By its nature, the construction industry is an optimistic group. However, by the end of the “summer of recovery,” firms’ rosy view that better times were right around the corner has been tested and found wanting. Major contractors, engineers, subcontractors and construction service firms have concluded that the industry recession will last for the foreseeable future and that they need to be prepared to hold on for as long as it takes.

The ENR Construction Industry Confidence Index (CICI) for the third quarter of 2010 plunged to 32 on a scale of 100 from a relatively optimistic 41 in the second quarter ; an index of 50 would mean a stable market. Responses from 610 executives of large construction and design firms confirm the general sense that there will be no recovery any time soon, either in the construction market or in the general economy.

The CICI measures executives’ sentiment about the current market and projections for where it will be in the next three to six months and over a 12- to 18-month period. The index is based on responses to surveys sent to more than 2,000 U.S. firms on ENR’s lists of the leading contractors, subcontractors and design firms. The current index is based on a survey conducted over a two-week period earlier this month.

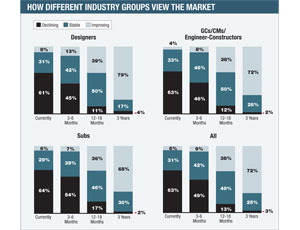

This quarter, 63% of all respondents say the market is still in decline, up from the 53% that saw a continuing drop in last quarter’s survey. Further, 49% in the current survey believe the market will continue to decline over the next three to six months, compared to 37% in the first quarter. As in past surveys, design firms continue to be more optimistic about a turnaround in the near term than general contractors or subcontractors (see chart, p. 34).

The most telling responses in the CICI survey did not concern construction markets but reflected the industry’s views on the American economy. Starting in the third quarter of 2009, CICI survey respondents consistently have rated the overall U.S. economy well ahead of construction-market prospects. But in applying the CICI formula, survey respondents gave the current U.S. economy a rating of 39 on a scale of 100, down a surprising 17 points from the second quarter.

The startling confidence drop in the recovery of both the construction market and the general economy may be because upbeat economic projections this spring have failed to produce a recovery. “For a long time, you didn’t hear much about the possibility of a double-dip recession,” says Brian Summers, chief operating officer of the Construction Financial Management Association (CFMA), Princeton, N.J. Talk of that possibility has returned, he says.

Loss of faith

This loss of faith in the prospects of a recovery in the U.S. economy is reflected in the overall CICI index and in the individual market sectors measured by the survey. The petroleum sector is the only one experiencing a significant increase in optimism. The sector index, as measured by 126 responding firms working in that sector, rose to 50 from 44, which signals a return to market stability.

In what could be a statistical anomaly, the rating for the nearly moribund hotel and hospitality sector inched up to 27 from 25 on a scale of 100. But other sectors in the general building markets mostly fell one to three points in the CICI ratings, including last quarter’s strongest one, health care, which dropped to 63 from 65. The biggest hit among buildings’ sectors was in multi-unit residential, which fell to 32 from 39.

Infrastructure markets, which many in the industry felt were in good shape, still took a beating. This confidence drop may be due to voter concerns about the federal deficit coupled with shrinking local tax revenue, both of which are squeezing public works. Survey responses in the water, sewer and waste sector drove down that market rating to a barely stable 52 from a healthy 62, while the environmental cleanup sector rating fell to 54 from 63. Confidence in the transportation sector dropped to a break-even 50 from 53; among power-sector respondents, confidence dropped to 62 from 64.

A new CONFINDEX survey, to be released soon by CFMA, also shows a confidence decrease, but only a mild one. CFMA polls 200 chief financial officers in general contracting, subcontracting and heavy and civil construction firms. “Our CONFINDEX went from 108 to 106 for the third quarter of 2010,” says Mike Verbanic, CFMA’s director of marketing. “It is a decline, but not a major one.”

CFMA’s index is based on a scale of 200, with 100 being a stable market. Surveyed CFOs found that general business conditions, including backlog and availability of bank credit, all fell between 1% and 2%, says Verbanic. The sharpest decline of all CONFINDEX components was in market prospects, which dropped to 110 from 115, he adds.

