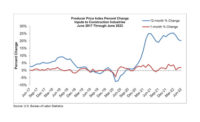

While it may be too soon to say for sure, there are some early indicators that the steep prices for machines in resale channels may be leveling off. Pressures from supply chains still facing disruptions due to the COVID-19 pandemic along with a busy summer construction season caused prices to rise steadily month-over-month earlier this year, but the worst of that may be over, according to the latest data from industry analyst firm EquipmentWatch.

“In the last six months, used construction [equipment] values have fluctuated within plus or minus 1%, so they’ve been very stable, a little bit surprisingly so,” says Sam Pierce, EquipmentWatch sales engineer. “It’s a good sign things are leveling off, and might keep going that way.”

2022 3Q Cost Report

(Subscription Required)

Another indicator that the equipment supply may be stabilizing along with prices is a shift in the mix of model years among used equipment. EquipmentWatch found that recent model year equipment is turning up more in resale channels, while auction data is still showing an appetite for equipment almost a decade old. “There are more models from the recent years being out there, we’re seeing that pretty prevalently,” says Pierce. “In our most recent data, we’re seeing models from the last five years make up 13.9% of all models being sold and used. Last year at this time, machines from the last five years were only 10%.”

But while resale prices have cooled slightly, there’s no sign of a plateau yet, and older equipment is still commanding strong pricing at auction, with the busy construction season seen in the rising year-over-year auction pricing.

For equipment manufacturers, there are still some lingering supply chain issues that are impacting their ability to get new equipment into the markets. In its third quarter earnings report, Deere & Co. forecasts a 10% increase in sales of earthmoving equipment, but sales of compact equipment will be flat or down 5%. This is not due to a decline in demand. Deere reports that the lower forecast “reflects extremely low levels of inventory and supply challenges constraining shipments.”

Continued high material prices have also impacted the used equipment market in unexpected ways. EquipmentWatch had to recently revise its calculations for the forced liquidation value of equipment, or the lowest value it might sell for a reasonable price. Prices for scrap metal and materials found in equipment and attachments have been steadily climbing, and the analyst was not capturing just how attractive the scrapping of used machines for their component materials had become.

“Since materials costs have been increasing and all the parts shortages are impacting maintenance, salvage scrap prices have also been going up,” says Pierce. “So we realized our values were a bit low. We’re going to keep a tighter eye on that in the future.”

Post a comment to this article

Report Abusive Comment