The construction industry is surprisingly collegial, considering how competitive it is. Contractors, designers and subcontractors regularly talk to one another, even to their intense rivals. As people in the industry share insights with each other about their particular markets, firms often ask about broader market conditions or about markets beyond their focus or geographic locale to see if their experience matches that of others around the country. With this in mind, ENR is introducing a new Construction Confidence Index survey.

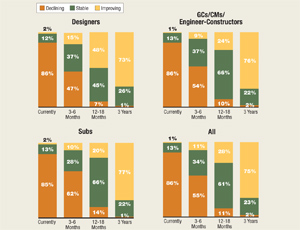

The overall results should come as little surprise, as they mirror general surveys of the overall economy. Of those firms surveyed by ENR, 86% see the current construction market as “declining,” with another 13% seeing it “stable.” Only 11 out of 752 respondents saw the market as currently “improving.”

Further, those who responded to the survey were not optimistic about the immediate future, with 55% predicting further declines in the overall market in the period three to six months from now.

A little further out, 12 to 18 months from now, respondents were a little more optimistic, with 61% seeing the market as “stable” and 28% seeing it as “improving.” It is only at three years down the road that the industry becomes truly optimistic, with 76% predicting an “improving” market and only 2% seeing overall decline.

What was truly surprising is how similar the different groups in the industry viewed the market. Less than 0.5% separated the views of designers, general contractors and specialty and subcontractors in the current market. Design firms were only slightly more optimistic than contractors about a early turnaround in the market, with 15% believing the market will improve in the next three to six months and 48% believing the turnaround should come within 12 to 18 months.

Designed by ENR in conjunction with McGraw-Hill Construction Analytics to measure each quarter industry sentiment about the construction market and various sectors within the market now and in the near- and long-term, the survey was distributed to over 2,000 contractors, architects, engineers, subcontractors and construction managers who have responded to the various ENR Top lists over the past five years.

This initial survey was conducted during the period from March 15 to April 1. In all, 752 firms responded. The responses were fairly evenly divided, with 42% coming from general contractors, CMs and engineer-constructors, 22% from design firms and about 36% from specialty contractors and subs.

Firms were asked whether their officials thought the overall construction market was rising, falling or stable at the current time, in three to six months, in 12 to 18 months and in three years.

Low Marks

To assess the industry’s mood, ENR enlisted economists at MHC Analytics, which, like ENR, is a unit of McGraw-Hill Construction. They created a scale of 1 to 100, with 100 meaning all respondents are reporting “improving” activity. A value of 50.0 means all respondents are reporting “stable” activity, effectively a neutral market. Opinions about the current market were given a weight of 50% in the formula, responses about the market in three to six month were given a weight of 30% and responses about the market in 12 to 18 months were counted as 20% in the formula. The formula produced an initial Construction Confidence Index of 25 on a scale of 100.

This ENR index is comparatively lower than the Princeton, N.J.-based Construction Financial Management Association’s CONFINDEX survey of commercial construction companies’ financial health, most recently released in December 2008. The CFMA survey index of chief financial officers of commercial construction companies was pegged at 84, below the “neutral point” of 100 on its rating scale. Another index, the Architecture Billings Index produced by Washington, D.C.-based American Institute of Architects, released on April 22, showed a rating of 43.7 in March, up from 35.3 in February. But this still is below the 50.0 barrier, marking a neutral market.

As for specific market sectors, retail clearly shows the poorest prospects, according to the 376 survey respondents working in that market. The commercial office market and the industrial and manufacturing sectors also received low marks (see table below). On the other hand, firms in the infrastructure markets that may benefit from the Obama administration’s economic stimulus plan, were somewhat more optimistic that their markets would turn around quickly. Among the vertical markets, the health-care, K-12 and higher-education sectors held the most promise in the near term.

Nowhere To Run, Nowhere To Hide

Markets nationwide have taken a hit, leaving in trouble firms that are narrowly focused, says Doug Pruitt, CEO of Sundt Construction Inc., Tucson, Ariz., and president of the Associated General Contractors, Arlington, Va. He says the Texas, Oklahoma and Louisiana markets have held up better than most states, but that the recession is nationwide.

Even the most active market sectors have had their ups and downs. “In the past year, about 30% of the health-care projects in our area have been put on hold,” says Denny Terrell, executive vice president of Ivey Mechanical Co., Kosciusko, Miss. Ivey has found more of its work on the public-sector side, he says.

