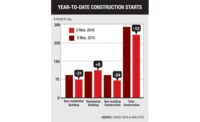

After a tentative start, the construction recovery hit full stride this year, and it is expected to keep pace in 2016, according to economists surveyed by ENR. The consensus among these economists is very tight. Dodge Data & Analytics forecasts a 6% increase in total construction starts next year, while both FMI and the Portland Cement Association (PCA) are looking for a 7% increase in construction put-in-place in 2016.

|

Click here to view Outlook 2016 PDF |

At first glance, Dodge’s 6% prediction may look like a slowdown in growth, compared to this year’s 13% jump in starts. However, this year’s starts got a tremendous boost from a flurry of megaprojects in the energy sector for powerplants and new liquefied-natural-gas facilities. “If you remove the highly volatile energy sector, total construction starts would be up 8% this year,” says Robert Murray, Dodge’s chief economist. That caveat puts the forecast for a 6% increase in construction starts for 2016 in line with a slow and modest recovery. “We see 2016 as another step in the expansion process that still has a few more years to go,” Murray says. “Next year’s 6% increase is more of a pulling back from a surprising upturn in 2015, as opposed to [the uptick indicating] the market losing momentum,” he adds.

Construction next year will continue to be propped up by strong economic fundamentals, and the overall economy continues to register job growth, low inflation, easing money-lending standards, increased local and state funding, and relatively low long-term interest rates, Murray says.

“Going forward, PCA believes the underlying economic fundamentals will continue to strengthen,” says Ed Sullivan, chief economist for the association. “The U.S. job market lies at the core of our optimistic outlook regarding both the economy and construction markets.” Thus far, the average monthly job-creation figure during 2015 has been around 211,000 net new workers, which Sullivan expects to continue into next year. This average is driving the PCA forecast.

Earlier, PCA estimated that total construction put-in-place would increase 4.8% this year. However, Sullivan says this will probably be bumped up to 6%. PCA’s forecasted 7.3% increase in total construction in 2016 is being driven in a large part by a projected 13.8% increase in residential construction, which, in turn, is being driven by the job market, Sullivan says. That jump would be up from the 6.3% increase PCA estimates for this year.

“Pent-up demand for housing has been accumulating since the recession began,” Sullivan says. “Household formation has not increased in proportion to job creation.” He notes that, on average, one household is created for every two jobs created. However, in 2014, 2.6 million net new jobs were created but only 700,000 new households. “That should have been closer to 1.3 million households,” Sullivan suggests.

The National Association of Home Builders (NAHB) expects this pent-up demand to explode in 2016. The NAHB is forecasting a 27.2% increase, to 914,000 starts, in housing starts in 2016. That momentum should carry over into 2017, when NAHB predicts another 24.7% increase in housing starts, which are predicted to reach 1.14 million.

However, the boom in multi-family starts has peaked, according to NAHB. After climbing at a double-digit pace for the past four years, multi-family starts are expected to decline 2.3% in 2016 and then slip another 0.8% in 2017, according to NAHB’s latest forecast.

FMI Corp.’s forecast also is banking on strong economic fundamentals, including overall economic growth of 3.7% in the second quarter of this year, overall unemployment falling to 5.3% and low energy cost, which includes gasoline prices reaching their lowest point in five years, says Randy Giggard, chief economist for FMI.

These positive trends have led FMI to upgrade its estimate for total construction growth this year to 6% from 5%. FMI’s forecast for another 7% increase in total construction put-in-place next year would push the market to $1.09 trillion dollars, which would be the highest level since 2008, unadjusted for inflation, Giggard says. FMI’s numbers include improvements and renovations.

Although FMI also sees a healthy residential construction market next year, a lot of its forecasted 7% increase in construction put-in-place for 2016 hinges on its optimism for non-residential building construction.

“Manufacturing has been the rock star of 2015 and should come in at 18% growth for 2015,” Giggard says. He expects that pace to diminish to around 5% to 7% for 2016 through 2019.

If manufacturing is the rock star, then lodging is the opening act. FMI estimates the construction market will increase 15% this further 6% increase in total growth for construction starts next year. Dodge predicts an 8.7% increase in the dollar value of non-residential construction building starts in 2016, following a flat 2015. Next year, the largest annual increases in this sector will be 14% for office-building work and 11% for stores and shopping centers. Work for other commercial projects is predicted to increase 10% next year, according to Dodge starts.

“In 2016, the strengthening economy, improving housing market and an increasing number of large projects should encourage an expansion in retail starts,” Murray says. He forecasts that sector to increase 10%, to $20 billion, next year.

Falling vacancy rates, now at their lowest level since mid-2008, are levering up the office-building market, says Murray. “Improvement in vacancy rates is fairly widespread across the country,” Murray adds. The market also is being pushed by robust office employment. Over the past year, 807,000 new office jobs have been created, accounting for nearly 29% of all new jobs created during that period, he adds.

The only cloud on the forecast horizon appears to be the non-building sector. Dodge predicts that the dollar value of this sector will decline 14% next year. However, this dip will be down from an unexpected surge in electric utility and highway work this year.

In 2015, Dodge recorded a 159% increase in electric-utility work. This year’s numbers were boosted by several mega-projects, including a $1.2-billion solar farm in California and two $800- million natural-gas-fired plants. However, a sharp reduction in the dollar amount of LNG export terminals will shape the 2016 forecast, Murray says. “The gas-plant segment will fall back to about $8 billion, down from $31 billion this year,” he says. In addition, Murray expects powerplant work to fall to $26 billion next year, down from $29 billion in 2015. The combined declines will result in a 43% annual drop in 2016.

Highway construction also received a boost from several large projects in 2015, including a $2.3-billion interstate job in Florida. These large projects helped to push the dollar value of new highway starts up 13% this year, according to Dodge. The market should fall back 4% in 2016 but still will remain well above 2014’s level, Murray predicts.

However, environmental work is expected to rebound 4%, to $35 billion, in 2016, after slipping 0.4% this year, according to Dodge.

Post a comment to this article

Report Abusive Comment