The recession is expected to keep its grip on costs through the second half of this year, despite a shift in what is affected. Construction costs heavily influenced by residential construction have already bounced up from historic lows, but that may be coming to an end, along with the expiration of federal tax credits for first-time homeowners. Costs associated with the nonresidential building markets have bottomed out. But while there is not much room for further declines, there is also very little upward pressure from either the labor or materials markets on the nonresidential building cost indexes.

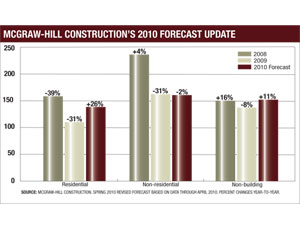

In the latest update of its 2010 construction-markets forecast based on actual construction starts through April, McGraw-Hill Construction still is predicting a 2% annual decline in the dollar value of the non-residential building market this year. “We’ve become a bit more pessimistic on this year’s prospects for the commercial and educational building markets,” says Robert Murray, MHC’s chief economist. He expects to see annual declines this year of 18% for manufacturing buildings, 12% for hotel and motel work, 6% for both office and school buildings and 5% for commercial structures.

“We’re looking for a decent increase, from very low levels, for single-family housing, but the size of that increase has been reduced,” says Murray. “To see a sustained increase in home sales, we need to see an improvement in the employment situation,” he adds. “Right now we are returning to the sense that it is going to be a gradual, hesitant improvement, vulnerable to the occasional weak month.” He adds that the situation for public works is very similar.

“The risk [overall] is greater on the downside but not to the extent that it would turn total construction in 2010 into a decline,” says Murray. “What I am most worried about is state and local finances. If there is anyplace for [a second wave of] stimulus spending, it would be to shore up state and local finances.” But in the end, Murray expects a 26% increase in residential buildings and a 14% increase in public works to save the day, resulting in a 10% increase in the dollar value of overall construction in 2010.

The impact of the weak non-residential building market on construction costs is clear in this quarter’s indexes. Selling price indexes, which reflect the reduced margins of subcontractors due to intense competition, are down 2% to 8% from a year ago. General building cost indexes, which measure commodity prices and labor wage settlements, are averaging annual increases less than 2%. Special-purpose cost indexes compiled by the U.S. Dept. of Commerce show annual declines of 4.6% for warehouses, 4.3% for office buildings and 1.5% for schools.

“Construction costs are stabilizing at lower levels,” says Karl Almstead, who puts together the Turner Building Cost Index, which is down 7.9% from a year ago following an 8.9% annual decline in the second quarter of 2009. “Commodity prices increased during the first quarter of this year, but competition is still pushing contractor’s selling prices down, although they are not falling as fast as they were a few quarters ago.”

Lumber prices responded to the first signs of a housing rebound by quickly rising from depressed levels. However, the market is not sustaining these higher prices. The mill price for framing lumber already has declined more than a hundred dollars per thousand board feet since the end of last April. “Prices peaked at $367 on April 30,” says Sean Church, editor of Eugene, Ore.-based Random Lengths, a lumber-industry trade journal that publishes market prices. “The June 18 price was $257, which is up from $213 a year ago.”

Church attributes the run-up and subsequent rapid decline to a combination of factors. “Producers had cut production to historically low levels in late 2009. Retail yards and distributors started restocking due to low inventories in the beginning of 2010, after the housing tax credit had increased demand. The low supply and increased demand created a spike in prices that peaked on April 30. The expiring tax credit and decreasing orders from lumber yards with renewed inventory combined to stop the increase.”

A similar scenario is unfolding for structural-steel and reinforcing-bar prices, which are starting to fall back after initial gains during the first quarter. On June 15, the price for rebar tracked by McGraw-Hill’s Platts’ Steel Market Daily fell $25 to $585 a ton for the benchmark price for the Southeast.

Post a comment to this article

Report Abusive Comment