Workforce

AGC: 93% of Firms Need More Workers, 77% Can't Find Anyone Qualified

Survey conducted with Autodesk finds labor shortage across the industry

Image Courtesy AGC

Ninety-three percent of construction firms currently have job openings, and nearly as many, 91%, are having difficulty filling those open positions—especially jobs requiring skilled craft workers—according to a survey conducted by the Associated General Contractors of America and technology vendor Autodesk. Additionally, 70% of survey respondents also reported having difficulty finding salaried employees.

"One of the main reasons labor shortages are so severe in the construction industry is that most job candidates simply are not qualified to work in the industry," said Ken Simonson, AGC chief economist, who oversaw the survey. Simonson added that 77% of respondents stated that they are not able to fill open positions is because "available candidates lack the skills needed to work in construction or cannot pass a drug test."

All types of construction companies are experiencing similar challenges. Nearly identical results were reported by contractors that exclusively use union craft labor or are open-shop employers, and regardless of firms' size, geographic region or industry segments.

AGC conducted the survey of its members in July and August 2022. A total of 1,266 individuals from a broad range of contractor types and sizes completed the survey. Among responding firms that identified their market segments, 68% said they are involved in building construction, 35% highway and transportation construction, 32% perform federal construction projects and 27% work on utility infrastructure projects.

Stepping In to Build Careers

Respondents are not waiting around for fresh hiring candidates. More than half (51%) of the contractors surveyed—up from 37% in the 2021 survey—reported they've used a career-building program at high schools, colleges or career and technical education programs. Thirty-nine percent said they have tried online strategies, like using Instagram Live, to better connect with younger applicants. Between one-third and one-quarter of the contractors said they used an executive search firm or professional employer organization (32% of respondents), craft staffing company (30%), software to distribute job postings and manage applicants (29%), or engaged with a government workforce development or unemployment agency (28%). Roughly 22% of firms added or increased their use of unions or of specialty contractors to meet labor needs. Just 6% applied for employment-based visas, such as H-1B or H-2B.

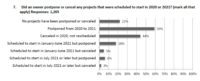

Approximately 86% of respondents reported raising base pay for their workers. Meanwhile, 70% have passed along rising materials costs to project owners during the past year, with 58% of respondents reporting that owners canceled, postponed or scaled back projects due to increasing costs.

Allison Scott, director of customer experience and industry advocacy at Autodesk, said that there were some encouraging signs in what contractors were saying about their recruitment efforts.

"Twenty-five percent are enhancing their online learning," she said. "Autodesk has increased investment in our learning initiatives specifically for construction. And we're seeing similar growth in digital learning."

With the Biden administration recently announcing a $10,000-per-borrower student loan forgiveness program, careers in both salaried and the skilled trades should be more attractive to young people considering changing careers or getting in on construction at the ground floor, said Stephen Sines, vice President of operations at the Morganti Group in West Palm Beach, Fla.

Sines shared a story about how he had recently interviewed a job candidate who had previously been in the hospitality and office management fields.

"What we look for is not immediately do they have the skill set we need, but are they trainable? Are they sophisticated? Can they pick up on it quickly?," he said.

Sines said construction is providing better opportunities for people who want to move up to a better career in his community. He asked the job candidate if her previous job was hourly or salaried and she said it was hourly. "I said, 'well, with Morganti, you would be a salary-paid employee,'" he explained.

Brian Turmail, vice president of public affairs and strategy at AGC, said enticing underemployed or under-compensated college graduates into careers in construction is a focus of the trade group and programs such as "Trade Up 2 Construction," a campaign from the AGC of Washington State and member contractor North Star Enterprises.

"So many people know there's not one way into the construction industry and it's not always a clear path for a lot of people," said Cheryl Stewart, executive director of the Inland Northwest AGC. Stewart said that with Trade Up 2 Construction, the Inland Northwest AGC will have counselors to talk to candidates to help get them onto the right pathway for a successful and long career in construction.

Other contractors on the August 31 press conference call said that they are also stepping up efforts to recruit people in both high school and mid-career due to what they said were an unprecedented level of openings and work.

"We've seen tremendous growth in every market category that we have in Oklahoma and anybody else has in industrial and commercial construction," said Brandon Bull, area lead at Lithko Contracting in Oklahoma City. "There's dramatic competition for craft in general. For the first time since I've been around, we've actually lost people to the housing industry, which has never happened before."