Inflation Bows To Sub-Prime Crisis

|

The sub-prime mortgage disaster helped knock the wind out of construction inflation during 2007 by flooring the housing market. Pessimism over a looming financial crisis is deepening with tighter credit starting to squeeze other sectors far beyond housing.

As a result, construction inflation in 2008 is expected to be reeled in another notch, according to industry forecasts. ENR predicts that falling material prices will dampen annual escalation measured by its Building Cost Index. But as the main cost driver shifts from the materials to the labor markets, labor-intensive cost indexes such as ENR’s Construction Cost Index will get a boost.

As the housing recession lingers on through 2008, lumber and cement prices will continue to fall. Steel prices are expected to follow as the credit crunch spills over into the nonresidential markets, according to analysts interviewed by ENR. The weaker materials markets will have the biggest impact on the BCI, which is forecasted to increase just 1.8% next year. Inflation measured by this index already has been easing with annual increases of 2.6% in both 2007 and 2006, 5.0% in 2005 and 9.7% in 2004.

However, materials only make up 20% of the CCI. As a result, the CCI will follow a different path with a projected increase of 3.2% in 2008, up slightly from this year’s 2.6% increase.

These two trends point out the importance of labor costs in forecasting ENR’s indexes. Union wage rates account for 80% of the CCI and 64% of the BCI. A year ago, ENR’s forecast called for a 4.7% increase in the BCI’s skilled labor component and a 5.0% increase in the CCI’s laborers component. The actual increase was 4.5% for skilled labor and 3.4% for laborers among ENR’s 20 cities.

ENR is forecasting that the labor component of its indexes will hold close to the increases already negotiated for next year. Multiyear collective bargaining agreements reported by the Construction Labor Research Council, Washington, D.C., call for another 4.3% increase in 2008. ENR expects the labor component of the BCI to match this increase. The CCI’s labor component is forecasted to increase 4.7% next year as ENR’s wages for laborers catch up to the larger national average increase reported this year by CLRC.

“Activity in the nonresidential market remains strong in spite of the sub-prime issues and that has stretched the availability of labor pretty thin,” says Karl Almstead, vice president of Turner Construction Co., New York City. That is making labor the main driver for construction cost escalation, he believes.

“Material prices are easing and we no longer see the hyper-activity of a few years ago,” says Almstead. This is helping to reduce the “perceived risk” that suppliers were putting into bids, which is a main reason escalation is easing, he adds. “We are out of the 10% range and down to the 7% range,” he says of the Turner cost index, which tracks the selling price of construction.

The Big Three

The materials component of both ENR cost indexes consists of lumber, cement and steel. Prices for all three are forecasted to decline in 2008. Housing will continue to decline throughout 2008 but the new twist will be weaker nonresidential markets as the sub-prime crisis spills over into other markets, says John Mothersole, economist with the Washington, D.C., forecasting firm Global Insight Inc.

Lumber prices, normally the most sensitive to changes in the housing market, should be impacted the least by 2008’s projected decline in residential construction. “Lumber prices have been falling for awhile and most indicators point to prices being close, if not at, production costs. Any lower, and the mills would be cutting their own throats,” says Mothersole. He predicts that lumber prices will bottom out in 2008 after three years of declines. But ENR sees a bit more room for prices to fall. ENR’s forecast is for lumber prices to decline another 1.3% in 2008, following this year’s 7% decline.

While lumber mills were quick to cut prices, cement producers have only recently succumbed to the pressure of falling demand. “Historically, there has been a tight relationship between cement prices and shipments,” says Mothersole. “So far, the price corrections we have seen are not what we would associate with the sharp declines in shipments, which suggests that prices have room to move downward. We believe current prices are generous.”

Downward pressure on cement prices will become greater with scheduled increases in capacity. The Portland Cement Association, Skokie, Ill., says there is 4.68 million tons of additional capacity coming on line in 2008 and another 8.65 million tons in 2009. The combined expansion will boost total domestic capacity by 15% over 2007’s level. Much of this will make up for falling imports, which PCA says could be down 40% this year. However, ENR believes there will be enough cement on the market to push prices down 1.3% in 2008, following three years of strong gains .

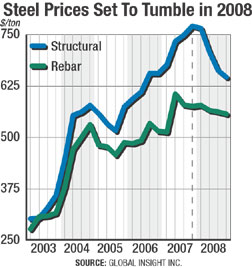

Steel prices also are set to come down after large double-digit increases in three of the last four years. “There are two opposing forces working on steel prices,” says John Anton, Global Insight’s steel analyst who expects housing to take nonresidential down with it. “Demand in 2008 will be the weakest since 2001. Normally, if I saw demand this weak I would expect a crash in prices but mills have been making preemptive cuts in production, which is curtailing supply. I think demand will eventually win this tug-of-war and look for structural steel prices to fall 5% next year.”

ENR’s forecast calls for steel prices to decline 3.5% in 2008.

Related Links:

Related Links: