Despite the headline-grabbing attention of federal deficits and budget cuts, the real problems facing construction remain the prolonged recession in the private nonresidential building markets, the weakening of the once-dependable public markets, a stalled housing recovery teetering on the brink of slipping back into recession and high unemployment. That does not add up to a quick recovery, which in turns equals low inflation abetted by desperate bidding. The sudden turnaround from the Keynesian economics of stimulus to the Hoover-era economics of austerity only make the outlook bleaker.

“What we are seeing is suppliers trying to bump up prices and the industry wondering if it has enough work to support those increases. Last year quite a few price increases did not stick,” says Julian Anderson, principal with Rider Levett Bucknall. The RLB construction selling price index shows an annual increase of just 0.7%.

“I don’t see any big changes coming. This will be the cost model for at least the rest of this year,” says Karl Almstead, vice president responsible for the Turner building cost index, which is up just 0.9% for the year. He is concerned that public work is “evaporating” even before the private sector recovers. “Anything that has federal dollars attached to it will be very hard to come by,” Anderson adds.

Contractors are desperate and ignoring increases in commodity prices, says Don Short, president of The Tempest Co., Omaha, Neb. He says they are consciously bidding below prices being quoted by their suppliers and then betting prices won’t go up further, making their plight even worse. Right now, copper is the biggest culprit, he adds. “I think 2011 is going to be a year of bankruptcy,” says Short.

“Asphalt has the greatest potential to spike during the next few quarters, but prices for most building materials will be rather flat in 2011,” says Robert Martin, building materials analyst for IHS Global Insight, Washington, D.C. Furthermore, housing appears to be following a “W” cycle, says Martin. “The only question is how steep the second decline will be.” That will certainly check prices for materials such as lumber and wallboard,” he says.

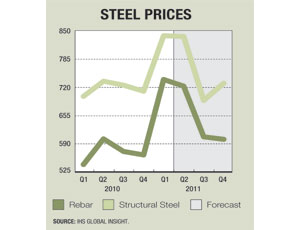

Structural steel and reinforcing bar prices are still riding high as producers try to pass along a huge spike in scrap prices. “Scrap reached its second-highest level ever,” says John Anton, steel analyst with IHS Global Insight. “Record level prices with such low demand is illogical,” he adds. Anton predicts that steel prices will start to come down in April and that by May contractors will see broad declines. He sees the average price for structurals falling from a peak of $842 a ton this quarter to $691 a ton by the third quarter of 2011. He predicts that rebar prices will fall from $740 a ton this quarter to $600 a ton by the end of the year.

Aftershocks

Charles Bradford, steel analyst at Bradford Research, New York City, said the recent Japanese earthquake is not expected to affect global steel prices since very little steel capacity is produced in the northern region, which bore the brunt of the recent catastrophe. He says only two of 11 steel plants within 400 kilometers of the earthquake’s epicenter were confirmed to have halted operations following the quake. One is Sumitomo Metal Industries’ Kashima facility in Ibaraki Prefecture, the other is Nippon Steel’s Kamaishi plant in Iwate, both integrated steel mills. Bradford said 28 million tons of capacity had been impacted by the earthquake, accounting for 2% of capacity at all 11 plants.

Power shortages at some large Japanese flat-rolling mills have forced them to cut back production, which could tighten supply. But Bradford says he was unsure whether flat-rolled steel prices will rise or fall since it was hard to measure how many mills had restarted production and the effects of lost production at other mills not affected by the earthquake. The extent of lost demand from auto companies that have cut back production is also unclear.

Prices for rebar or beams could also rise if Japan’s scrap markets are not viable for a while, since Japan is a big exporter of scrap used to produce these products. In the second week of March compared with the same period in February, prices for bar remained unchanged. Sheet was up 7% following a huge increase of 70% for sheet and 15% for bar in the past three months, Bradford says.

Prices for copper could be further affected by disruptions to the production of electronic components and autos, which contain copper. An IHS Global Insight report, titled Japanese Earthquake to Impact Component Supply and Pricing, noted that damage was negligible for Japan’s largest electronic component producers that operate facilities far to the south of the epicenter of the quake.

“From what we can tell the aluminum industry came through the earthquake fairly well with only a few facilities suffering damage, but rolling blackouts are expected to slow production,” says John Mothersole, nonferrous metals specialist with IHS Global Insight.

“Reconstruction from the earthquake will have an impact on a three- to five-year time horizon,” Mothersole says. He also predicted that the immediate impact of the earthquake could cause three to six months of disruption in the supply chain and reduce demand.

Mothersole predicts that following the earthquake, copper consumption will grow globally at 7.0% this year and 6.3% next year. Before the earthquake, global growth was expected to be 7.1% in 2011, so there will be a ripple effect.

Post a comment to this article

Report Abusive Comment