If there is any good news this quarter for the glass curtain-wall and window-wall sector, it is only that things probably can’t get much worse. That’s what glazing contractors, owners and architects are saying this spring as prices for glass-wall systems continue to tank.

Per square foot, window-wall and curtain-wall prices are down as much as 10% over already low prices at this time last spring, say glaziers across the country. “They stink,” says Anthony Callas, preconstruction manager at Lake Forest, Calif.-based Heinaman Contract Glazing Inc., about the current prices for standard window wall and curtain wall.

“There’s been a massive drop in prices, and it’s creating a bad situation. We’re seeing jobs go for very little, much lower than costs,” Callas says. “Glazing contractors are putting themselves at peril in this market to keep work going, taking on jobs at less than cost.”

Prices are hovering between $75 and $85 per sq ft for standard window-wall systems, Callas says. “Those are the responsible prices,” he adds, as many glazing contractors are making “unrealistic and irresponsible” bids of between $65 and $75 per sq ft of window wall and between $85 to $95 for higher-end curtain-wall systems, which are being underbid by $10 or $15 per sq ft. This “recipe for disaster” as Callas put it, is being noted throughout the industry.

As a result of bogged-down window-wall and curtain-wall prices, says Glenn Heitmann, president and CEO of St. Louis, Mo.-based building-enclosure consultant Heitmann & Associates, “Two things will happen. Contractors trying to make jobs profitable in this environment will struggle and may not make it, and others who take the crap jobs will eventually wish to God that they never took [them].” Heitmann sees the crisis unfolding “across the board—architects, engineers, consultants, everyone, and the fallout will be very strong.”

At the confluence of prices for aluminum and flat glass––the two main materials used in window systems––and market influences factored from abroad and regionally, the window-systems market faces a tangle of obstacles before a price recovery is possible, analysts say.

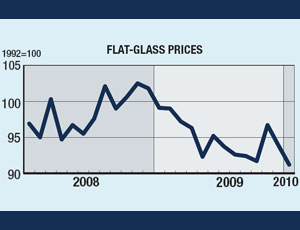

“Flat-glass prices have been declining year over year on a quarterly basis since the second quarter of 2009,” says Armine Thompson, an economist at Washington, D.C.-based Global Insight. “However, the largest drop was seen in the final quarter of 2009, with a 7.4% year-over-year decline. On an annual basis, flat-glass prices dropped 3.6% in 2009.” Thompson points to the 32% drop in commercial construction put-in-place last year as underlying the price downfall. “As the nonresidential construction market continues to contract through the rest of 2010, we expect flat-glass prices to continue their downward trend.” Thompson says prices will contract another 3.5% in 2010 before rebounding in 2011 if a non-residential recovery takes hold.

Prices for aluminum have followed suit, heading steadily south during last year but showing signs of a tepid recovery this quarter, with bids for briquetted aluminum borings jumping by 15% at Seattle-based Boeing Co.’s March scrap auction. But analysts say an “excess supply amid an extended period of weak demand is going to provide fundamental resistance to higher prices,” says Justin Lennon, analyst at New York-based Mitsui Bussan Commodities.

Also conspiring against glazing contractors are fuel surcharge costs associated with shipment of window systems, says Callas. In recent years fuel charges were not calculated into prices, but “we are beginning to see quotes with fuel surcharges of 15 cents per sq ft,” he says.

At a glass and glazing industry conference in Cambridge, Mass., on March 17, fabricators reported 10% to 15% drops in curtain-wall values in the last year, says Mic Patterson, director of strategic development at Los Angeles-based curtain-wall fabricator Enclos. “Part of this is material cost, part is reduced margins,” he says.The ensuing low-bid market melee has pitched curtain-wall competition “into the realm of [the] destructive, [the] cutthroat,” Patterson says. “Reputable companies resist dropping prices below what they know to be sustainable.”

Post a comment to this article

Report Abusive Comment