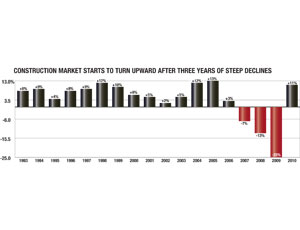

After three years of declines, the construction market may be eyeing a rebound in 2010 thanks to a much-improved residential market, but for designers and contractors in other building sectors, it could be too soon to celebrate.

McGraw-Hill Construction is forecasting that total construction starts will climb 11% to $466.2 billion in 2010, following an estimated 25% decline in 2009.

After a 39% drop in construction between 2006 and 2009, an improving residential market and signs of strength in select public-sector markets such as transportation and infrastructure could spark an overall turnaround in 2010, says Bob Murray, vice president of economic affairs for McGraw-Hill Construction.

“This is not a booming market; it is just inching upward,” Murray says.

Single-Family Stability The main buoy for the industry is single-family housing, which could rise 30% from an estimated 430,000 units started in 2009 to 560,000 starts. That would be on par with 2008, when 549,000 units were started.

Murray says that even with the rebound, levels remain 65% below the mid-decade peak of the housing boom. Murray adds that his residential forecast hinges on continued low mortgage rates and the extension of first-time homebuyer tax credits.

The outlook on multifamily housing remains mixed. Murray sees activity rising from 140,000 units started in 2009 to 160,000 units in 2010—a 14% rise. Although the sector could rebound, activity remains nearly three times below 2007 levels when 452,000 units were started.

Ed Sullivan, chief economist at the Portland Cement Association, is less optimistic about multifamily projects. He predicts that a comeback won’t be seen until 2011.

Although 2009 was a challenging year, the worst is yet to come in nonresidential building sectors, analysts forecast. According to McGraw-Hill Construction estimates, the commercial and manufacturing sectors could continue to struggle next year with an estimated 6% drop in combined value of starts to $55.5 billion—nearly half the level seen in 2007.

Sullivan sees the market sliding even further, down 22% in 2010, and doesn’t expect a rebound until 2012.

“If you look at vacancy rates, the job market, issues with credit—the fundamentals will take a while to come back,” he says.

Murray estimates that office building starts will ease back another 3% in 2010 to $19.7 billion in starts, as employment remains weak and businesses curtail expansions.

As companies rein in travel expenses and consumers take fewer vacations, hotel construction is feeling the...

Post a comment to this article

Report Abusive Comment