With the economic slump battering tax receipts, state budgets remain in dire shape and the pain may continue into fiscal years 2011 and 2012, according to preliminary findings from the National Governors Association and National Association of State Budget Officers.

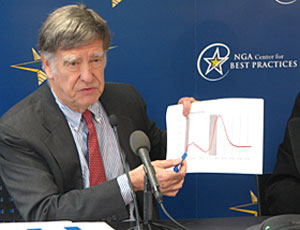

The groups on Nov. 12 released preliminary findings from their next biannual Fiscal Survey of the States, due out soon. Scott Pattison, executive director of the budget officers' group, says that for fiscal 2009 and 2010 "We are seeing the worst numbers and indicators that we've ever seen in terms of state fiscal conditions."

Pattison says that states' combined 2009 collections of sales, personal income and corporate income taxes fell 7.4% from the 2008 level. The sharpest decline was in corporate income tax collections, which plunged 16.1%.

NGA and NASBO also said that in fiscal 2009, which for most states ended June 30, 42 states cut their operating budgets by a total of $31.2 billion.

That is a much more severe reduction than in the last fiscal crunch, when cuts were $14 billion in 2002 and $12 billion in 2003.

The reductions included layoffs at 19 states in 2009. Pattison added that

25 states had layoffs or plan to do so in 2010.

According to the previous NGA-NASBO fiscal survey, released in June, 15 states reduced their transportation spending in 2009 and 19 planned cuts in that sector in 2010.

Raymond Scheppach, NGA's executive director, notes that an economic downturn's biggest impact on states occurs two years after a recession ends.

He also says that when a rebound begins, states still will face large "unmet needs" that they will have to address. NGA and NASBO say those include pension funds and deferred spending on infrastructure.

Scheppach also notes that the American Recovery and Reinvestment Act has been a boost to states, especially its $87 billion in Medicaid funding and $48 billion in fiscal stabilization funds. "Without those," he says, "the cuts would have been a lot more draconian."

President Obama said Nov. 6 that further moves are needed to boost job creation, stating that his advisors are looking at such things as additional funding for roads and energy-efficient buildings.

Even though states are in a deep fiscal hole, Scheppach says NGA has not requested any further fiscal help at this point from the White House. He does note that the health-care bill that the House approved Nov. 7 does include $23.5 billion in additional Medicaid assistance to states.

Post a comment to this article

Report Abusive Comment