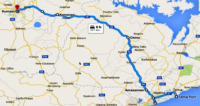

Plans to construct a $4-billion crude oil processing plant in landlocked Uganda inched closer to implementation this spring after the government signed a project framework agreement with Albertine Graben Refinery Consortium for a 60,000-barrel-per-day refinery.

The government identified the consortium members as two firms from Mauritius, YAATRA Africa and Lionworks Group Ltd., along with two others from Italy, Nuovo Pignone International SRL (formerly Nuovo Pignone S.p.A) and Saipem S.p.A.

YAATRA Africa, an affiliate of Washington, D.C.-based YAATRA Ventures, is focused on the development of infrastructure projects in sub-Saharan Africa, according to the company's website. Lionworks Group Ltd. is anchored by General Electric Capital.

Uganda is represented by Uganda Refinery Holding Co., which is held by government-owned Uganda National Oil Co.

Uganda says the April 10 agreement paves the way for preparation of front-end engineering and design, project capital and investment cost estimation, and environmental and social impact assessment.

The refinery is expected to produce petrol, kerosene, heavy fuel oil and diesel. No project timelines have been made available.

Uganda's estimated proven oil reserves exceed 6.5 billion barrels of oil, with 2.2 billion barrels recoverable in the oil fields of Hoima District. These reserves are being developed by China's China National Offshore Oil Corp., France's Total SA and UK's Tullow Oil Plc.

The Albertine Graben Refinery Consortium is the second attempt by Uganda to develop the project. Previous negotiations with a consortium led by Russia's RT Global Resources LLC and South Korea's SK Engineering & Construction Co. collapsed.

Mozambique Development

In Mozambique, a tender has been issued for a new oil refinery in the northern part of Nacala nearly 11 years after Texas-based Ayr Logistics Ltd. won the rights to develop a crude processing plant in the same area. Mozambique's national oil company, Empresa Nacional de Hidrocarbonetos (ENH), could not confirm if the tender is for the same project that had initially promised to create 1,000 permanent jobs.

"ENH intends to conduct a study to evaluate the feasibility of implementation of a refinery in Mozambique using liquid hydrocarbons from the Rovuma basin, the Mozambique basin and the international market," said the company in its tender invite. Imports are to "make up and stabilize the production profile and profitability of the project," said ENH.

Ayr Logistics, in partnership with South Africa contractor Group Five, was to construct a 300,000-barrels-per-day refinery in Nacala-a-Velha in Nampula province at a cost of $5 billion. The refinery, which was slated for completion in 2015, was to rely on crude supplies from the Middle East in the initial operation stages.

A second refinery of 350,000 barrels per day that was to be developed in Mozambique's southern Maputo province by local incorporated company OilMoz stalled during the global economic crisis. The agreement to construct the estimated $8-billion crude processing plant over a period of four years was signed in April 2008.

OilMoz said the project, which would have had 15,000 jobs available during construction and a permanent staff of 2,500 when completed, was to be developed under a build-own-operate-transfer model. OilMoz did not respond to inquiries on the current status of the project.

Post a comment to this article

Report Abusive Comment