The legal, political and economic effects of two South Carolina utilities’ decision to abandon construction of the V.C. Summer nuclear expansion project have barely begun. But the fallout is sure to follow, as state politicians, utility company executives, laid-off workers, project opponents, frustrated ratepayers and other parties respond to the debacle. Meanwhile, the canceled project is casting a shadow over Plant Vogtle, its Georgia-sited sister project being built by Southern Co. and Georgia Power.

In the end, the new cost estimates resulting from Westinghouse’s post-bankruptcy disclosures proved too high for the ownership team of South Carolina Electric & Gas and, specifically, its minority partner, the South Carolina Public Service Authority, also known as Santee Cooper. SCE&G owns 55% of the project, with Santee Cooper owning the remaining 45%.

The additional impact on ratepayers—already burdened with an 18% monthly surcharge—was too much for Santee Cooper to consider.

SCE&G, a division of SCANA Corp., cited uncertain availability of federal production tax credits and the amount of anticipated guarantee settlement payments from Westinghouse Electric Co.’s parent company, Toshiba Corp., among the factors leading to its decision. “It would not be in the best interest of its customers and other stakeholders to continue construction of the project,” SCE&G said in a statement.

But it was Santee Cooper’s conclusion not to consider proceeding with construction that forced SCE&G’s decision.

Kevin Marsh, SCANA chairman, said, “Ultimately, our project co-owner Santee Cooper’s decision to suspend construction made clear that proceeding on our own would not be economically feasible.”

The additional impact on ratepayers—already burdened with an 18% monthly surcharge—was too much for Santee Cooper to consider.

According to Santee Cooper’s analysis, finishing the project would be “uneconomical,” Mollie Gore, communications manager, told ENR. “It would cost 75% more than originally planned, or $11.4 billion, to finish both units, and with just one unit we lose economies of scale,” added Gore. “We would have to raise rates an additional 41% to complete both units and 37% to finish just one unit.”

To date, Santee Cooper has estimated it spent approximately $4.7 billion in construction and interest for its share of the project. The utility stated, “The analysis shows the project would not be finished until 2024, four years after the most recent completion date provided by Westinghouse, and would end up costing Santee Cooper customers a total of $11.4 billion.”

That equates to a roughly $25-billion cost for the V.C. Summer nuclear project in Jenkinsville. Originally estimated to cost $9.8 billion, the units were to come on line in 2017 and 2018, respectively.

Like their Georgia peers, both South Carolina utilities relied upon fixed-price contracts with Westinghouse to shield them from financial risk. But shortly after their enactment, those same contracts pushed Westinghouse into bankruptcy.

Nevertheless, Gore says, “Santee Cooper has made good decisions throughout this process based on information available at the time. It is unfortunate that Westinghouse’s bankruptcy has put us and our customers in this difficult situation.”

Busted Schedule

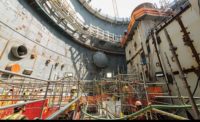

Both the V.C. Summer and Plant Vogtle projects have experienced setbacks related to workers’ and suppliers’ compliance with the stringent nuclear-construction standards—including documentation—enforced by the Nuclear Regulatory Commission. Recently, a ramping up of craft workforces at both projects failed to generate expected gains in productivity, though the Vogtle project is further along.

Days after the utilities’ decision resulted in more than 5,000 lost jobs, news website Quorum reported on the frustrations of V.C. Summer workers, several of whom complained that poor management had hampered productivity.

The website quoted one worker who claimed there were “thousands and thousands of wasted man-hours for people standing around. I’ve never seen anything like that before. It was a complete mess.”

In an Aug. 1 petition to the South Carolina Public Service Commission regarding the project abandonment, SCE&G focuses on enabling continued compensation from ratepayers and states that its portion of future costs for completing both units would total roughly $8.8 billion.

Fluor Corp., hired by Westinghouse in 2016 to serve as construction manager, took a hit to future earnings from V.C. Summer’s cancellation. In an Aug. 3 earnings call, Fluor CEO David Seaton remarked on his own company’s frustrations, saying, “The hell of it is, I don’t think these projects needed to be canceled if people had done what they should have done originally.”

The company is still owed $73 million for work completed at V.C. Summer prior to June 30, but Seaton said Fluor had placed liens to secure its payments. Fluor’s contract with SCANA is continuing, with Seaton noting a “small tail” of revenue likely to be generated over the next two quarters as the company “safely and efficiently [shuts] down that site.”

For the period of July 31 to Sept. 30, SCE&G anticipates capital costs of roughly $220 million “to demobilize the construction team and begin to restore the site to a stable condition,” according to its petition.

On Aug. 4, Georgia Power announced that it expected to finalize its own estimates for both completion and abandonment options by the end of the month.

Post a comment to this article

Report Abusive Comment