Infrastructure, water and health care work is sustaining design firms in New York/New Jersey and New England, say executives from some of the leading companies from the two regions.

The top 10 design firms in New Jersey and New York reported a combined $2.85 billion in 2020 revenue, an increase of 5.2% from the year before. In New England, the top 10 firms logged $1.59 billion in 2020 revenue, up 22.3% from the $1.30 billion reported in 2019.

Regional revenue for all companies on ENR New York’s Top Design Firms list remained steady overall. In New York and New Jersey, 96 companies on the 2021 list reported $5.7 billion in revenue, compared with the $5.66 billion cited by 96 firms on last year’s list. In New England, the 58 ranked firms reported combined 2020 revenue of $2.19 billion in Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont. Last year, New England’s 59 listed firms reported $2.4 billion in revenue.

Health care was strong in both regions—no surprise considering the flurry of activity during the COVID-19 pandemic. In the New York region, the top 10 firms in the health sector had combined revenue of $291.3 million in 2020, up a whopping 112% from $137.2 million in 2019. The top 10 firms in New England’s health care sector reported nearly $58.9 million in revenue, down 4.45% from $61.6 million reported last year.

|

Related Links |

Education projects such as the Donald M. Payne Sr. School of Technology in Newark reflect the strength of the sector in New Jersey, says French & Parrello CEO Steven A. Tardy.

In the New York region, the top 10 firms in some sectors tied to infrastructure reported an increase over the prior year. The highest ranking engineering firms saw combined revenue of $1.4 billion in 2020, growing 14.1% from $1.2 billion in 2019. In transportation, the biggest companies reported combined revenue of $1.6 billion, a year-to-year increase of 5.3%.

On the other hand, some infrastructure-related sectors in the New York region declined slightly. Revenue of top designers in the power sector fell by 3.4% to $262.4 million, compared with $271.7 million the year before. In the wastewater-solid waste category, revenue at the top 10 firms totaled $164.3 million, a 2.1% drop from $167.9 million the previous year.

Health care projects, like this 52,000-sq-ft COVID-19 Center of Excellence for New York City Health & Hospital Corp., remain strong opportunities for the construction industry, says Edward Feinberg of JFK&M.

The top 10 firms recording transportation work in New England accounted for $618.1 million in work compared with $621 million the previous year, a decline of less than 1%. In New England’s power sector, the top 10 firms had revenue of $135.1 million in 2020, a 40.7% decline from $227.7 million in 2019. As for wastewater-solid waste, New England’s top 10 firms reported $136 million in revenue this year, a 4.9% decline from the $143.1 million reported last year.

ENR spoke to executives from design firms that appeared on the New England or New York regional lists. Their thoughts about industry trends and the future of construction have been edited for clarity and length.

How do you believe Biden administration policies will impact design and construction in New York, New Jersey and New England?

Rich Humann, CEO and president of H2M architects + engineers: There has been a clear signal from the administration that the federal government is committed to spending within a number of market sectors as well as restoring budgets to state, city and local governments impacted by the pandemic. The American Rescue Plan signed by the president was a $1.9-trillion package intended to provide much needed government budget support, particularly for New York and New Jersey. When the pandemic hit, uncertainty in revenue streams caused governments at several levels to pull back, pause and in some cases cancel capital projects and programs. The billions of dollars will fill those budget gaps and allow capital programs to get back on track. The latest infrastructure bill will infuse more capital into roads, bridges, railways and water/ wastewater systems.

Steven A. Tardy, CEO, French & Parrello Associates: The need for infrastructure spending is well recognized, and the advancement of an infrastructure investment bill will facilitate both short-term and longterm economic growth in the entire tristate region. Functionally obsolete infrastructure, and infrastructure in a state of disrepair, are a drain on the economy and a nuisance for the public. Infrastructure spending will help alleviate these issues, boosting the economy by providing the necessary platform for growth while also providing needed jobs.

Joseph Barbagallo, president of consulting, Woodard & Curran: We anticipate that engineering design and construction firms will see new requirements around procurement to address environmental justice and new incentives around renewable energy and green design and construction. Proposed infrastructure funding would drive public sector design and construction projects, but we are also monitoring increased requirements around energy code and decarbonization initiatives that have the potential to increase the cost of construction. Without incentives, that could have a dampening effect on the recovery in the private sector and associated design and construction opportunities.

Which sectors offered the biggest opportunities?