Most firms are not anticipating a quick market turnaround. “Will quarters two to four this year be better? We’re not counting on it,” says David Barnes, CFO of MWH Global, Broomfield, Colo. “We’re asking our business line leaders for more forecasting—where is the uncertainty?”

| Market | No. of Firms | Currently (%) | 3-6 Months (%) | 12-18 Months (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dec- lining Activity | Stable Activity | Impro- ving Activity | Dec- lining Activity | Stable Activity |

Impro- | Dec- lining Activity | Stable Activity |

Impro- | ||

| Commercial Office | 508 | 93 | 7 | 1 | 77 | 20 | 3 | 18 | 54 | 28 |

| Distribution/ Warehouse | 262 | 86 | 13 | 1 | 69 | 27 | 5 | 21 | 52 | 27 |

| Education K-12 | 296 | 33 | 57 | 10 | 15 | 54 | 30 | 4 | 45 | 51 |

| Entertainment | 196 | 81 | 18 | 2 | 68 | 26 | 6 | 27 | 55 | 18 |

| Health Care | 455 | 35 | 56 | 9 | 18 | 56 | 26 | 4 | 35 | 61 |

| Higher Education | 458 | 39 | 55 | 7 | 19 | 54 | 27 | 4 | 42 | 54 |

| Hotels | 328 | 84 | 14 | 2 | 71 | 25 | 4 | 22 | 55 | 23 |

| Multi-Unit Residential | 251 | 85 | 13 | 2 | 63 | 29 | 8 | 18 | 45 | 38 |

| Retail | 376 | 96 | 4 | 0 | 80 | 17 | 3 | 25 | 48 | 26 |

| Industrial/ Manufacturing | 364 | 79 | 20 | 1 | 55 | 37 | 7 | 15 | 48 | 37 |

| Transportation | 248 | 37 | 46 | 17 | 10 | 34 | 56 | 4 | 27 | 69 |

| Water, Sewer and Waste | 233 | 30 | 57 | 13 | 11 | 46 | 43 | 3 | 36 | 61 |

| Power | 185 | 38 | 48 | 15 | 14 | 44 | 42 | 2 | 27 | 72 |

| Petroleum | 122 | 52 | 43 | 6 | 25 | 59 | 16 | 7 | 39 | 55 |

| Environmental/ Hazardous Waste | 100 | 28 | 59 | 13 | 15 | 52 | 33 | 0 | 41 | 59 |

| SOURCE: ENR | ||||||||||

For many general contractors, the market downturn has not yet had a major impact on business, but most anticipate that it will down the road. “Last year was a good year for most big contractors, and 2009 has been OK so far,” says Jeff Hoopes, president of Swinerton Inc., San Francisco. “We are more nervous about 2010. Sales aren’t there, and we are burning through backlog.” He believes markets will begin turning by year’s end, but the beginning of 2010 will be tough until new projects hit the construction phase.

The market has caused firms to be very cautious in their projections. “There are a lot of good tendencies in 2009, but we don’t know if we can believe them,” says Bob Anton, CFO of CDM, Cambridge, Mass. CDM has had some strong contract signings but has an “early-warning indicator” system in case new projects don’t materialize. “We don’t want to be halfway through the year and try to salvage it.”

Out of Work

As part of the survey, ENR also asked firms about staffing. Of the 749 respondents that answered the question about layoffs, 62.3% of firms reported they had laid off people in the past six months, while only 12% said they had added staff during that period. What is even more startling is that over a quarter of respondents said layoffs amounted to more than 10% of staff; one in 10 said that over 20% of staff had been laid off. Of the 701 firms answering the question about future layoffs, 35% expected further cutbacks, while only 13.7% anticipated hiring additional staff.

ENR also asked firms their opinion on the new federal financial stimulus package. Responses to this question were generally positive, but not overwhelming. When asked whether the stimulus package would have a positive impact on the industry, 400 firms said they “somewhat agreed,” but only 61 “strongly agreed” that it would. On the other hand, 142 disagreed that the stimulus package would benefit the industry, including 31 that strongly disagreed.

While many big firms believe the stimulus bill will not impact their firm, a few have found surprising opportunities. “We thought there was nothing there for us, then we found out there was a $60-million upgrade to an old post office here in San Antonio that we are looking into,” says Don Kuykendall, president of Nathan Alterman Electric Co.

Many large firms are actively finding jobs. “The shovel-ready jobs generally are smaller than we normally like to pursue, but we are picking up some stimulus work,” says Joe Prego, vice president of contractor American Infrastructure, Worcester, Pa. “We are aggressively tracking building energy upgrades in the stimulus bill, particularly by the [General Services Administration] and the Dept. of Defense,” says Charles Bacon, CEO of mechanical contractor Limbach Facilities Services, Pittsburgh.

The major problem many see is the continuing reluctance of financial institutions to lend on projects. “Everything we do is predicated on the availability of money, either through banks or bonds,” say Hugh McCoy, vice president and managing partner of White-Spunner Construction Inc., Mobile, Ala. He says there are a lot of projects on the boards that make sense and a lot of money is available, but financial institutions are afraid to pull the trigger on loans.

There are glimmers of hope. The federal stimulus package broadened the federal Build America Bonds (BAB) program to aid public entities in financing projects. The program calls for the federal government to subsidize up to 35% of a public entity’s interest costs on taxable bonds.

On April 15, the University of Virginia issued $250 million in bonds under the BAB program to help finance its $800-million building program. “That bond issue was oversubscribed five times over,” Bacon notes. Hoopes notes that California recently was able sell $6.5 billion in bonds, showing that investment money is there waiting to be deployed.

For many, the biggest threat in the recession are firms that bid for cash flow, rather than for a decent margin. “Our people see competitors underbidding quite a bit,” says Terrell. “We have to tell them to hold the line on bids because we want to be here when the market turns around. Low-ball bidders won’t be.”

Post a comment to this article

Report Abusive Comment