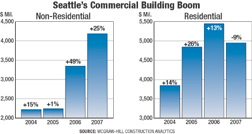

Michael Moore / ENR Seattle market is strong, but housing is cooling.

|

Seattle’s commercial building boom is making life interesting for area builders as they struggle to put together competitive bids and meet project budgets, knowing that materials and fuel prices will continue upward and owners are becoming more resistant to escalation adjustments.

The big issue for project managers is how to mitigate the risk of volatile material and fuel prices. The reality is that the days of stable prices for construction materials are over for the foreseeable future. The major factors are increased construction activity and demand for materials in Asia and the devaluation of the dollar relative to other currencies.

The best example of this is the inverse relationship between the dollar’s value and fuel prices. The price of oil is currently set on world markets in dollars. Every time the dollar goes down in relation to the euro and other world currencies, oil producers raise prices in dollar terms in order to maintain constant real revenue.

“We have seen prices on fuel go through the ceiling over the last 45 days,” says Curt Burks, senior vice president of Skanska Building Co. for the Seattle area. “We are faced with a financial tsunami coming right down on top of us. We have a choice, either learn to get on top of the wave and ride it or be washed out to sea,” he says.

“Skanska is trying to get on the crest of the wave of volatile market changes and ride it by using Integrated Project Delivery on a number of our current projects,” says Burks. “We have introduced language into the request-for-proposals process that asks our subs and fabricators to tell us how they will deal with the market’s future and current escalation risk.”

“We bring on key subs early in the process, and will even compensate them for their pre-construction services, based on their level of involvement, to gain instantaneous cost feedback and guide cost points in the design,” Burks says. “The current reality is that we want ourselves and our subcontractors to become proactive in supply-chain management,” says Burks. “It is necessary for everyone involved to understand the full financial risks on a project so that no one entity carries all the risk in a given situation,” he adds.

Early Involvement

Burks notes that Skanska's preconstruction project teams make a point of sitting down with the design team early to outline the integrated project delivery team’s goals, focusing on cost solutions and how to incorporate and track potential savings in the early design. He also points to examples of how materials prices can be brought under control before a project begins, such as framework agreements with key suppliers, bulk buys, set-asides, a greater focus on mill orders and rolling dates and subs that have dedicated commodities buyers on staff.

Developing materials procurement strategies and procedures in the pre-construction phase also has paid off for Opus Corp., nearly two years along in the construction of a 440-ft-tall residential building in downtown Seattle. Like Skanska, Opus asked its key suppliers and subs for input on how to cover any price increases in critical areas, such as the aluminum curtain walls and copper wire.

Michael Moore / ENR Agencies lack tools for mitigating risk.

|

For example, Opus protected itself from volatile aluminum prices by purchasing enough aluminum billets to cover its needs on the project, says Todd Williams, senior project manager. “We more than covered our risk. If the job had dried up, we would have made a profit on the aluminum,” says Williams.

Opus took a different approach with copper. “We told the electrical contractors that we wanted it to take the risk. We advanced it money to buy copper wire and store it in bonded warehouses. That protected us as well. I’ve heard of jobs like ours that didn’t take precautions and the subs are after hundreds of thousands of dollars in escalation fees.”

Williams says his biggest problem is finding quality subcontractors to work with. Along with the lack of A-list subs is a scarcity of quality workers. “We are having a hard time finding good drywall people. The union halls are empty and getting quality workers is a challenge to everyone,” he says.

Steel is one of the more predictable commodities for project planners and managers. “The price is going up, and up and then up,” says Gordon Holladay, comptroller for fabricator/erector SME Steel Contractors, which is based in Salt Lake City, but has projects from the Pacific Northwest to southern California and Las Vegas. “I just received a letter from Arcelor-Mittal informing me of another price increase, and the price of wide flange is already at record levels.”

Scrap Indicator

One of the earliest indicators of the prices for mill shapes is the price of scrap, which feeds mini-mills. Over the last 18 months, the price of scrap steel has doubled, from $6 or $7 per hundred pounds to around $13 today, says Holladay. The declining value of the dollar also is increasing upward pressure on domestic prices for imported shapes, he adds.

| + click to enlarge |

|

Holladay’s comments are echoed by president of The Erection Co., a major Seattle erector. “Buying steel these days is like walking around in a minefield,” says Jones. “Our more prudent clients bring their steel supplier on board early and give it a set of stick drawings that show the major shapes so that they can get the mill orders in early and at a known price.”

Contractors bidding on government contracts in the Seattle area are not able to use the same risk-mitigation strategies and tactics that commercial builders have in their arsenal. “We have to carry the [escalation] risk in our bids to the government agencies we deal with,” says Fred Paup, executive vice-president of Seattle’s Manson Construction.

“We specialize in dredging, pile driving and water-based construction,” says Paup. “Fuel is one of our major costs and we might add a premium if possible to mitigate risk, but the fact is that government budgets are flat, which means there is less work if prices are too high.” Paup says he has seen fuel costs account for project cost increases of as much as 25% over the three-year life of an average Manson project.

Life for mid-size Seattle area contractors may be a little easier than it is for the big firms. “We just broke ground on a 36,000-sq-ft urgent-care and medical- office facility where our concrete bidders gave us bids that warned of surcharges and other possible escalation,” says Dan Ryan, president of Tim Ryan Construction, based in the Seattle suburb of Poulsbo. “After the dust settled, one of the ready-mix firms came back to us and offered to trim its price by $10 per cu yd.”

Ryan attributes the price drop to the slowdown in residential construction. “The more housing slows, the more the downward pressure on materials prices and nonunion labor will offset the rising fuel prices,” he explains. “Even though everybody has announced increases, you’ll see the surcharges dropped as business slows.”

Related Link:

Related Link:

Post a comment to this article

Report Abusive Comment