|

| (Photo by Monica N. Macezinskas, photo manipulation by Nancy Soulliard for ENR) |

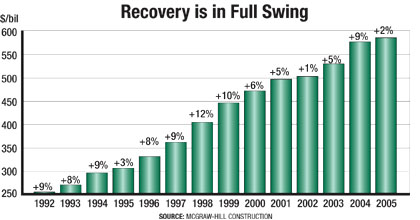

For one record year in 2004, almost all construction markets showed strong growth and both McGraw-Hill Construction and the U.S. Dept. of Commerce estimate that total industry growth will be up 9% this year. This is far above the flat rate predicted at this time last year, primarily because the single family housing market posted its third year of double-digit growth, defying widespread expectations of a slowdown. At the same time, nonresidential building markets started to rebound with McGraw-Hill Constructions income properties category posting an 11% gain.

|

| Source: McGraw-Hill Construction |

The consensus among economists is that the rebound in nonresidential building markets will continue into 2005, with housing finally starting to succumb to rising interest rates. But just how this plays out in different industry forecasts depends on how high interest rates actually go and how sensitive housing is to the increase. The result is fairly widespread in this years batch of forecasts, which range from a 2% increase in total construction predicted by McGraw-Hill Construction to a 6% increase projected by Commerce.

However, the economists optimism may not last much past 2005. The upward pressure on interest rates from the combined massive federal budget and trade deficits is expected to intensify after next year. The National Association of Home Builders predicts that fixed mortgage rates will increase from 5.9% this year to 6.5% next year before rising to 7.1% in 2006. As a result, NAHB is forecasting single-family housing starts to decline 4.4% next year and another 3.5% in 2006 (see related links).

McGraw-Hill Construction expects lower starts to lead to a 3% decline in the value of single-family housing construction next year. But this will still be the second-largest housing market on record. Experts say the slowdown in growth will be offset by annual increases of 15% for commercial building and hotel construction, and 12% for office building work.

Commerce expects housing to continue to defy the odds with a 6% increase in the value of new housing next year. This will be boosted by a 12% increase in the housing renovation market. In contrast, Commerce looks for more modest growth in the nonresidential markets, forecasting annual increases of 8% for healthcare, 6% for office buildings and 4% for commercial and lodging markets.

"If interest rates go from 6 to 8% in a year we are in trouble," says Randy Jiggard, manager of market information for FMI Corp., Denver. FMIs forecast calls for total construction to increase 5.5% next year after growing 8.5% this year. It also predicts that both residential and nonresidential building markets will increase about 6% in 2005.

"We look at mortgage rates of 6.5% as a tripping rate that will turn the housing market," says Ed Sullivan, chief economist for the Portland Cement Association, Skokie, Ill. He doesnt expect that to happen until after the first quarter of next year, with the most negative impact on housing being felt in 2006. PCAs forecast, which is adjusted for inflation, calls for construction to increase 2.9% in 2005 after rising 3.7% this year in real terms.

"In growth terms we see a complete reversal in what is going to drive the construction market over the next couple of years," says Sullivan. After climbing 14% this year, PCA expects the value of the single-family housing market to slip 0.5% in 2005 before dropping 4.6% in 2006 and another 1.6% in 2007.

PCA estimates that after subtracting inflation, the nonresidential building market only increased 0.1% this year. But the group predicts that market will rise 10% next year before jumping another 15% in 2006. Public construction should increase 4% in 2005 and 5% in 2006 after declining 1.5% this year, says PCA.

To underline how optimistic economists are, they are even calling for the long-dormant industrial market to rebound in 2005. PCA forecasts a 53% hike in...

s representatives of the "dismal science," construction economists are proving an optimistic lot this year, judging by a review of several industry forecasts for 2005. Cheered by this years robust growth rates, the strongest since the late 1990s, economists appear confident that 2005 will set a new record for overall construction volume. However, construction will reach this new height with a different market mix as nonresidential building and public works take over the role of growth driver from the homebuilding market.

Post a comment to this article

Report Abusive Comment