Humann: Two of the most significant have been power and energy and water/wastewater. The commitment to renewable energy has been clear and is likely the top priority of the new administration. It is also a priority within our region. The Northeast has tremendous opportunity for wind turbine-generated power, especially along the coast from New Jersey to Massachusetts. The development of solar energy and battery storage systems are also playing an emerging role, helping round out major renewable initiatives. At the same time, drinking water and overall water quality continue to have a major focus at all levels of government. Particularly in the Northeast, where the regulatory authorities tend to lead the way nationally, current and emerging contaminants are driving the need to implement new and advanced treatment systems for water and wastewater.

The Rutgers Newark Alumni Center is another French & Parrello project in the education space.

Tardy: Opportunities likely to be generated by the advancement of an infrastructure bill include transportation, utility and education/school projects. While roads, bridges and railway projects may be at the forefront, continued spending on schools and new initiatives such as offshore wind are also likely to see a significant boost. In the private sector, we anticipate continued spending on warehousing and distribution centers and health care facilities as well as on multiand single-family residential development.

Barbagallo: We are anticipating significant opportunities in the public sector in response to stimulus, especially in communities that are vulnerable to environmental injustice and in communities that had the foresight to advance planning of critical infrastructure projects through the pandemic. Our team has done a great job positioning our clients for funding opportunities and getting projects shovel ready, so we are quite optimistic about our public sector businesses.

Edward Feinberg, Partner, Jacob Feinberg Katz & Michaeli Consulting Group LLC: I definitely feel that the health care market will offer the biggest opportunities—especially with the COVID-19 virus—and also the suburban residential market.

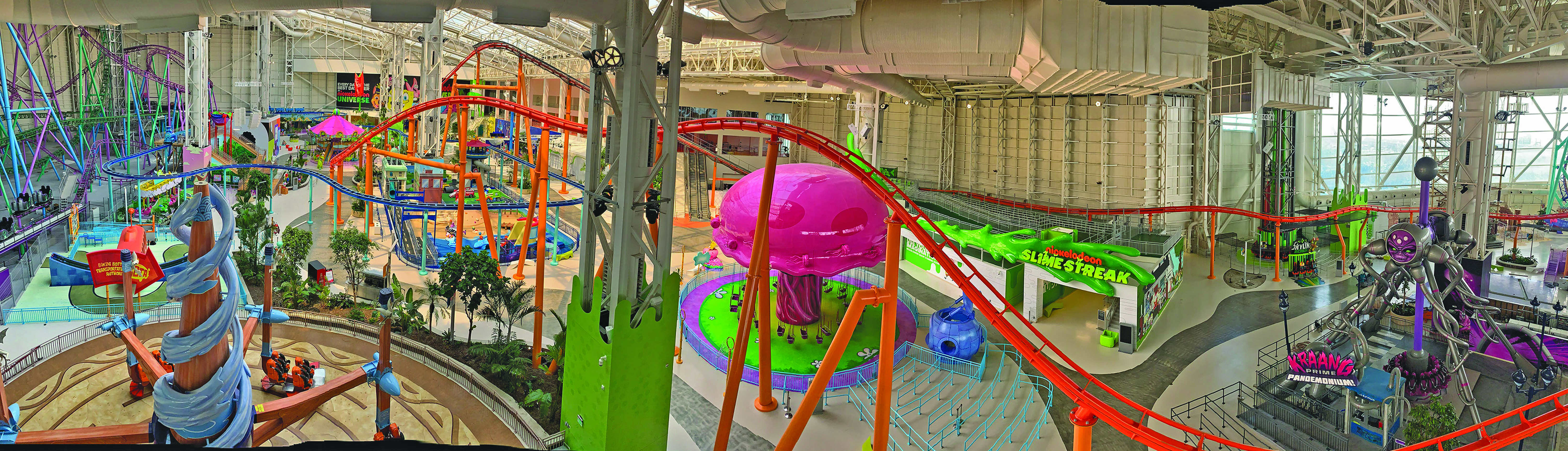

French & Parrello worked on New Jersey’s American Dream mall and entertainment center, which postponed its 2020 grand opening due to the pandemic.

Which sectors have cooled down in the regions?

Humann: Sectors that have cooled down the most have been residential, commercial and retail development and redevelopment. Whether or not the cooldowns will be short term will be primarily dictated by the acceptance of remote work and remote shopping. As the pandemic hit and employees in most industries worked from home, commercial space became a major overhead item of new focus. Long-term effects are likely to impact the commercial office space market; redevelopment of those spaces has potential. Similarly, the retail sector took a major hit as businesses struggled to recover or did not recover at all and consumers flocked to online shopping, but the repurposing of retail space may provide future potential. Funding tightened and municipal regulatory processes essentially closed shop when government workers left the office, affecting the progress of projects that were deemed “essential” by state government. Living close to where you work will be less of a demand in many industries, so housing choices should open up further.

