the forecasts for each construction sector, as follows.

• Single-family housing in 2012 will improve 10% in dollars, corresponding to a 7% increase in the number of units to 435,000 (McGraw-Hill Construction Dodge basis). This is still a low amount, as the excess supply of homes due to foreclosures continues to depress the market.

• Multifamily housing will rise 18% in dollars and 17% in units, continuing its moderate, upward trend.

• Commercial building will grow 8%. Warehouses and hotels will see the largest percentage increases, but improvement for offices and stores will be modest.

• The institutional building market will slip an additional 2% in 2012, after falling 15% in 2011. The tough fiscal environment for states and localities will continue to dampen school construction, and the uncertain economic environment will limit growth in health-care facilities.

• Manufacturing buildings will increase 4%, following the 35% gain in 2011, as the low value of the U.S. dollar continues to support export growth.

• Public works construction will drop a further 5%, after a 16% decline in 2011, due to spending cuts and the absence of a multiyear federal transportation bill for highway and bridge construction.

• Electric utilities will retreat 24%, following a 48% jump in 2011.

The 2012 Dodge Construction Outlook was presented Oct. 19 at McGraw-Hill Construction’s 73rd annual Outlook Executive Conference in Washington, D.C. In addition to Murray’s Dodge Construction Outlook presentation, industry experts delivered forecasts for residential building, building materials, labor costs and the economy as a whole.

Post a comment to this article

Report Abusive Comment