Despite industry-wide increased material costs and labor shortages, specialty contractors in the New York and New England regions have bounced back from the COVID-19 pandemic.

In fact, the top 17 firms ranked on this year’s ENR New England list bounced back in a big way. Contractors working in Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont logged a combined $2.05 billion in regional revenue for 2021. That’s a whopping 46% increase from the $1.4 billion those firms reported last year. That 2020 total was down 26% from the $1.9 billion the top 17 participating firms reported for 2019.

Related Links:

ENR New York 2022 Top Specialty Contractors

ENR New England Top Specialty Contractors 2022

For the second straight year, Wayne J. Griffin Electric Inc. tops the ranking with $334.17 million in regional revenue, 27% above the $263.77 million reported by the Holliston, Mass.-based firm in last year’s survey.

Hudson, Mass.-based S&F Concrete Contractors Corp., which did not participate in last year’s survey, is second this year with $319.50 million in regional revenue. E.M. Duggan, this year’s ENR New England Specialty Firm of the Year (see p. NYNE24), is No. 3 on the list for the third straight year. The Canton, Mass., mechanical firm reported $222.30 million in regional revenue on this year’s survey, up from $185 million in last year’s survey and closing in on the $233.50 million reported for 2019.

Results were not as upbeat for the New York region, which includes New York and New Jersey, with top specialty contractors continuing to show declines. This year’s top 10 firms posted $1.58 billion in total regional revenue, a 19% decline from the $1.95 billion reported by the top 10 last year. Last year’s regional totals represented an 8% decrease from the $2.12 billion posted by 10 top firms the previous year.

E-J Electric Installation Co. is once again No. 1 on the ranking with $641 million in revenue, a 1.4% decline from the $650 million reported last year. The second and third ranked firms on this year’s list did not submit surveys the previous year. W&W Glass LLC is second with $220 million in reported regional revenue while Electra USA Inc. is third with $211 million.

ENR New York’s Specialty Contractor of the Year, International Asbestos Removal Inc. (see p. NYNE18), was ranked No. 6 with $57.49 million, a nearly 19% increase from the $48.49 million reported on last year’s ranking when the firm ranked No. 10.

ENR spoke to Tony Bond, president and CEO of Medford, Mass.-based BOND Brothers Inc., to gain insights on construction industry markets in the New York and New England regions. The firm is the parent of Bond Civil & Utility Construction Inc., ranked at No. 5 on the New England Specialty Contractors list with $157.76 million in regional revenue and also ranked No. 5 on the New York survey with $71.29 million in regional revenue. His answers are edited for space and clarity.