Tardy: We anticipate a pause in the development of retail and office buildings, although the repurposing of existing buildings and new innovations in interior space design may give rise to increased spending on retrofit and fit-out projects.

Barbagallo: Commercial development sectors like office buildings, retail and hospitality will be down for a while as the whole country continues to wrestle with the long-term effects of the pandemic.

Feinberg: The airport and hospitality markets have cooled down dramatically.

What key innovations helped you boost productivity or other metrics?

Humann: Our productivity has always been driven in large part by our ability to collaborate and coordinate. When we scattered, that natural coordination was lost. We invested a higher percentage of revenue into IT last year in order to better utilize collaboration software for design and coordination.

Tardy: Conference calls and email just weren’t viable as a long-term solution for team collaboration during the pandemic. Digital collaboration and presentation tools like Microsoft Teams and Zoom were necessary in order to remain connected with co-workers and clients. Functions such as screen share, video conferencing and chat rooms were found invaluable. These tools provided for enhanced online project management capabilities and relatively seamless communication between multiple project teams. Enhanced digital communications facilitated collaboration and cohesion among stakeholders in the industry, including owners, designers, contractors and regulatory agencies.

Barbagallo: We have seen increased productivity through innovations associated with remote field data collection across an integrated asset management technology platform, remote operations at our plant sites, new treatment technologies to maximize effectiveness within existing footprints for our clients and the use of drones and augmented reality tech for more efficient field data collection.

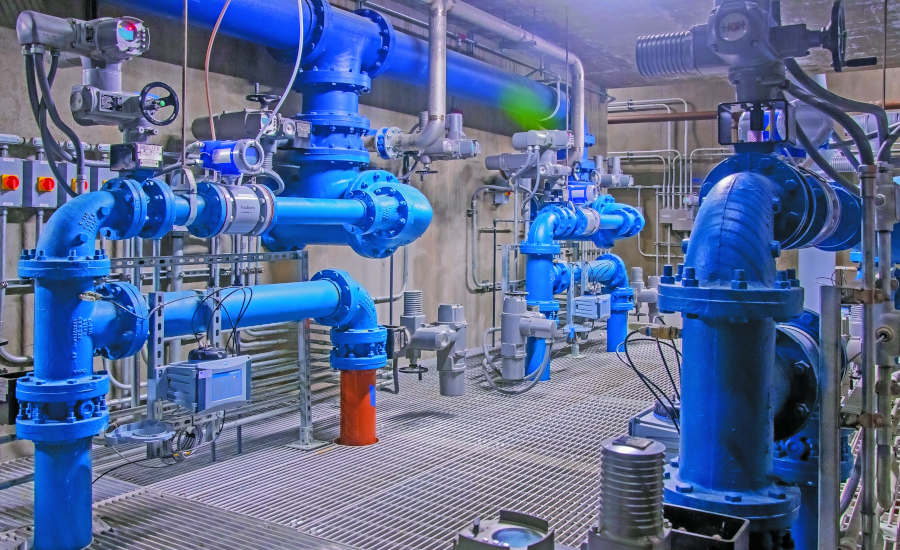

Ranked No. 7 on the New England Top Design Firms list and and No. 45 on the ENR New York ranking, Woodard and Curran served as lead consultant on the design-build team that completed a $16.4-million water treatment facility for the University of New Hampshire.

How do you think the industry is rebounding from COVID-19?

Humann: There are very positive signs in the sustained trend of the broader economy and in the significant funding committed by governments to just about every market sector the construction industry services. The ability of the industry to effectively pivot in its reaction to the pandemic allowed us to obtain the type of crisis training that will serve us well and evolve and enhance our approach to delivering professional services. We grew in 2020 and have projected even stronger growth in 2021. Our challenge, like for many other firms in the industry, will be the same as it was before the pandemic: recruiting and retaining the best talent.

Tardy: We see the continued reopening of New Jersey state as a major boost to the economy and a benefit to the industry.

Barbagallo: The rebound post-COVID is being buoyed in the public sector through stimulus funding and in the private sector as a function of pent-up demand and a reduced workforce. This is providing opportunity across market sectors. We anticipate that the rebound will be driven primarily by policy, technology and innovation, with a pronounced focus on ESG principles, resulting in a new future for the industry that looks very different than the past.

Feinberg: I believe that the industry is rebounding very slowly from COVID-19. I still receive many résumés from headhunters trying to place their clients in engineering positions.

Post a comment to this article

Report Abusive Comment