Despite advances in recent years in the state of digital data management in construction, a new report from Dodge Data & Analytics with Viewpoint Construction Software shows there is still a great deal of work to be done.

The report, “Improving Performance With Project Data,” offers some insights into the state of digital project data, based on a survey of contractors, construction managers and subcontractors in the construction industry. Respondents cited large improvements in their companies data gathering in the last three years, particularly at larger companies.

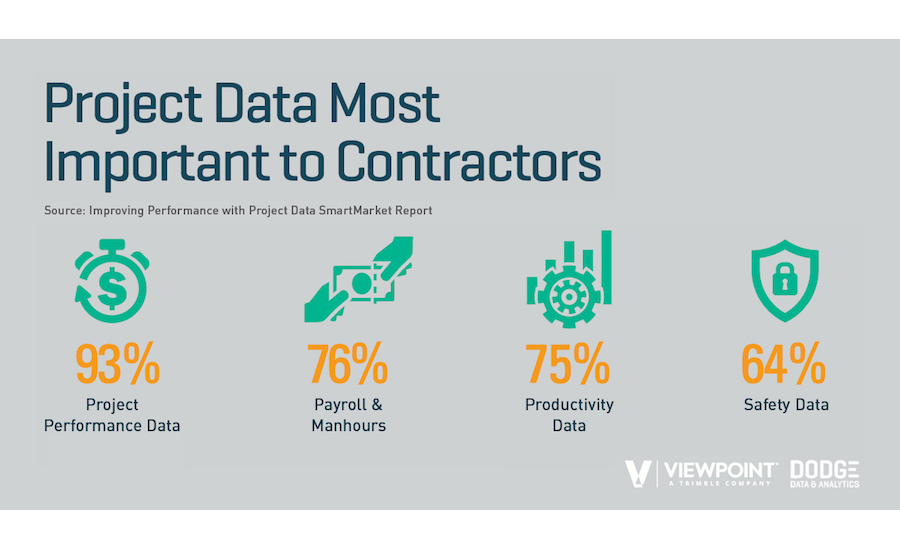

In the report, contractors, estimators and site superintendents were asked to rank the types of data by how important it was to have them digitized.

Unsurprisingly, project schedule and performance data was widely considered the most important kind of project data to gather, with 93% of respondents citing it. Roughly three-quarters of respondents put payroll and productivity at the top of the list, while 64% said safety data was most important.

Only 37% of respondents said equipment tracking data was important to gather, showing telematics and other fleet management technologies are still seen emerging as a major growth area. While software companies have well established footprints in project scheduling and financial information, the report finds that a great deal of safety and equipment usage data is still tracked with paper forms and spreadsheets. Respondents at larger firms reported that their companies planned to switch to a software-based tracking approach for safety in the coming years.

While some of these trends are to be expected, there were signs of change. roughly two thirds of respondents said their companies were hosting their data on-premises, many are using cloud-based services, either from software providers or third-party companies such as Amazon. When asked about the benefits of the cloud, most cited the ability to access data from both the site and the office. But many respondents also expressed concerns about the security of data stored in a cloud maintained by another company, and some respondents, including a disproportionate number of specialty contractors, see high costs as an impediment to using cloud storage.

Mobile apps were by far the most popular method of inputting new project data, with drones, sensors and wearable technology ranking comparatively low. Allowing users to input data and see up-to-date information on mobile apps ranked highly.

“One nuance in the report that is worth highlighting is the importance of delivering data directly into the hands of people on site,” says Matt Harris, chief product and strategy officer at Viewpoint, which sponsored the DD&A study. “Data is not just a tool for executives, but for superintendents and project leaders to consume it right then and there when they need it.”

While Viewpoint sees much of its software platform dedicated to comprehensive solutions, the study does reveal the longstanding gulf in technology investment between large and small firms still exists to a degree. Large firms were likely to have dedicated database systems for different types of data. Small and midsize firms were much more likely to have to deal with single enterprise software platforms for all of their data.

Despite the disparity in technology expenditures, large and midsize firms overwhelmingly said they had dedicated IT staff to manage data storage and access at the company. Only about half of small firms reported having dedicated IT staff, with the rest saying the duties were handed off to others at the company.

Post a comment to this article

Report Abusive Comment