The picture on green building is getting clearer: Green building is growing around the world and quickly becoming an industry standard. A new research study conducted by McGraw-Hill Construction on global green building trends demonstrates that green building is well established across the globe and is expected to grow even more over the next five years. The study found that players across the industry—including owners, architects, engineers, contractors and consultants—engaging with green building have grown steadily. Firms doing more than 60% of their work in green building have grown from 18% in 2009 to 28% in 2012. By 2017, more than half the industry (51%) expects more than 60% of their work will be green building, a testament to the engagement of the industry.

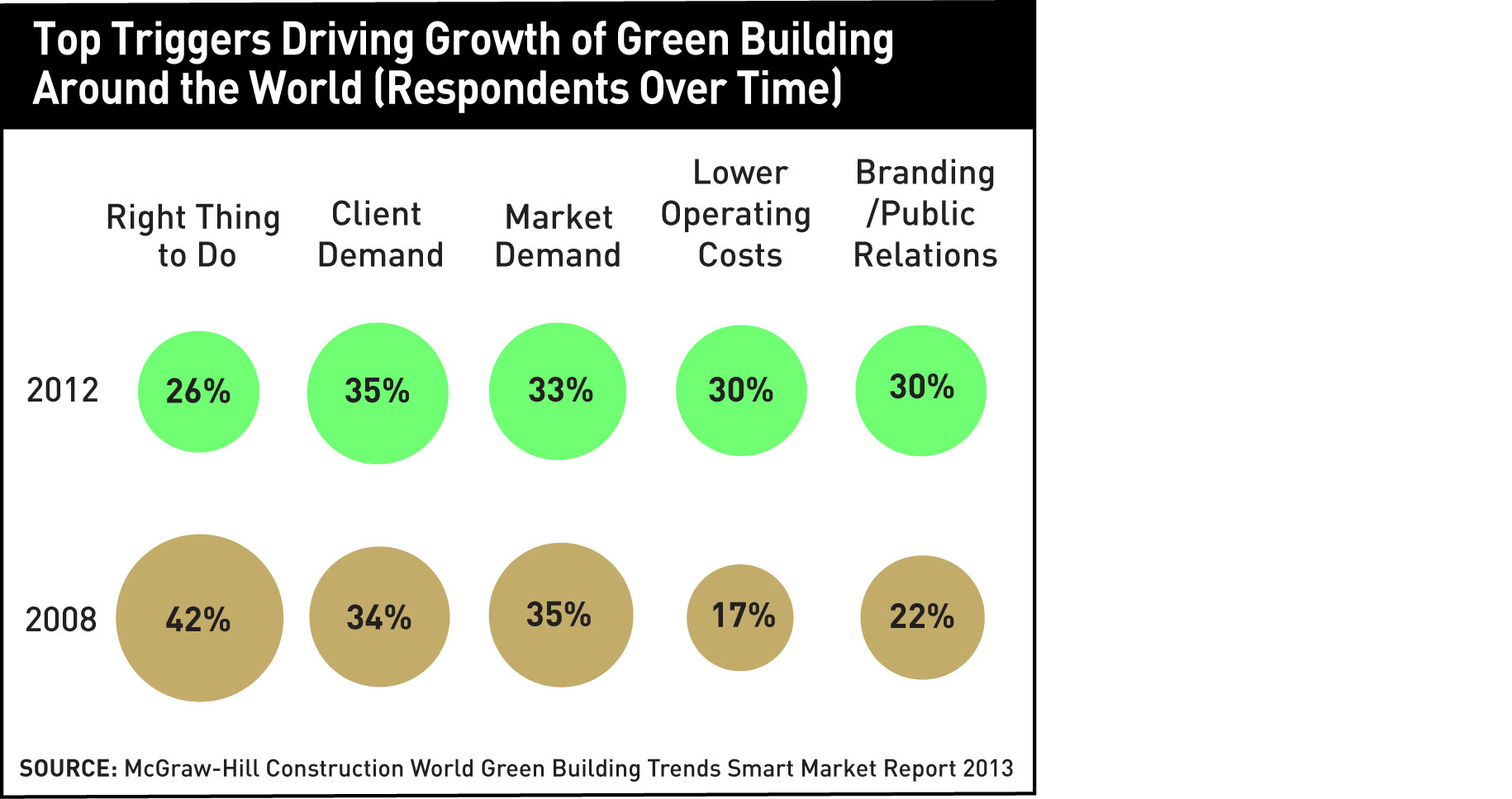

One global trend that is helping to promote this growth is a shift from doing green building out of environmental and social motives to being driven by strong business imperatives. The study demonstrates that while, in 2008, the largest percentage of green builders was engaged in the practice because it was the "right thing to do," that percentage has dropped; the predominant forces driving the market now include business factors such as client and market demands for green building, lower operating costs, and green branding and marketing advantages.

The operating cost savings for new construction and retrofits constitute the most likely reason for the increased importance of market factors. New green buildings report an eight-year payback for green investment, with operating costs over five years decreasing an average of 15%, according to the respondents. Green retrofits average a seven-year payback and an average decrease of 13% in operating costs over five years. However, 37% of the respondents also report that they did not track any performance metrics on their green buildings, which suggests the industry can do more to promote these benefits.

No matter where the respondents were located, energy costs were the most important environmental reasons to build green. However, interesting regional differences are evident when it comes to the reason chosen as being the next most important. For example, water reduction is critical in the U.A.E., but it is also a priority in the U.S. and Brazil. Lower greenhouse-gas emissions rank second only to energy in Europe and Australia. In South Africa and Singapore, there is a high level of concern about natural-resource conservation.

