The JBKnowledge 2015 Construction Technology Report received 2,044 responses from construction industry professionals, polled between June 17 and July 8, 2015. JBKnowledge conducted the survey in conjunction with the Construction Financial Management Association, the Texas A&M University Department of Construction Science and HCSS construction software. Most of the companies that responded were construction managers or contractors in the commercial sector. Most had between 201-500 employees and did $21-50-million in sales revenue. The majority of individual respondents were estimators, executives and project managers.

One notable conclusion is that less than half of the companies that responded could meet Europe’s soon-to-be-implemented requirement of delivering as-built BIM models of all construction projects. “Companies would have a hard time turning spreadsheet data into BIM,” states the survey.

Here are other highlights:

-

Fewer 2015 companies have dedicated IT depts. compared to 2014 companies (58.9% in 2014 and 57.4% in 2015).

-

Most companies with in-house IT depts. have over 100 employees . A significant decline comes with any less employees.

-

Most companies with in-house IT depts. have $51-100-million in sales volume. A significant decline comes with any less sales volume.

-

Most respondents (41%) don’t know the percentage of revenue spent on IT. Of those that did know, 34.1% spend less than 1% of revenue on IT.

-

All of this means that the construction industry underspends cross-industry averages by 60% to 70% with 16% being outsourced.

-

The most limiting factors to adopting new technology are: budget (38.7%) and a lack of staff to support the technology (33.5%).

-

Companies that claimed to “try everything” were the smallest companies surveyed, with $1-5 million in sales volume annually.

-

The majority of companies (53.2%) did not bill IT expenditures to projects.

-

Most did not have IT R&D (67.2%). Out of those, respondents in the oil and gas industry are the most likely to have R&D departments.

-

38.5% of respondents said they unofficially perform IT-related roles. Some donned mock titles like, “”IT Guy by default,” or the “”Unofficial fixer of all problems.”

-

Almost 20% of survey respondents base the size of their IT staff on how “stressed out” the IT staff is.

-

The survey cited a severe lack in cloud security methods and procedures most likely due to understaffed IT departments.

-

“Our ERP vendor would say they have mobile tools, but I disagree. A few slices of the application can be available if it would ever work... which it doesn’t,” wrote one participant.

-

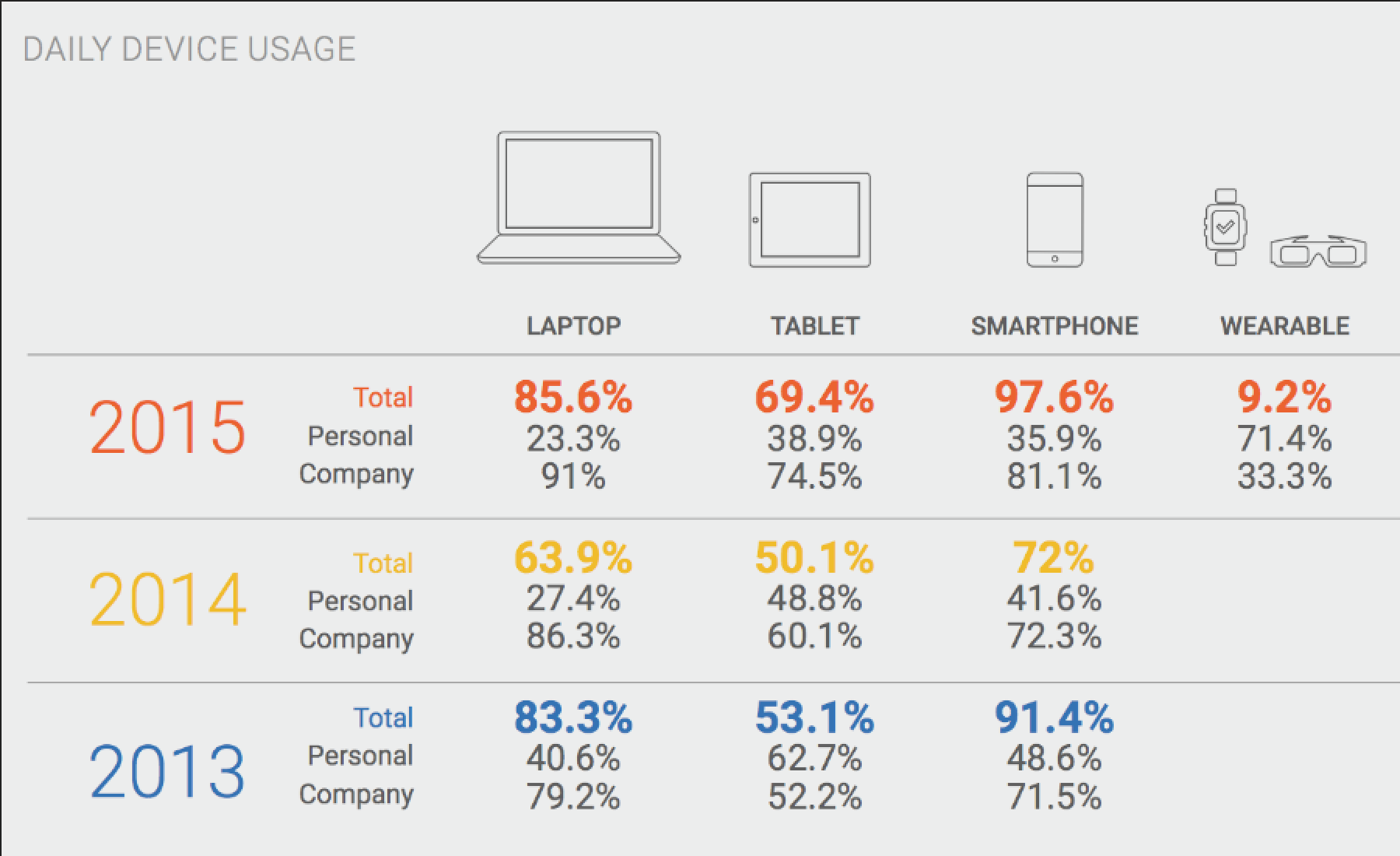

Device usage has increased since 2014 across the board for laptops, tablets and smartphones. Wearables were added to the 2015 survey and 71.4% of those in use are personal wearable devices.

-

58.7% of companies use iOS devices while 21.4% use Android.

-

If software doesn’t integrate nearly 50% of respondents transfer data manually.

-

The survey states that, “Year after year, the integration section of this survey elicits the snarkiest comments from survey participants. While entertaining to read, the comments reinforce the fact that technology providers are neither meeting expectations nor promises in data integrations.”

-

Most respondents (70.3%) didn’t know what emerging technology to expect in coming years the next most popular selection was Drones (20.7%).

The survey includes more data detailing which software is most popular for given tasks in the industry. It can be downloaded here.

Post a comment to this article

Report Abusive Comment