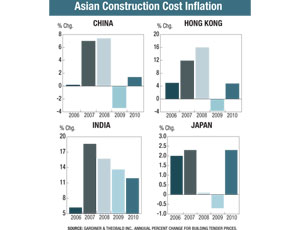

The global recession knocked down building costs in many Asian countries in 2009, but inflation appears to be making a modest comeback in the region this year. The London-based international cost consultant Gardiner & Theobald Inc. reports that building costs in Shanghai declined 3.4% in 2009 after increasing about 7% in both 2007 and 2008. This year, building costs in Shanghai increased 1.4%, says G&T.

In Hong Kong, G&T saw building costs fall 3.7% in 2009 after posting double-digit gains during each of the previous two years. In 2010, building costs in Hong Kong were back up 4.8%, says G&T. The firm reports a similar trend in Japan.

In India, building cost escalation is slowly coming under control. It has been declining from an annual rate of 19% in 2007 to 12% for this year, according to G&T’s report.

Vietnam is experiencing its own building boom, and Turner Construction Co., New York City, is there working on several projects, ranging in size from 74,500 sq meters to 930,000 sq m. This activity is starting to drive costs up in Vietnam, says Ken Osterland, Turner’s project manager in Hanoi.

Osterland says the overall market has been impacted by 12% inflation of the dong, which in turn has had an impact on material prices. In Ho Chi Minh City and Hanoi, Osterland says, contractors face price hikes of 23% for structural steel since last January, which has pushed prices in Vietnam to $792 per tonne.

During the same period, Turner saw prices for concrete reinforcing bar go up 19% for medium-sized bar and 13% for larger bar, while prices for cement increased 3%. Local contractors on Turner’s projects “are starting to ask for 5% price-escalation clauses in their contracts as a result of inflation,” says Osterland.

China’s relentless growth is starting to push prices back up after 2009’s set-back. Prices for concrete reinforcing bar in Shanghai increased from 3,682 Renminbi per tonne in December 2009 to 4,346 RMB per tonne this December, according to the international cost consultant Rider, Levett and Bucknall, which is headquartered in Phoenix. RLB notes that, during the same period, cement prices in Shanghai went to 398 RMB from 367 RMB per tonne.

For rebar in China, “the trends are going up despite a downward adjustment in rebar prices in the middle of this year,” says H.K. Yu, analyst in RLB’s Hong Kong office. “Although the Chinese government has recently implemented stringent measures to curb the rising property market, construction activities in China appear not to have been affected, and there is still a strong demand on construction materials,” he says.

On average, cement prices in China this year have risen by about 500 RMB per tonne, says Liu Zuoyi, spokesman for the China Cement Association in Beijing. He cites “increases in demand and production costs, along with electricity-use restrictions imposed by the government this quarter on energy-intensive industries,” as the reasons behind the recent price increases for cement.

The same dynamics are also pushing up steel prices in China. Iron-ore prices went from $60 per ton in December 2009 to $170 per ton currently, says Gan Yong, spokesman for the China Iron & Steel Association in Beijing. “Robust global demand plays a role,” says Yong. “This year, steel operations recovered significantly in South Korea and Japan, resulting in a surge in demand for iron ore which remains huge,” he says.

Despite higher production costs that impact Chinese steel mills, construction costs in China are being driven by “a demand pull rather than a cost push,” says Peter Morris, an analyst with London-based Davis Langdon. “Rising costs in China have everything to do with demand for a limited resource.”

Post a comment to this article

Report Abusive Comment