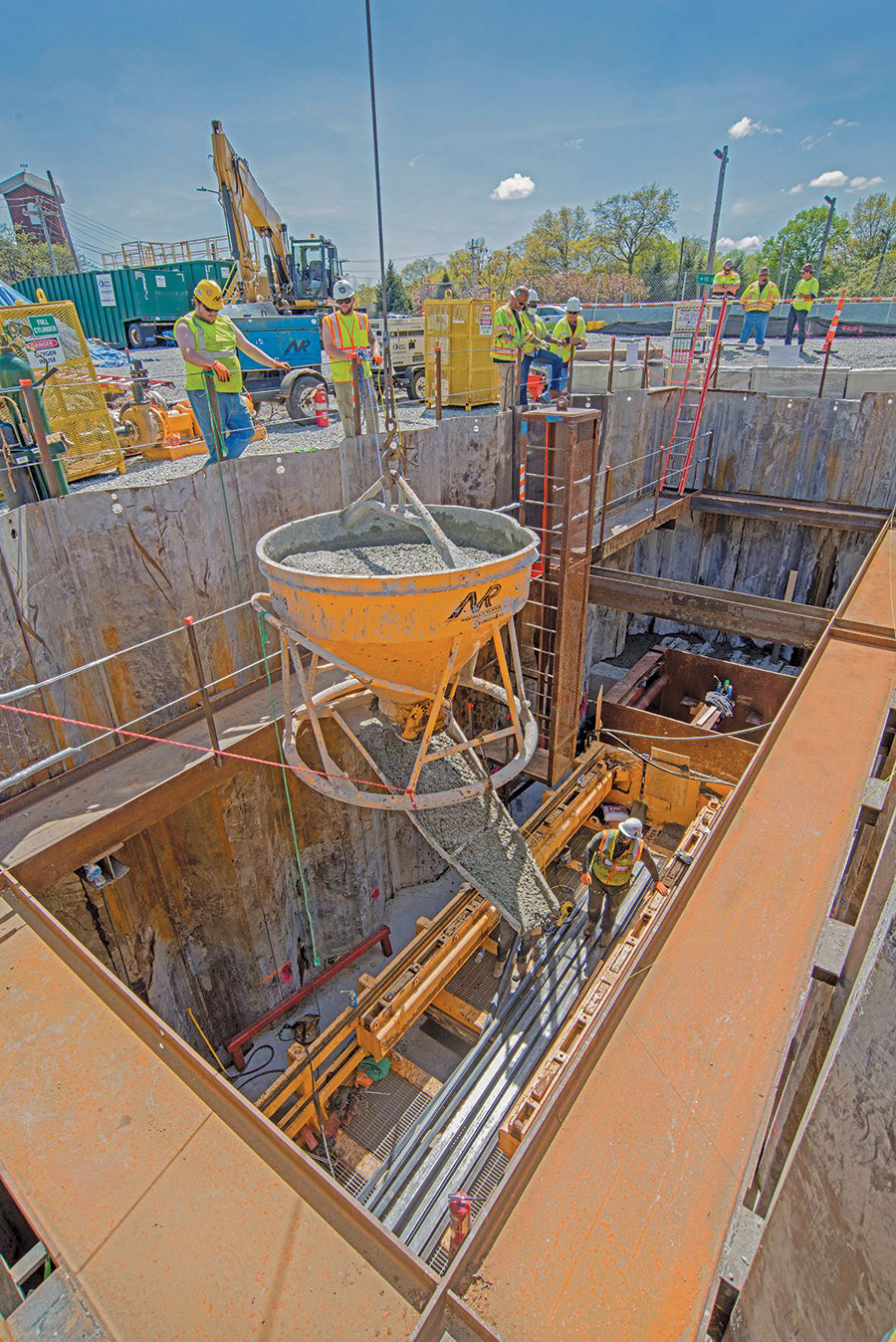

Bond’s civil and utility unit is working on the Q143/R144 Providence Downtown Reliability Microtunnel project for Rhode Island Energy.

Photo courtesy BOND Civil & Utility Construction

What lessons from the last two years have most shaped the way BOND does business now?

Tony Bond: As a fifth-generation family-owned business, we have steered our company and employees through many unprecedented times. We have long offered our employees training and career development opportunities that support their professional aspirations, but we are now also focused on new employee engagement networks and programs that support their professional and personal goals. We have been able to retain some of the most experienced and dedicated staff and attract a new generation. It’s more important than ever for us to put resources, time and energy into developing our workforce and providing current employees with the best opportunities so that we can keep delivering no matter what market conditions are.

Which sectors have offered the biggest opportunities in the region(s)?

Bond: The energy transition has provided an opportunity for our company to apply our experience and services to an increasingly diverse mix of industries and customers. From utilities to higher education to public sector entities, we are working with customers to build healthier and more efficient and reliable environments for our communities. That means implementing more advanced technology and sustainable materials and adapting existing infrastructure to lower emissions. By operating in states that are leading the country in adopting climate policies, we have been able to seamlessly expand into supporting and developing renewable energy infrastructure, including offshore wind energy and battery storage.

Which sectors have cooled down in the region(s)?

Bond: I can’t say that any one sector has “cooled down” as there has been a larger consideration for the big picture and how the built world impacts our environment and society. We have seen our utility partners rethink how they provide power and heat for their customers, shifting to new sources like offshore wind, battery storage, geothermal and other means. We have seen our higher education clients shift on how they can revitalize current spaces and make them more efficient and effective for students and faculty, and for the environment. There are still great opportunities in the markets we serve, it just looks very different than it did two to three years ago, and we have done a great job adapting to that change in our clients’ needs.

What key innovations have helped you boost productivity or other metrics in the region(s)?

Bond: Lately we’ve been using drone technology and different artifical intelligence products to identify gaps in project progress and safety trends to better fulfill onsite needs. These allow project teams to track the speed and success with which different tasks are achieved, bringing a new level of insight for our teams. Our team leaders can use their time more productively by focusing more on the client while monitoring jobsite progress. If any obvious gaps in performance appear, they can easily implement a solution remotely. This is especially important when it comes to safety, given the workforce shortage and challenges when it comes to jobsite incidents.

E.M. Duggan, ENR New England’s Specialty Contractor of the Year, is performing plumbing, HVAC and fire protection on the Boston University Data Science Center. At about 300 ft, it will be the tallest building on campus when it opens in October.

Photo courtesy E.M. Duggan

How do you think the market will perform in New England and New York during the next year or two?

Bond: I’m confident that the Northeast market will continue to move at a fast pace and both our New York and New England bases will expand. BOND corporate expertise in our building, civil and utility and mechanical units runs deep across industries. As the market shifts toward renewable energy projects, reliability and resilience and battery storage, we are here with previous experience under our belts to help ease the transition process. We can seamlessly integrate these new elements into all our markets, be it utility and energy, health care, education or public agency. While keeping one eye on the slowly mending supply chain and another on the rates of inflation that are affecting costs of materials and labor, I still feel it’s safe to say that the market will only continue to grow during the next few years.

Post a comment to this article

Report Abusive Comment