Global engineering and construction firms are optimistic about market and bottom line improvements in 2011, but they are being realistic about remaining obstacles in the way of profitable growth, says the latest annual survey of 140 CEOs and other top executives by Swiss-based financial and business consultant KPMG International.

The survey, titled “Adapting to an Uncertain Environment” and released late last year, reports that nearly half the respondents say company backlogs will rise next year—driven by either pent-up owner and consumer demand, expansion into new market sectors such as power or moves into new geographies such as the Middle East, Australia, Africa and India. But 47% say obtaining project financing will remain a high hurdle in 2011, and nearly 50% report they need to beef up internal “accountability” policies and procedures. Click here to read the entire report.

Respondents are from firms based in 25 countries, including close to 46% from Europe, the Middle East and Africa, 24% from the Americas and 30% from Asia-Pacific countries. Companies based in the latter region are the most optimistic, with 21% confident of a “significant” backlog hike next year.

Firm annual revenue ranges from $250 million to more than $5 billion, with about 18% of respondents in the largest-revenue category. About 65% report that their work is primarily in domestic markets, while 18% consider their firms “global.”

“The willingness of contractors to move into new markets and possibly to evolve their value proposition could be the difference between thriving and merely surviving,” says Geno Armstrong, international sector leader in KPMG’s engineering and construction practice. “With margins unlikely to rise for traditional business, such a repositioning could be vital. North American firms can learn a tremendous amount from the experiences and successes of their counterparts in other markets, particularly the ways in which projects are being financed.”

According KPMG, margins “continue to take a beating,” with “very few” respondents reporting improvement and a third noting declines; the figure was 50% for firms based in the Americas. The survey notes rampant price-cutting among firms. Close to half of Asia-Pacific firms “admit to pricing at or below break-even levels,” says KPMG. “Some have chosen to scale back activity rather than get pulled into a price war.” More than 30% of respondents say they are bidding on new projects with lower margins, but that factor is offset by the anticipated rising backlogs.

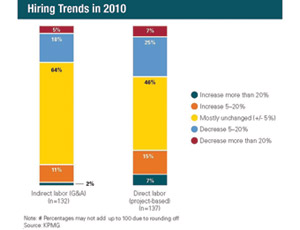

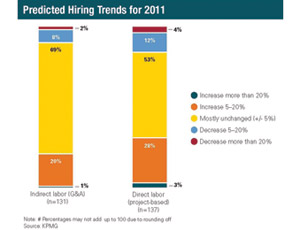

While executives note more “cost-cutting measures” to offset reduced prices, fewer say layoffs will be one of those measures. A third of respondents report staff cuts in this year’s survey, but that is down from two-thirds in the 2009 outlook. KPMG says “few” firms expect to lay off workers in 2011, with 31% of respondents likely to hire more direct labor in 2011. However, the survey notes that “bigger players are taking a slightly more cautious attitude to recruitment,” having already cut staff and “possibly restructured into leaner organizations.”

Firms also are beefing up risk management through more staff training, better bid planning and analysis, and a more “formal” internal risk process. “The more enlightened operators are realizing that a strong set of values can enhance their reputation and help win new business,” Armstrong says. “Shareholder value is increasingly linked to intangible assets, such as a company’s safety program, and customers are looking closely at whether contractors are responsible corporate citizens.”

Post a comment to this article

Report Abusive Comment