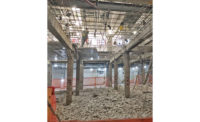

Opus Corp. Developers say office development projects, like this one for Opus Northwest, will pick up some of the slack in the housing market.

|

Mixed-use complexes with offices on upper floors and retail spaces at street level are cropping up in towns and cities across the nation as developers ride the momentum of a stoked economy that is keeping businesses’ and retail buyers’ wallets open. Many developers see the mixed-use office and retail markets as a life raft which has remained afloat as residential opportunities continue to dive. Others are thankful that when the housing slowdown started to set in, the office development markets was able to pick up steam, says Tim Murnane, senior vice president at Minneapolis-based Opus Northwest. It’s a market shift the firm has fully embraced. “We expect a continued surge in office and retail markets and we continue to be very busy with corporate campuses,” Murnane says.

Opus Northwest is developing several projects in the $150-million range in the northern Midwest, including a 1.3-million-sq-ft corporate campus for medical equipment manufacturer Medtronic in Mounds View, Minn., which was recently completed. This fall, the firm also opened the Burr Ridge Village Center and Hill Country Galleria, in Burr Ridge, Ill., a 1.3-million-sq-ft mixed-use development with retail, entertainment, civic office buildings and residential components.

Opus Corp. Congested marine ports are driving development inland.

|

New Look

But it is not merely business as usual for Opus Northwest’s architects, as new office-building designs reflect clients’ new expectations, which are moving away from the boxy, staid office structures of yore, and toward more ergonomic “people friendly” buildings, Murnane says. There is a push for building designs that allow workers to interact more,” he explains. “They want spaces that provide for ‘casual collisions’ or more opportunity for workers to spontaneously meet and interact. Designs have more open spaces, cafeterias, theaters” and other amenities typically not associated with office buildings.

Similar market dynamics are unfolding throughout the Southeast, where Charlotte, N.C.-based Dominion Partners LLC is in mid-step of a move away from residential markets and into office markets. “It’s been a steady year for business, but it’s been a transition year as we go from condos and into mixed-use and office buildings,” says Dominion CEO Andy Andrews.

The firm’s current portfolio includes a $50-million, 18-story mixed-use tower in Richmond, Va., and a 33-story, $120-million mixed-use tower currently under way in Raleigh, N.C., which at 563 ft, will be the tallest building in the growing city.

As many developers’ portfolios are being shuffled to adjust to changing domestic markets, those investing in industrial markets are encountering international influences more than ever. Projects with a global connection have grown from a burgeoning trend a year or two ago to a prime market mover today. Globalization now is manifesting itself across the U.S. in the form of many new projects under the category of “inland ports.” These warehouses and other distribution facilities are being pushed inland because of scare space at marine ports.

Moving Inland

Inland ports are probably the hottest new trend developers are embracing. Several factors are driving the trend, developers say. “More and more goods are being produced overseas, especially in Asia, and ports are becoming more congested as a result,” says Curtis Spencer, president of IMG Worldwide Inc., a global logistics consulting firm. “Shippers are looking at their port strategies to be more than Los Angeles-centric, and now clients want distribution facilities, warehouses and docking facilities to be located inland from the marine ports, nearer to rail transportation hubs.”

Spencer points to an approximately 8% annual growth in imports and the growing U.S. population as a harbinger of the trend’s ongoing voracity. “This started to happen in about 2003, but now everyone is involved with inland ports. It’s universal.”

While inland port development is superactive near port cities such as Oakland, Calif.; Los Angeles; and Seattle, global supply chains’ impact is not limited to the West Coast. Gulf of Mexico states and regions around ports in Jacksonville, Fla., and port hubs at Norfolk, Va., New York and New Jersey are also hotbeds of new development, developers say.

“With the Panama Canal being expanded to allow larger container ships through, there will be continued growth at ports in the Gulf of Mexico and the East Coast,” says Jack Rizzo, managing director of global construction at Denver-based developer ProLogis. The firm currently has 45 warehouse projects under way, with the bulk of them around ports in California and in the Northeast. ProLogis says it currently has approximately 14 million sq ft under development.

evelopers of industrial, mixed-use and office properties are facing two major influences in the current markets, one from abroad and one close to home. There is the increasing trend among big real estate developers to shift investments into office, industrial and retail developments and away from residential projects, as the residential markets continue to collapse under the weight of a legacy of loose sub-prime lending in recent years. And the ongoing globalization of markets across the board is congesting ports and forcing warehousers of retail and industrial products to look deeper inland for turf for their facilities. Arching over those dynamics is a sweeping revolution among clients and their architects to embrace greener and more environmentally sustainable structures and designs. Opus West, the western U.S. division of developer Opus, has begun development of a massive inland port facility, called the Opus Logistics Center, on a 475-swath of land near Stockton, Calif., which will house 8.2-million sq ft of warehousing and industrial space when completed. The $500-million project is a direct result of congestion at the Port of Oakland, says Opus West Senior Vice President Don Little. “The world is getting flatter as more and more manufactures are going offshore,” Little says. “There is virtually no footprint left at the port’s waterfront and so we have had to look inland.”

Post a comment to this article

Report Abusive Comment