For many firms that focus on buildings, much of the American Recovery and Reinvestment Act’s promise still hasn’t turned into contracts. Several federal agencies each have obligated less than half of their stimulus funding for building-related construction. Some projects for which contracts have been awarded haven’t seen a shovel move yet. Facing heavy workloads and looming legislative deadlines, agencies will be scrambling to get work out the door in coming months, including some huge projects.

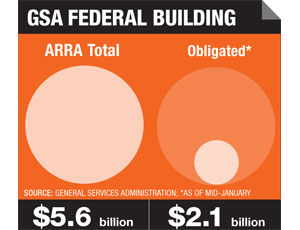

By mid-January, the General Services Administration had obligated $2.1 billion of its $5.6 billion in ARRA funds. ARRA requires GSA to award another $2.9 billion by Sept. 30, 2010, and the rest of its ARRA money by September 2011.

Bill Guerin, who heads GSA’s Recovery Act Program Management Office, says the agency has met its milestones so far and is on track to meet deadlines. But Guerin admits it is a strain on the agency’s contracting corps. GSA added 90 full-time employees and 30 contract workers to keep work moving. Guerin says, “GSA is really humming now.”

Although GSA keeps a running inventory of existing buildings, Guerin says initial studies to identify prime opportunities for “green” upgrades proved more challenging than expected. “These were things we thought would be the first out the door, and they took longer than we had hoped,” he says. “Those studies are done now, and we can move money to those places where we get the most bang for the buck.”

The influx of ARRA funds also has pushed GSA into new procurement territory. To speed delivery of some projects, Guerin says the agency turned to design-build, a method it has shied away from in the past. In November, it awarded a $21.9-million, design-build contract for a 33,000-sq-ft federal courthouse in Bakersfield, Calif., to Gilbane Building Co.’s San Jose, Calif., office, in partnership with NBBJ Architects of San Francisco. In December, Mortenson Construction, Minneapolis, won a $59.4-million, design-build contract to build a new, nearly 147,000-sq-ft courthouse in Billings, Mont.

Although using design-build has helped GSA award ARRA construction projects, crews still can’t start work right away, notes John Barotti, senior vice president and federal account manager in Skanska USA’s Washington, D.C.-area office. “Design-build is the quickest route for some of these projects,” Barotti says, “but even after something is awarded it could take six months of design before a contractor starts building.”

Some GSA-led projects are among the largest in the stimulus package, including a $435-million, design-build contract to provide a new U.S. Coast Guard headquarters in Washington, D.C. The contract, which includes $162 million from ARRA, was awarded in August to a team led by Clark Construction Group, Bethesda, Md. The next megaproject on the radar is a $500-million Social Security Administration data center to be built near Baltimore. A contract award is scheduled for September.

Although GSA projects are hitting the street more slowly than some other portions of the stimulus bill, Guerin contends the agency is providing long-term benefits. “These aren’t paving projects that take three months,” he says. “Our jobs will last for years.”

For the Dept. of Defense, recovery-act funds have augmented an already ballooning construction program. With broad initiatives such as the Base Realignment and Closure (BRAC) program pushing workloads to record levels, DOD contracting officers had their hands full before ARRA.

But Commander Alex Stites, Naval Facilities Engineering Command deputy operations officer, contends that because of BRAC and the expansion of other work, “we did not need to specifically beef up for the recovery work,” Stites notes. “We’ve been ramping up for years.”

In ARRA, DOD received $4.3 billion for facilities upgrades and by mid-January had obligated $3.1 billion of that. DOD’s other ARRA military construction category, which includes new facilities, is moving more slowly, with just $626 million of the $2.2 billion available obligated as of Jan. 22. ARRA says DOD must obligate all funds by September 2010.

Stites says more than 95% of NAVFAC’s projects were awarded by the end of January, with one notable exception: a new, $563-million replacement hospital at Camp Pendleton in San Diego County, Calif. A contract for that project will be let in September.

NAVFAC has used a mix of procurement methods, focusing on small or disadvantaged businesses for small projects; existing multiple-award construction contracts and indefinite-delivery/indefinite-quantity contracts for most of the small to medium-sized jobs; and stand-alone contracts for large projects.

The Army Corps of Engineers had obligated some 35% of its ARRA milcon funds by the end of January, with the rest to go out by Sept. 30. Its stimulus megaproject, a $700-million hospital at Ft. Hood in Texas, is scheduled to be awarded in September; construction is set to begin in May 2011. Patrick Burns, a Mortenson vice president and formerly The Civil Engineer of the Air Force, says that with the Corps and NAVFAC so busy with non-stimulus work, “I was surprised how many [ARRA contracts] they got issued.”

The Dept. of Veterans Affairs got $1 billion under ARRA to upgrade medical facilities, which VA is splitting among more than 1,000 projects. About $386 million was obligated by Jan. 19. It also has spent $112 million of the $150 million available for extended-care facilities.

Fred Downs, VA’s chief procurement and logistics officer, says it took time to “get cranked up and get the routine down,” but the department is pushing projects through. He expects all VA’s ARRA money to be obligated by July 31.

VA’s work may not stop there. With many bids coming in under the department’s estimates, Downs says the VA will try to use the surplus toward additional projects. “It’s not uncommon to see bids come in 10% to 15% under,” he says. “Competition is good, so that means we’ll have more work to come.”

Post a comment to this article

Report Abusive Comment