Summers says some CFMA members worry that the recession will not end next year. “Cuts in field staff were made this year, but if the recession continues into next year, headquarters staff overhead may be next, putting a few of our own members’ jobs at risk,” he says.

There is reason for workers to be concerned, according to survey responses. While 22.2% of respondents say their company staff levels have increased in the past six months, 48.9% say that levels now are lower. Also, 131, or 21.6%, of the 607 firms responding to this question say staff levels are down more than 10% within the past six months. These staff reductions are on top of the large-scale layoffs last year.

The construction unemployment rate hit 17.3% in July, according to the U.S. Labor Dept.’s Bureau of Labor Statistics. While the industry picked up 19,000 jobs in August, BLS says about 10,000 of these resulted from workers returning to employment after strikes were settled.

The ENR CICI survey also queried respondents about trends in obtaining project financing. According to the results, financial institutions still are sitting on their cash. In this quarter, 45.2% of respondents say obtaining project financing was tougher than six months ago, up from 39.3% last quarter. Also, only 9.0% said project financing was easier in this quarter, compared to 13.0% in the last survey.

| Currently (%) | ||||

|---|---|---|---|---|

| Market | No. of Firms | Declining Activity | Stable Activity | Improving Activity |

| Commercial Office | 430 | 78 | 20 | 1 |

| Distribution/Warehouse | 243 | 68 | 28 | 4 |

| Education K-12 | 367 | 36 | 51 | 13 |

| Entertainment | 187 | 66 | 32 | 2 |

| Health Care | 396 | 16 | 58 | 26 |

| Higher Education | 398 | 27 | 56 | 16 |

| Hotels/Hospitality | 287 | 71 | 25 | 4 |

| Multi-Unit Residential | 255 | 61 | 31 | 8 |

| Retail | 332 | 73 | 24 | 3 |

| Industrial/Manufacturing | 308 | 42 | 50 | 8 |

| Transportation | 215 | 33 | 47 | 20 |

| Water, Sewer and Waste | 204 | 25 | 59 | 15 |

| Power | 177 | 20 | 55 | 25 |

| Petroleum | 126 | 30 | 58 | 12 |

| Environmental/Hazardous Waste | 108 | 21 | 63 | 16 |

| source: ENR. NOTE: Percentages may not add up to 100% due to rounding | ||||

| 3-6 Months (%) | 12-18 Months (%) | ||||||

|---|---|---|---|---|---|---|---|

| Market | No. of Firms | Declining Activity | Stable Activity | Improving Activity | Declining Activity | Stable Activity | Improving Activity |

| Commercial Office | 430 | 60 | 36 | 4 | 19 | 52 | 29 |

| Distribution/Warehouse | 243 | 50 | 42 | 8 | 18 | 50 | 32 |

| Education K-12 | 367 | 32 | 52 | 16 | 13 | 51 | 36 |

| Entertainment | 187 | 48 | 45 | 7 | 25 | 46 | 28 |

| Health Care | 396 | 10 | 49 | 42 | 7 | 31 | 62 |

| Higher Education | 398 | 20 | 55 | 26 | 11 | 41 | 48 |

| Hotels/Hospitality | 287 | 53 | 39 | 8 | 20 | 53 | 27 |

| Multi-Unit Residential | 255 | 50 | 36 | 14 | 22 | 46 | 32 |

| Retail | 332 | 52 | 40 | 8 | 20 | 48 | 32 |

| Industrial/Manufacturing | 308 | 30 | 48 | 22 | 12 | 37 | 51 |

| Transportation | 215 | 26 | 45 | 29 | 14 | 41 | 44 |

| Water, Sewer and Waste | 204 | 15 | 61 | 24 | 11 | 45 | 44 |

| Power | 177 | 10 | 45 | 45 | 8 | 32 | 60 |

| Petroleum | 126 | 22 | 53 | 26 | 11 | 40 | 49 |

| Environmental/Hazardous Waste | 108 | 10 | 67 | 23 | 8 | 50 | 42 |

| source: ENR. NOTE: Percentages may not add up to 100% due to rounding | |||||||

Post a comment to this article

Report Abusive Comment