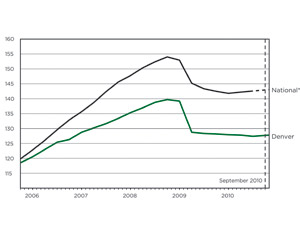

Denver-area construction costs have increased only 0.2% so far this year, says the latest research from global property and construction consultant Rider Levett Bucknall.

But it represents the first posted cost increase in Denver after seven consecutive quarterly price drops, the most significant of those a minus 7.5% change in bid prices from January 2009 to April 2009.

While this current uptick in Denver construction costs is lagging behind the national trend, both national and local construction costs are leveling off and expected to remain relatively stable.

Looking to the future, both nationally and locally, RLB says it is unlikely that bid prices will get much lower, since many suppliers can’t continue operating at rock-bottom profit levels and must increase their margins to stay afloat. On the whole, however, reduced contractor and subcontractor general conditions and profit margins continue to make moving ahead with construction projects very favorable for project owners.

The national construction cost index saw gains in the first and second quarters of 2010, with third quarter data set for another small rise. “After 18 months of economic turmoil, the American economy finally appears to be moving ahead again, slowly,” said RLB President Julian Anderson. However, he cautioned that “the outlook for the construction industry still remains questionable.”

One of the main factors creating intense market competition and more stabilized bid prices remains the significant decrease in construction activity. According to the U.S. Census Bureau, construction put-in-place dropped 11.8% from July 2009 to July 2010.

Most of the large Denver stimulus projects have already been awarded to boost workloads, but competition for these projects has been fierce and, at the subcontractor and supplier level, the total volume of work created by these projects has been less than anticipated.

Other Denver construction sectors are still suffering as well. Only a small percentage of the education projects planned during the boom are proceeding and the commercial and housing sectors are seeing limited activity as vacancy and foreclosures rates remain high. The shining light in the Denver construction market is the robust health-care sector, with three major hospital projects set to begin in 2011.

“The biggest concerns for construction in 2010 are the glacial pace of job recovery, the speed of healing in the credit markets and whether the specter of a ‘double dip’ recession will emerge,” Anderson said.

Post a comment to this article

Report Abusive Comment