Resilience

FEMA Program Called Successful at Creating Incentives for Community Flood Risk Reduction

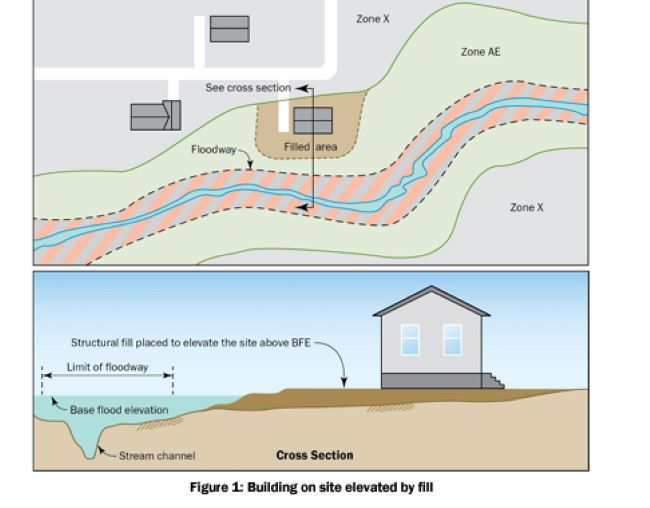

One flood-reduction strategy explored in the study is raising the elevation of the ground.

Image Courtesy of FEMA

A multiyear analysis of a voluntary federal program that provides insurance premium discounts to communities that take steps to reduce flood risks shows the effort is largely meeting its goal to boost community-wide resilience with use of a financial incentive for local climate adaptation actions.

Researchers from the Environmental Defense Fund and the Dept. of Earth and Planetary Science at the University of California, Davis, have concluded that the largest reductions in both insurance premiums and flood risk were in communities that participated in the program by engaging in “flood damage reduction” activities such as buyouts and relocations of floodplain structures, bildinge elevation and other minor structural changes. The conclusions were published in a March 2 article in Environmental Research Letters.

The Federal Emergency Management Agency (FEMA) established the Community Rating System in 1994 as a component of the National Flood Insurance Program. In exchange for community engagement in a range of risk-communication and risk-reduction activities that exceed minimum NFIP requirements, CRS provides discounts on insurance premiums between 5% and 45%. The CRS program rates communities on a scale of one to 10 according to the types of activities they engage in, with one representing the highest level of activity and engagement.

According to FEMA, more than 1,500 communities throughout the U.S. participate in the program. These CRS communities have over 3.6 million policyholders, accounting for more than 70% of all NFIP flood insurance policies.

“FEMA’s Community Rating System serves as an effective model for other federal market-based programs seeking to incentivize community level investment in climate resilience,” wrote Jesse Gourevitch, a post-doctoral fellow at the Environmental Defense Fund and lead investigator of the study. “As climate change increases the frequency and severity of major flood events, we expect the benefits of FEMA’s Community Rating System will only continue to grow,” Gourevitch wrote.

The researchers analyzed data from NFIP claims, policies and the CRS program between 1993 and 2020. They found that communities rated eight or better experienced a 12% to 37% decrease in NFIP claims compared to nonparticipants.

Another finding is that the greatest reduction in claims were associated with activities that fall under the flood damage category under the CRS program—primarily buyouts and relocating tenants of floodplain properties, as well as improving the resilience of buildings by elevating them or making other structural changes. However, despite the efficacy of these specific types of activities, only a small percentage of communities actually engage in them.

“We expect that broader adoption of these mitigations practices would have a positive impact on further reducing NFIP claims,” the researchers wrote.

They also made recommendations for improvement, including streamlining requirements for participation and providing more support for under-resourced communities to expand participation, as well as examining and addressing the current practice of requiring policyholders to pay a surcharge even if their community is not participating in the program. These households are paying into a program but not getting the discount on NFIP premiums, Nicholas Pinter, professor and associate director of the UC Davis Center for Watershed Sciences, concluded.

FEMA is planning an update of the CRS program to better align it with an improved understanding of flood risk and flood risk-reduction approaches.

.jpg?height=200&t=1721163439&width=200)