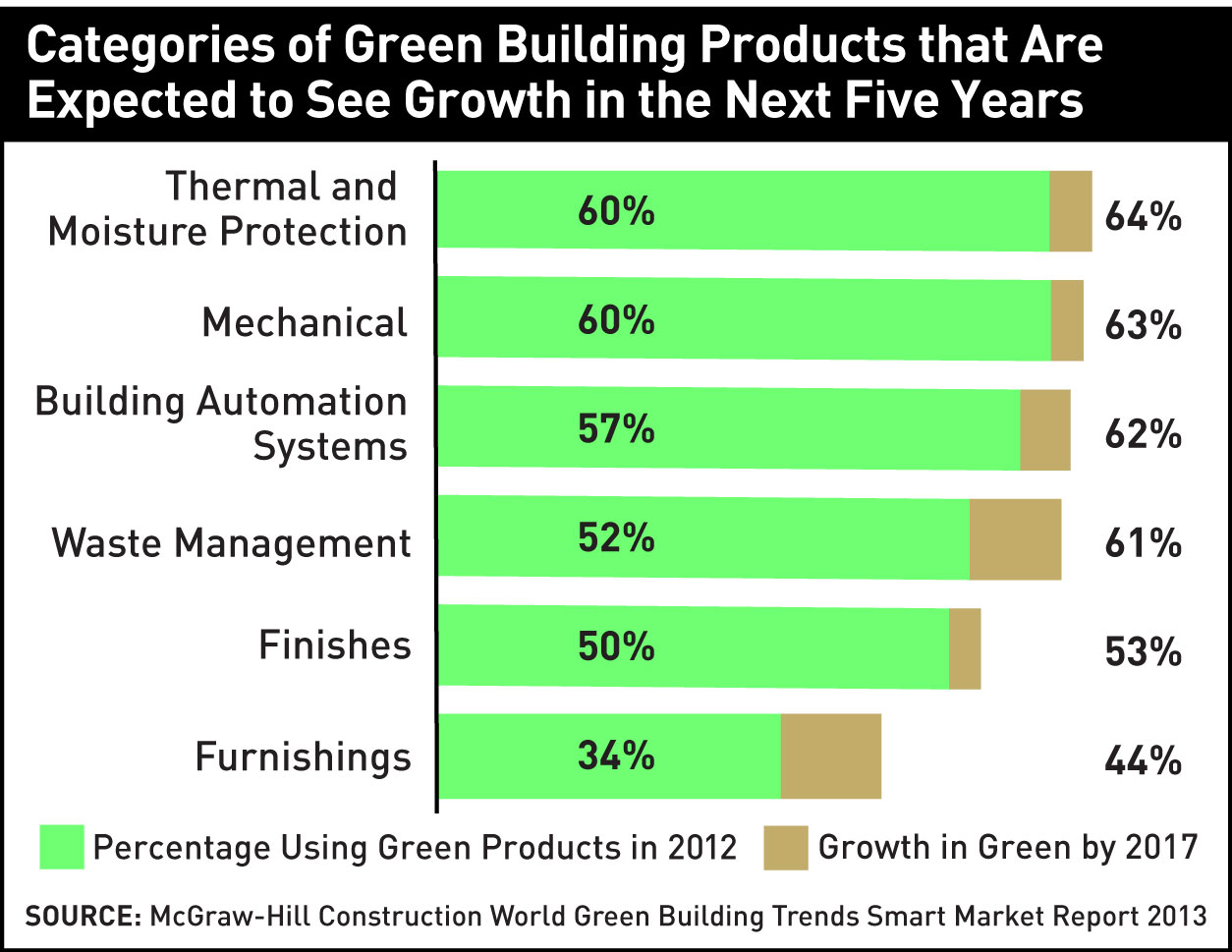

These regional drivers for green products should be kept in mind when considering the adoption of green products globally. The study results make clear that green products have permeated the market. In 2012, 89% of the respondents globally report using or specifying a green building product, and even more—91 percent—expect to do so by 2017.

At least 60% of the report’s survey respondents stated they had installed or specified products in the categories of electrical, mechanical, and thermal and moisture protection in 2012, and a slightly higher percentage expect to do so by 2017. While these same three categories were all in use in 2008, they were used by only 47% to 51% of respondents. The study results demonstrate there are strong market opportunities and support for the development of new green-building product and process solutions. By 2017, the strongest growth is expected in two areas: Waste-management products will increase in use to 62% in 2017 from 52% in 2012, and furnishings will grow to 44% in 2017 from 34% in 2012.

In addition to looking at global trends, the study explored trends in nine regions, demonstrating that while vigorous green adoption is universal, the factors driving green, the goals of green building and the products used to achieve those goals vary by region.

In many of the nine regions, the most dramatic growth in green building is expected in developing nations that are quickly catching up in terms of green commitments. Brazil and South Africa are two striking examples: In Brazil, the percentage of firms committed to green building is expected to more than double to 50% by 2015 from 24% in 2012; in South Africa, the percentage is expected to triple to 52% by 2015 from 16% in 2012. However, growth is not limited to these areas alone. Singapore, which currently has the highest level of green-committed firms in the study (64%), also will see a dramatic increase, to 89%, by 2015. Strong growth also is predicted in Norway (to 49% from 23%), the U.K. (to 68% from 45%) and the U.A.E. (to 74% from 48%).

For more data and intelligence on green building around the world, download the full World Green Building Trends SmartMarket Report at www.construction.com/market_research.

Harvey M. Bernstein is vice president of industry insights and alliances at McGraw-Hill Construction, ENR's parent company. Michele A. Russo is director of green content and research communication.

Post a comment to this article

Report Abusive Comment