...lenders to restructure debt, extend loan-maturity dates,” he adds. “Deals are few and far between now, and it is time for face-to-face meetings with lenders and tenants. It is time for reality checks.” Opus North is “fairly pleased with activity in Chicago’s office market” says Queenan, noting two recent deals to bring tenants into office properties the firm speculated on before the crash. Solo Cup Co. and DeVry University will inhabit 130,000 sq ft and 150,000 sq ft of office space, respectively, in the Windy City.

Just the Beginning

Still, many say this is just the beginning of the downturn’s effect. “We are not at the bottom yet, but we are close,” says Susan Persin, construction industry analyst at Oakland, Calif.-based Foresight Analytics. “The cuts have been made, and they are being felt everywhere, but it will not be until mid- to late next year [or] maybe into 2011, until we see improvement.” Foresight Analytics published a report this summer on the rising number of failing banks, as the number of banks FDIC is monitoring on its “problem list” climbed to 416 in June from 305 in the first quarter—the biggest increase since June 1994, during the savings-and-loan crisis.

One notable recent victim is Chicago-based Corus bank, a provider of construction loans for condominium, office and hotel projects. The federal Office of the Comptroller of the Currency closed the bank in early September and appointed FDIC as the receiver after more than half of Corus’ $3.9 billion of construction loans were in non-accrual or foreclosure.

Corus was the 91st bank to be closed in 2009, and some analysts say hundreds more banks could follow in the next few years because of souring commercial-development loans. Speaking in September before a U.S. congressional committee, Richard Parkus, analyst at New York City-based Deutsche Bank Securities Inc., said, “Construction loans are the epicenter of bank-loan problems, and delinquency rates will likely rise dramatically within the coming year, with losses likely to exceed 25%.” This would represent losses of at least $140 billion, disproportionately borne by regional and local banks, Parkus said.

Unemployment Crisis

Developers are doing what they can to stem the losses by cutting staff and canceling projects. Analysts say developers’ woes are having a broad-based effect on the construction industry, not only because of loan troubles that have rocked the banking industry but because of rising unemployment as projects are shelved. The U.S. Bureau of Labor Statistics says the industry lost more than one million jobs during the past year, causing construction employment to hit 17.1% in September, up from 16.5% in August— nearly double the national unemployment rate.

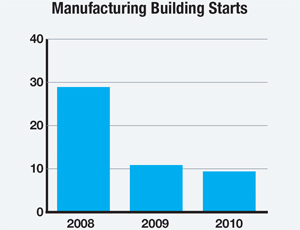

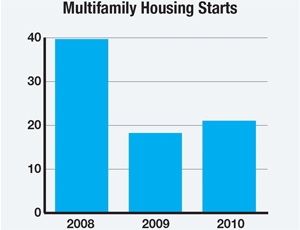

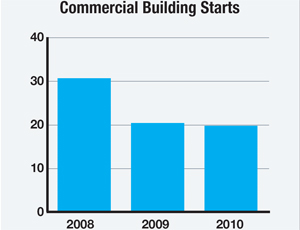

In September, the Associated General Contractors proposed a national plan to revive the struggling markets through a series of tax breaks and incentives. “While the nation continues to suffer through a recession, the construction industry is experiencing a depression,” says Stephen Sandherr, CEO of the Arlington, Va.-based association. Sandherr predicts investments in construction this year will drop by as much as $193 billion from last year, an 18% decline.

Developers and analysts say the office and condominium markets may be the hardest hit, with hospitality markets not far behind. Office construction under way at the end of the second quarter was 30% below what it was last fall, with delayed projects proliferating in cities across the nation, according to analysts.

In New York City, there are about a dozen scrapped or delayed hotel projects, as well as delays at the office towers at Ground Zero due to a lack of financing. The development of office towers at Brooklyn’s Atlantic Yards also is delayed.

Going forward, most expect the downturn to linger well into next year. “It is a very trying time,” says Queenan.

Post a comment to this article

Report Abusive Comment